How to Invest in Retail Treasury Bonds Online (Philippines 2019)

You can do so now with Retail Treasury Bonds Online!

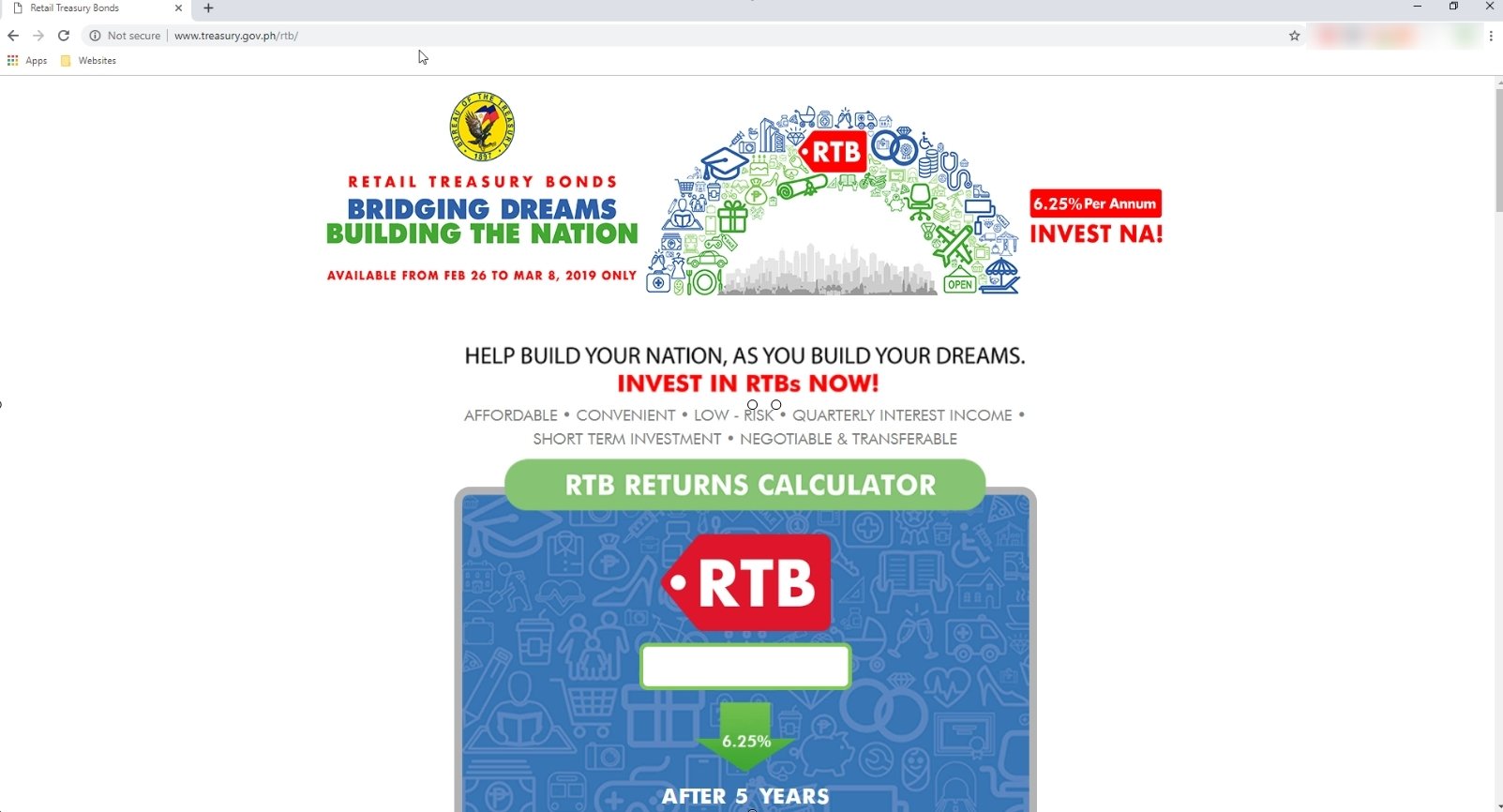

Step 1: Go to the Retail Treasury Bonds page within the Treasury Department’s website.

Go to the following URL: www.treasury.gov.ph/rtb

There are various information on the web page but if you want to know more about Retail Treasury Bonds, check out our blog post which further describes what it is.

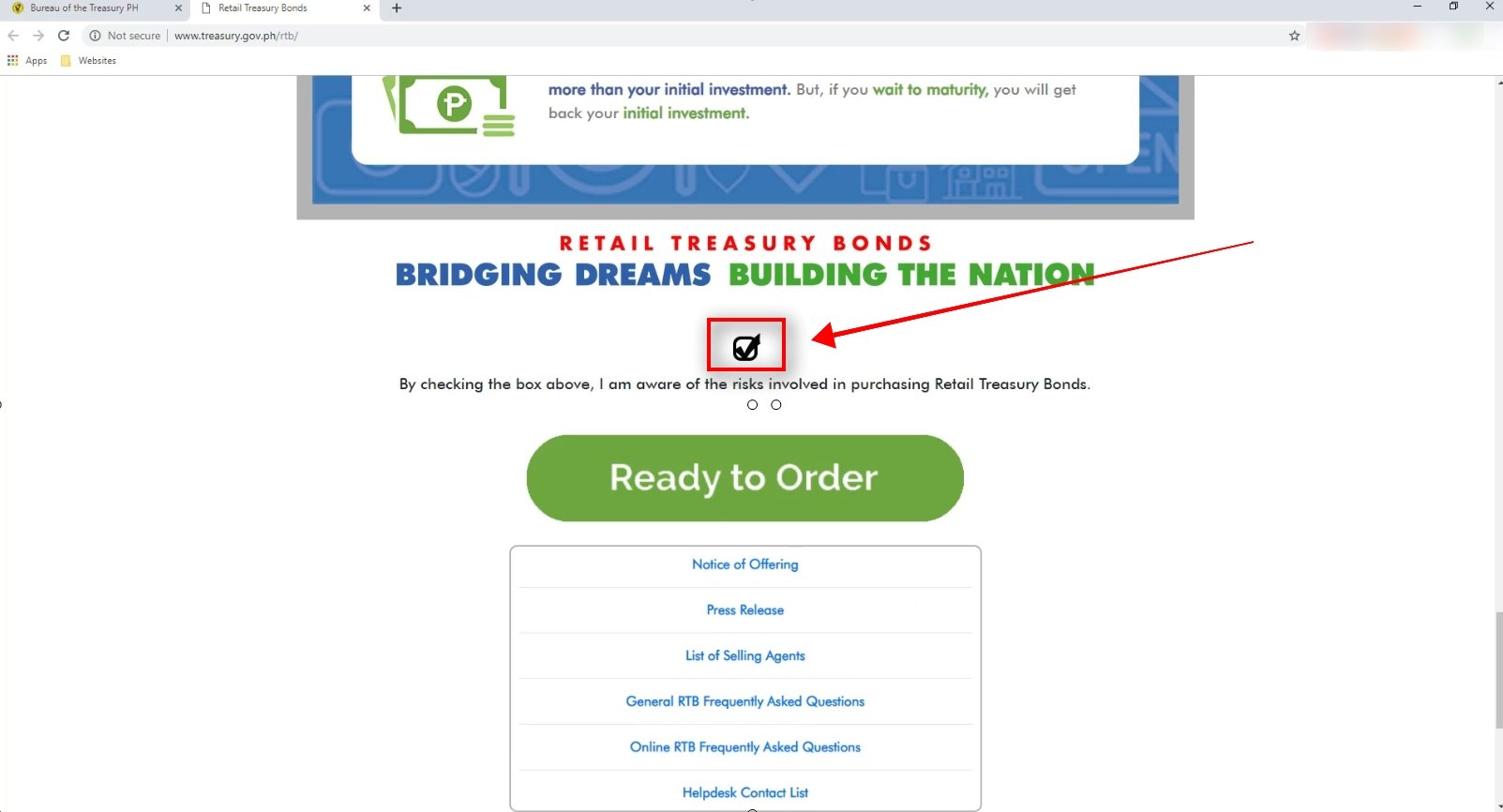

Step 2: Tick the checkbox and click on the Ready to Order button.

If you are already sure that you will be investing in RTBs, tick on the checkbox and hit on the Ready to Order button.

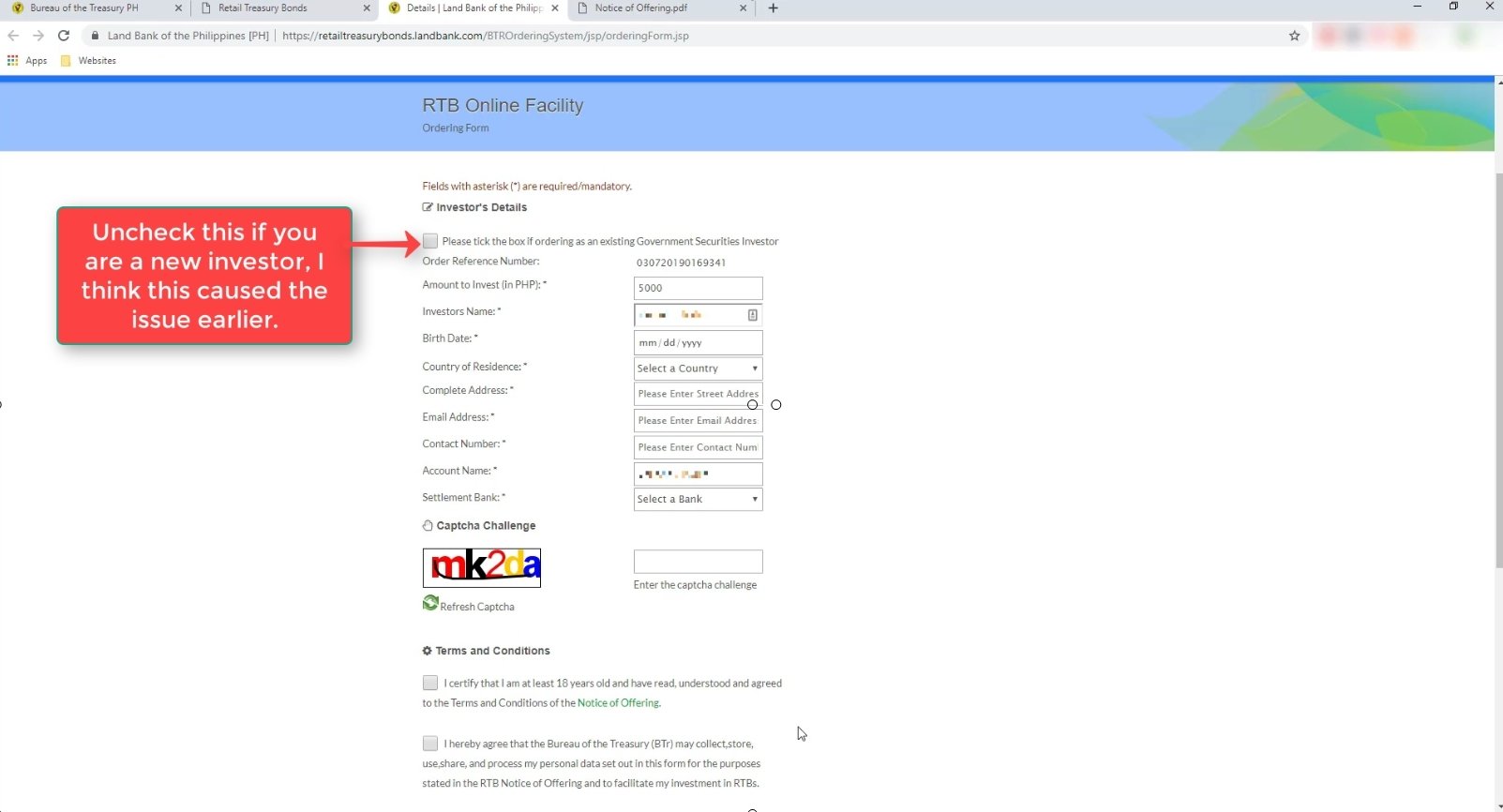

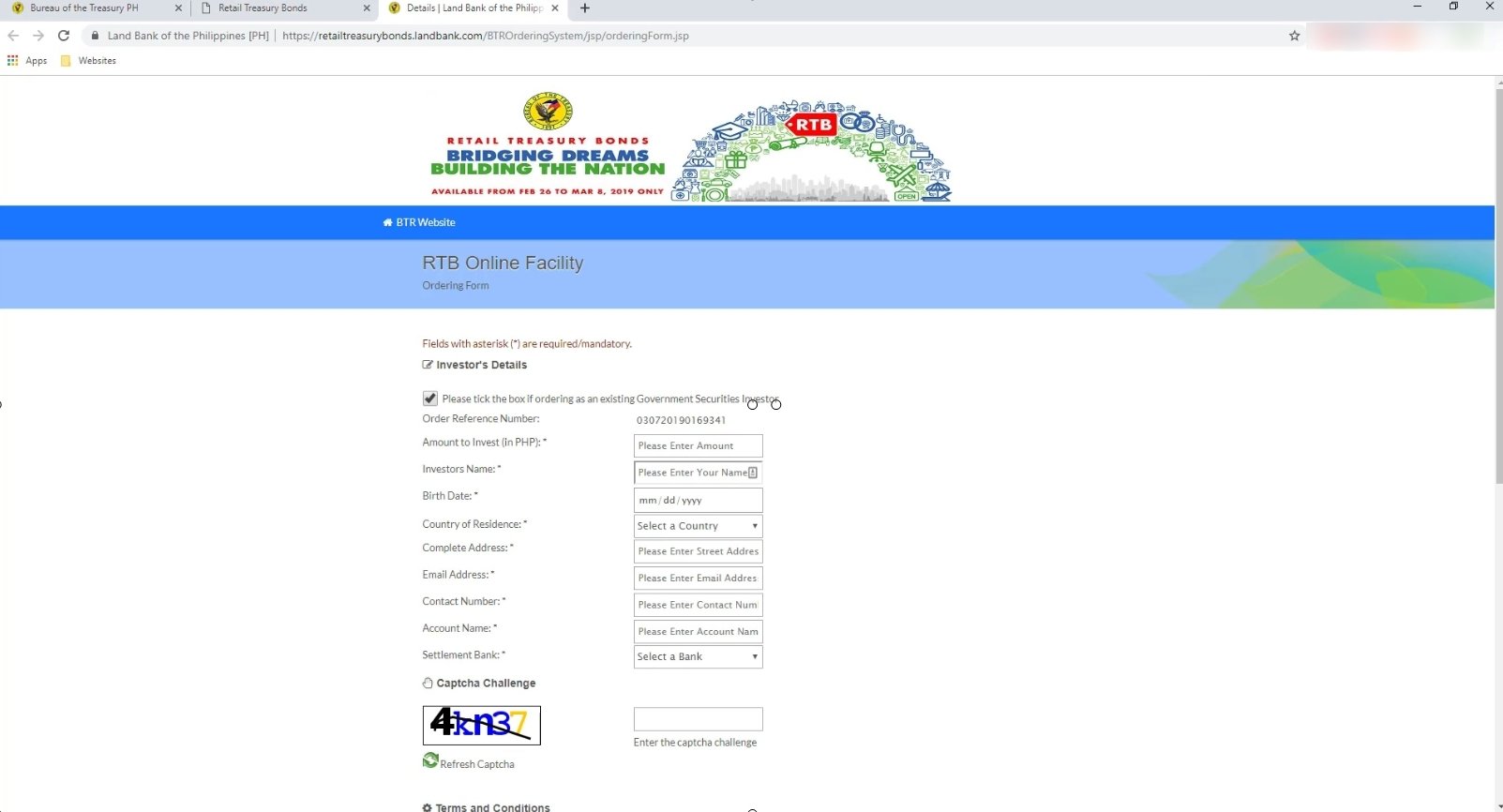

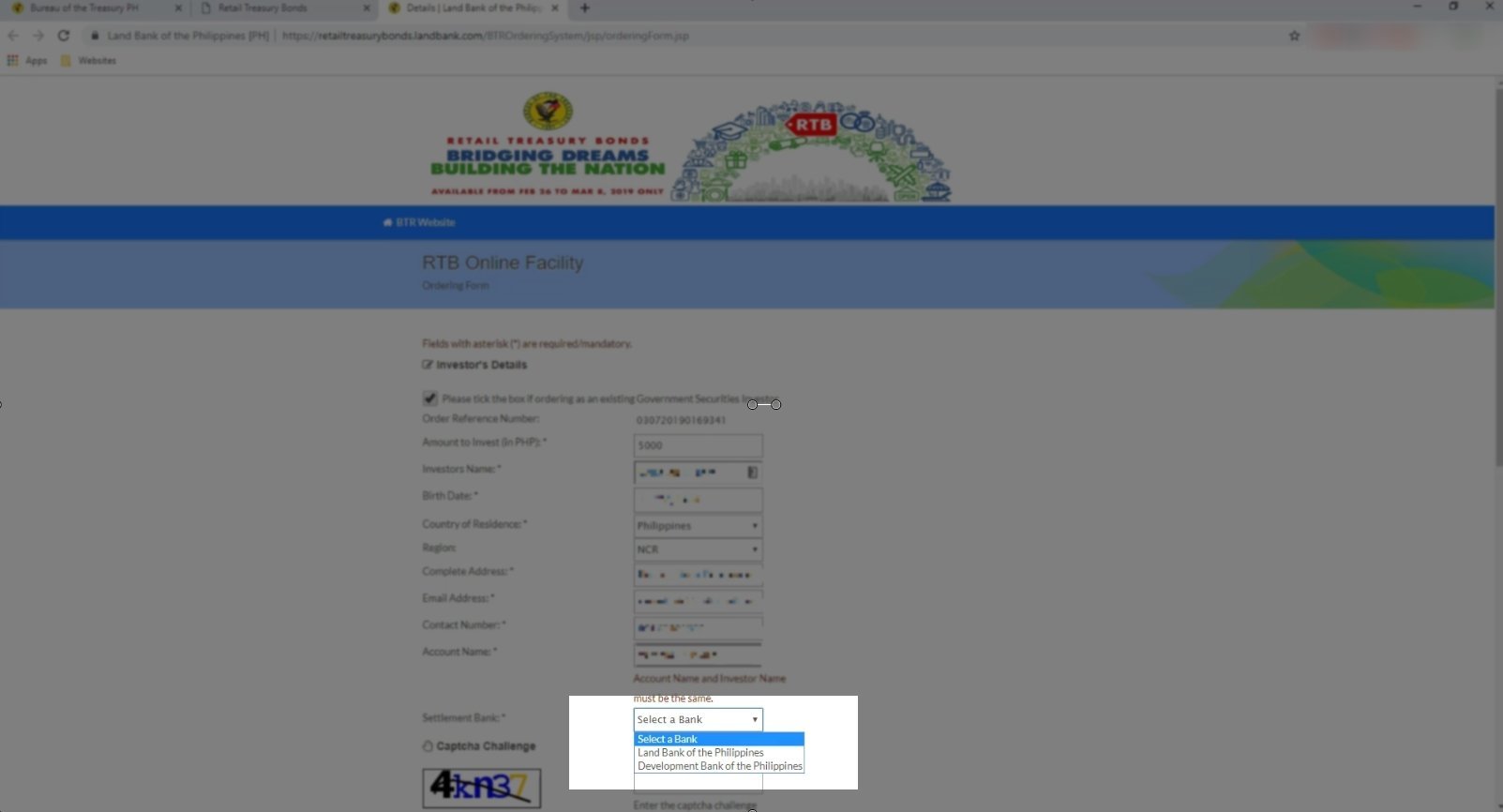

Step 3: Fill up the Ordering Form

You will need to fill out the ordering form as shown in the image below.

There are key things to note here:

If this is the first time that you are investing to Government Securities, make sure that you leave the box unticked.

As you can see in the YouTube video above, the form was not submitting initially because of this.

Amount to invest field: the minimum amount to invest is 5,000 pesos.

Account Name and Investor Name must be the same.

Settlement Bank: There are only two options for the bank as of now: Land Bank of the Philippines and Development Bank of the Philippines.

Hopefully, they’ll be adding more banks in the future.

If you do not have an account yet, we have a post on how to open a Land Bank Savings Account

You will also need to Enroll to Landbank Online Banking.

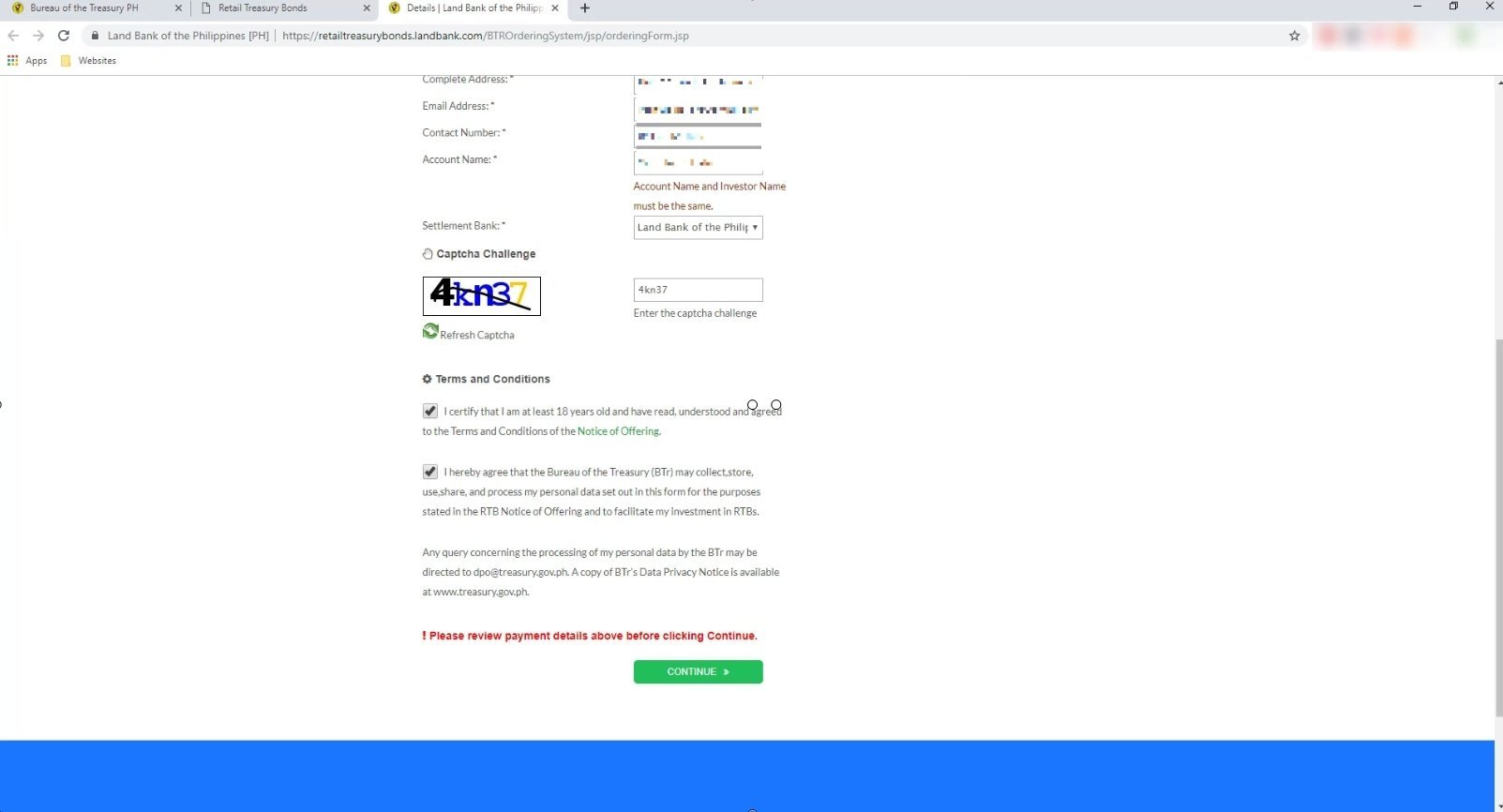

You will also need to agree to the terms and conditions then click on the Continue button to proceed.

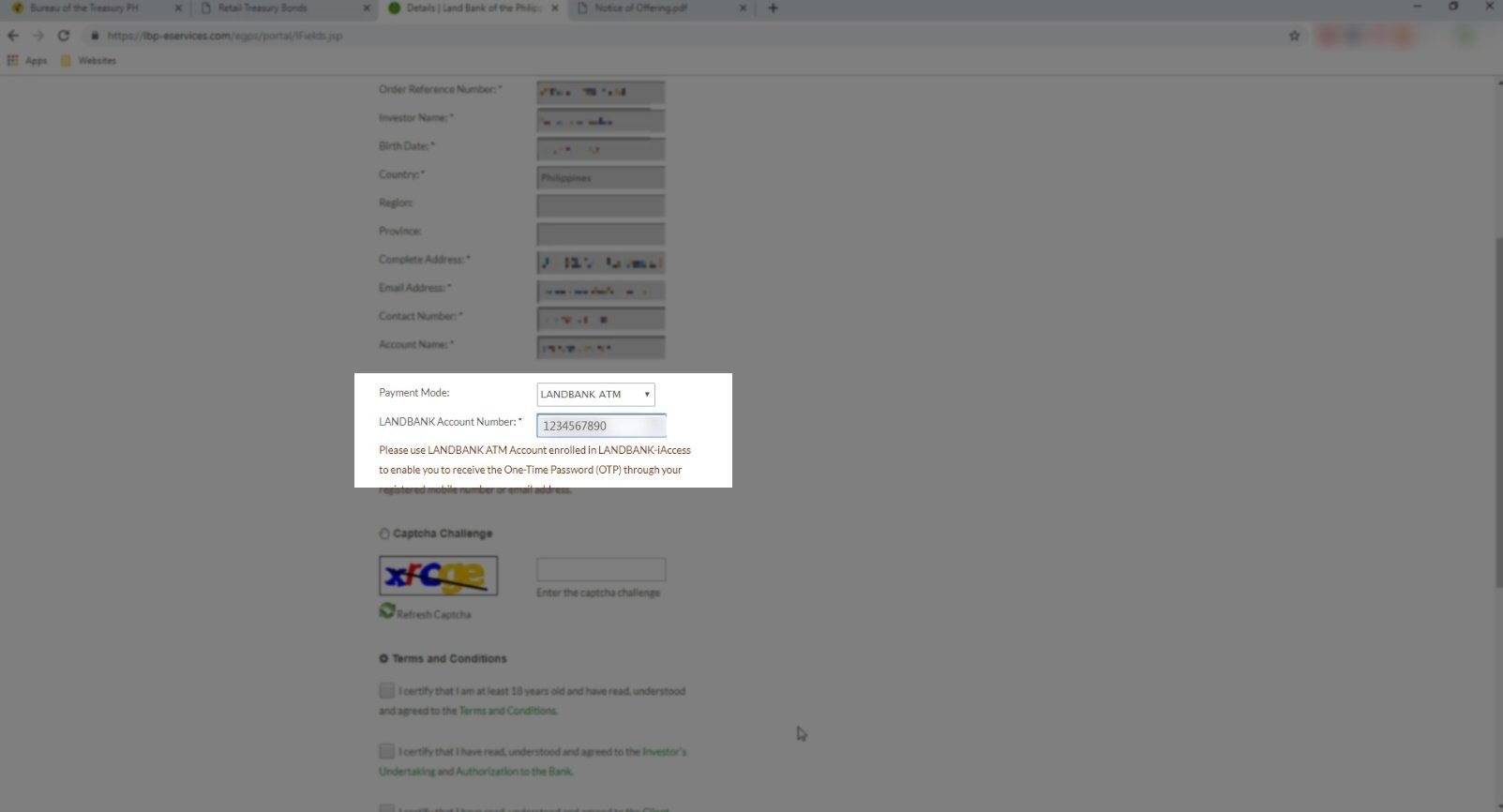

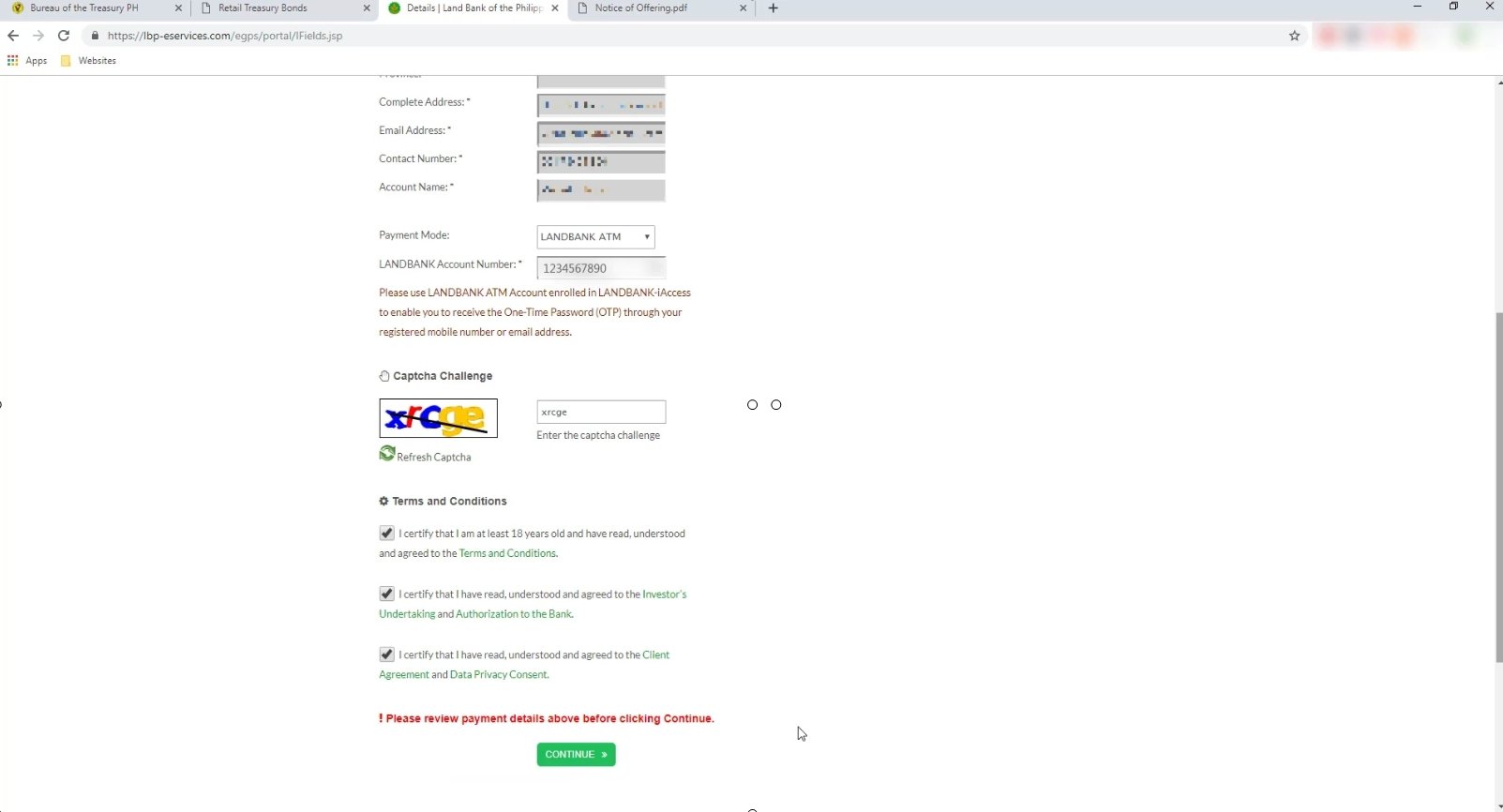

Step 4: Input your Bank account number

Since we chose Landbank as the settlement bank, we will need to input the Land bank account number.

You will again need to input the catcha challenge and agree to the terms and conditions.

Click on the continue button when done.

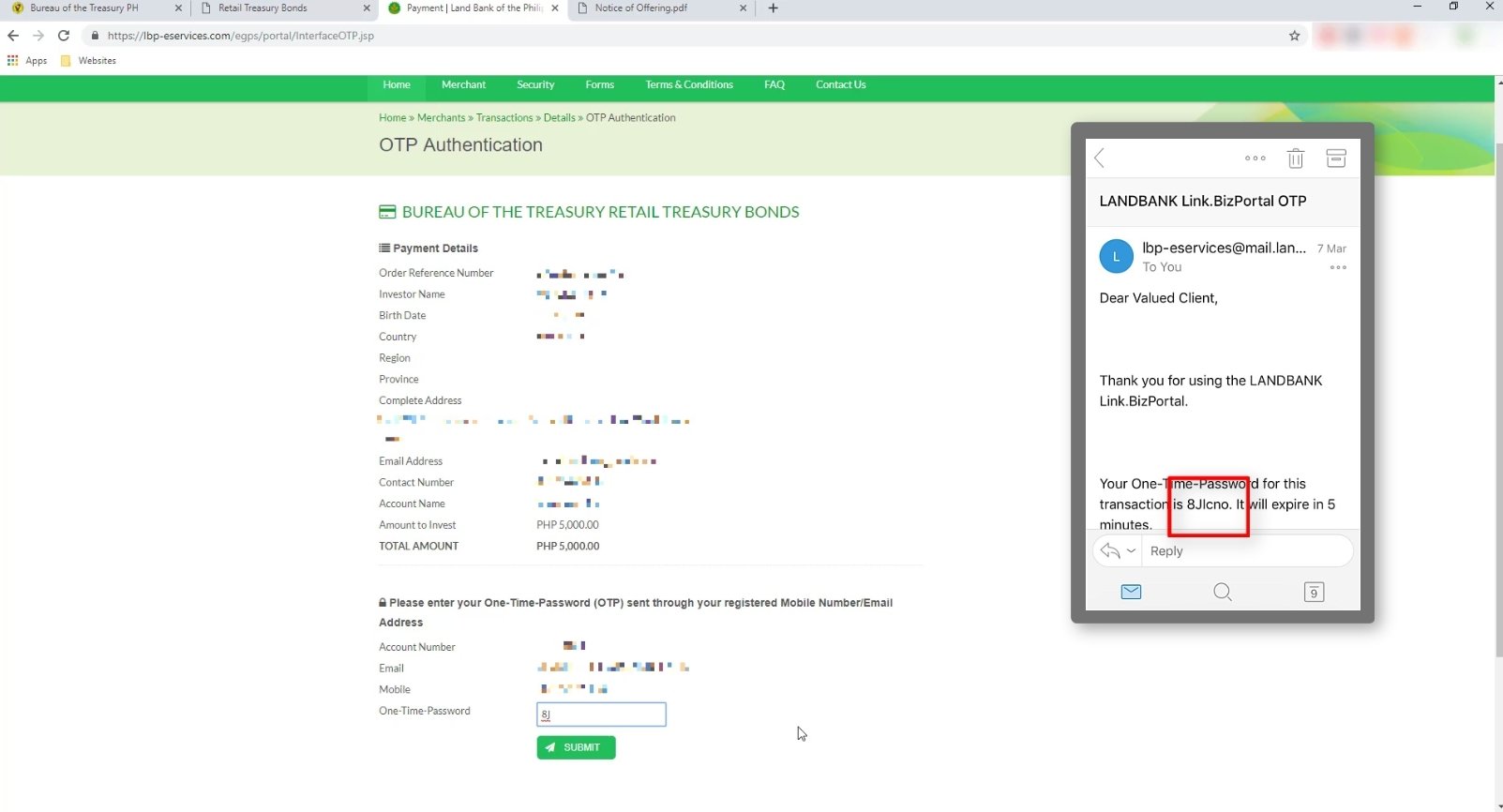

Step 5: Input the One Time Password.

The next screen will show you the payment details of your current transaction and will also require you to further validate it by sending a One Time Password or OTP to your mobile number or email.

In my case, I received the OTP via email.

It could take around 1 minute for the OTP to arrive.

Input the combination into the field and hit on the submit button to continue.

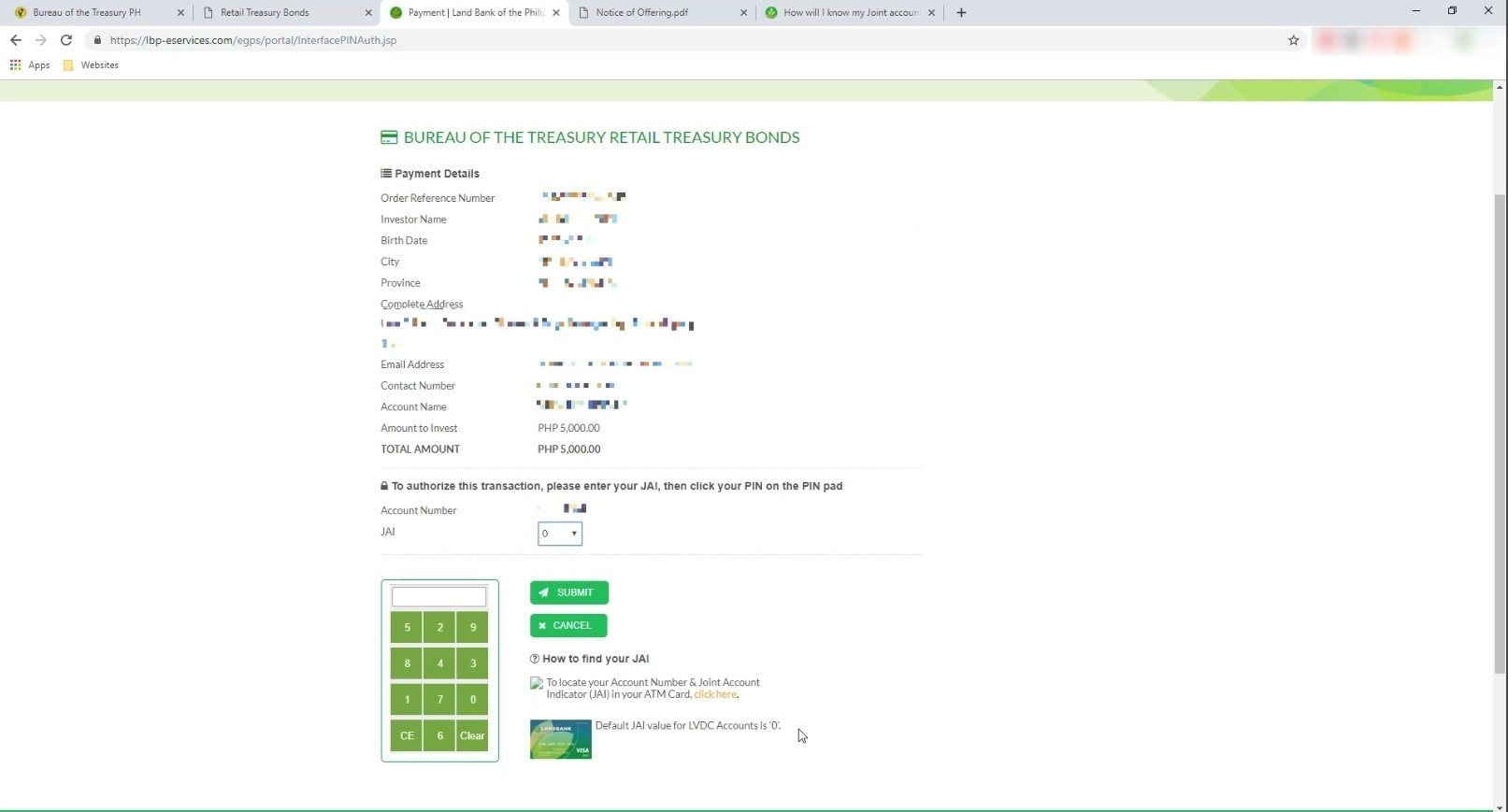

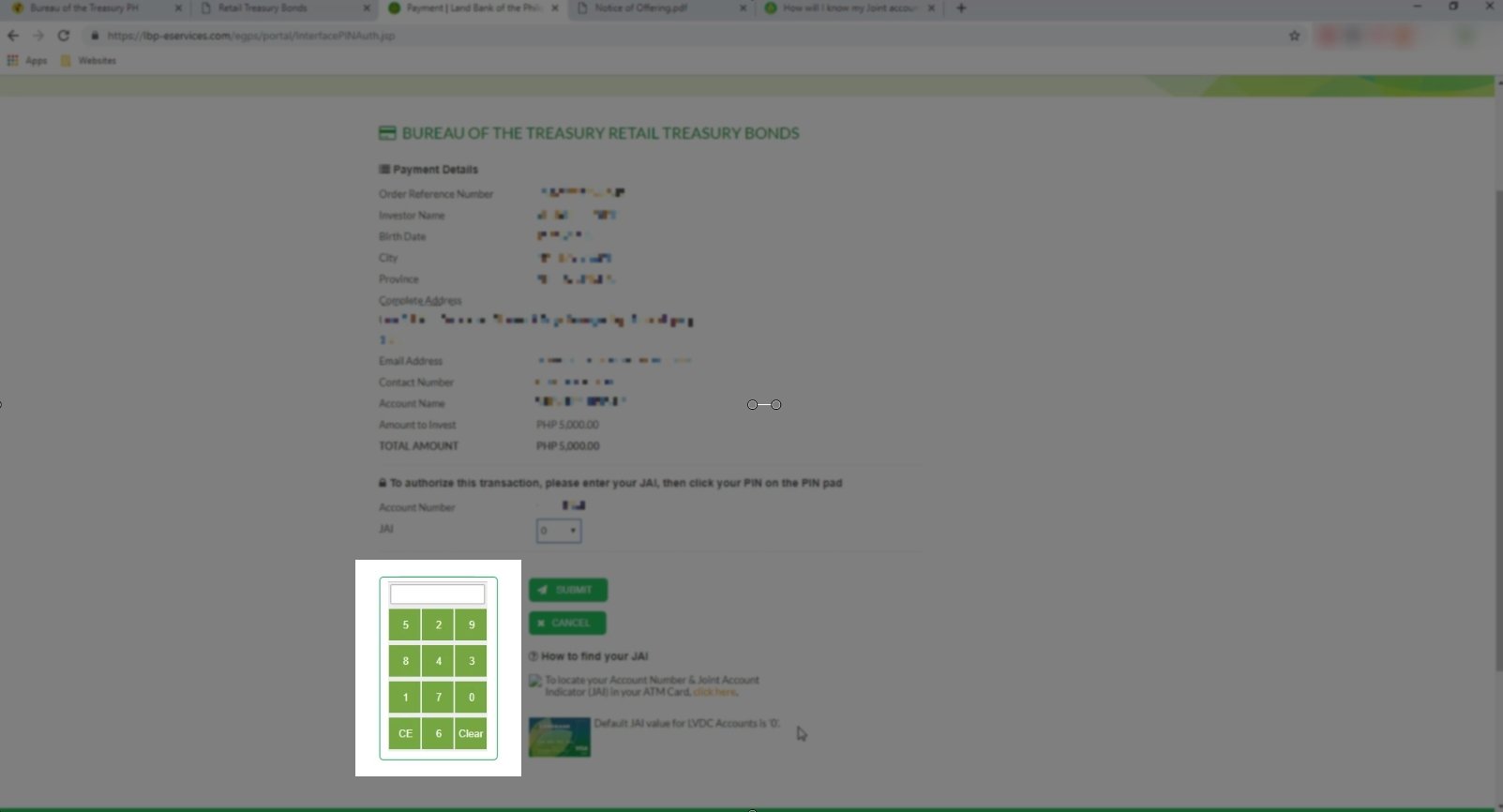

Step 6: Further validation will require your account JAI and PIN.

On the next step, they will require you to input your bank account’s JAI and PIN for added verification.

Since the account that I opened is not a joint account, the JAI number for me is 0.

Enter the pin using the virtual numpad.

Take note that the numbers are jumbled. I think this is for extra security.

Hit the submit button when done.

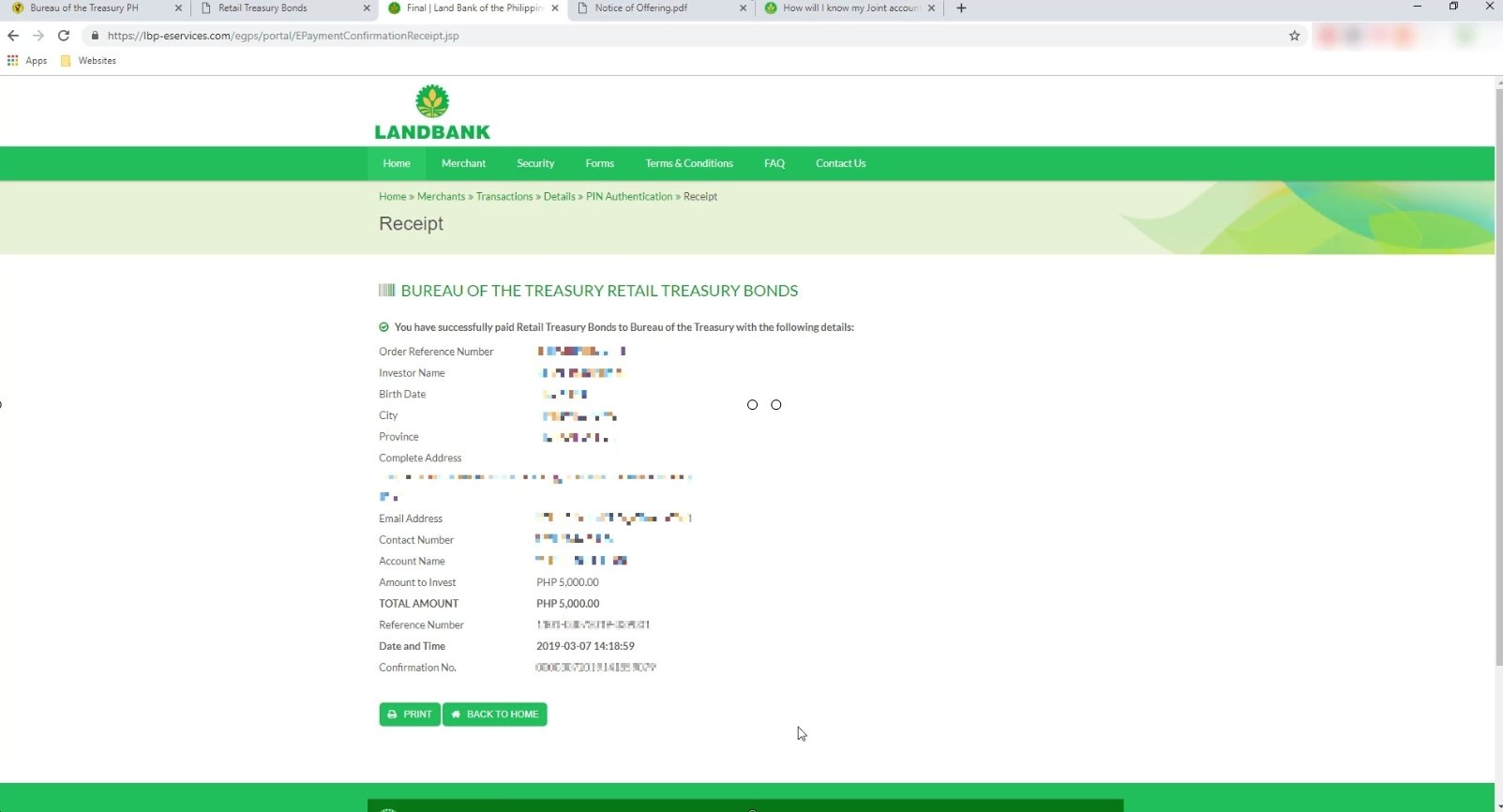

Step 7: You will see the receipt of your transaction.

If your transaction was successful, you will see a receipt detailing the investment transaction.

You will also have an option to print the receipt or save it to your computer by clicking on the Print button.

Did you miss investing to this RTB offering?

Don’t worry, the Philippine Government will surely release new offerings in the future.

We will then update this post if that happens.

Financial Transactions Made Easy!

More on our Youtube Channel.

Subscribe Now!