Retail Treasury Bonds Philippines 2019: What are Retail Treasury Bonds?

Video taken from the Bureau of the Treasury YouTube Channel.

If you are looking for a low risk investment for your personal goals and also want to contribute to building our nation, you should consider investing in Retail Treasury Bonds (Philippines).

For a minimum amount of only Php 5,000 you can already invest in RTBs.

Let me answer several questions you might have about Retail Treasury Bonds in the Philippines.

What are Retail Treasury Bonds?

Retail Treasury Bonds or RTBs are low-risk, fixed-income and fixed-term investments that are issued by the Philippine Government.

As part of their savings mobilization program, these type of investments are especially made by the government in order to make securities easily available to small investors at an affordable price.

The program also aims to advocate the importance of “saving” for Filipinos.

Funds from RTBs are usually used to aid government efforts such as health and educational programs, public infrastructure, etc.

RTBs are considered to be fixed-income securities as you earn at a fixed interest rate which are given to you quarterly.

Bureau of the Treasury

The Republic of the Philippines issues RTBs through the Bureau of the Treasury (BTr).

Bureau of the Treasury is the government office who is responsible in facilitating RTBs.

The current national treasurer is Rosalia De Leon.

If you want to know more about them, check out their official website.

Who can Invest in Retail Treasury Bonds?

Any individuals, corporations, financial institutions or other institutional investors can invest in the retail treasury bonds during the public offering.

It is really the drive of the Philippine Government to make government securities available even to small time investors.

Investing in Retail Treasury Bonds is ideal for people who do not want or is able to tolerate a lot of risk and volatility.

Age is not a factor in investing to RTBs.

Minors can invest in it.

Although, it will be placed under an “In Trust For” account and that the trustor-trustee relationship should also be proven.

Why Invest in Retail Treasury Bonds?

There are quite a number of reasons why it is beneficial to invest in RTBs:

Investing in Retail Treasury Bonds are considered to be low-risk.

What really makes RTB attractive to investors is it being a low-risk type of investment.

All types of investment have inherent risks but retail treasury bonds are among those that are nearly “risk free.”

Why is that so?

Well, a big factor is that you are lending your money to the Government where it has virtually unlimited resources to pay off their obligation.

RTBs are also considered as direct, unconditional and general obligations of the Republic of the Philippines.

Although other factors can affect your investment, the only real threat for you is the risk of the Government defaulting on its loan which has a low probability.

Retail Treasury Bonds are affordable.

The Philippine Government is really serious in providing more avenues for small investors to diversify their portfolio.

The placement is mostly targeted at retail or individual investors.

You can now avail of the RTBs and open an account for as low as Php5,000 during the public offering.

It is now convenient to invest in RTBs.

There are now 20+ banks and selling agents available from where you can invest into the Retail Treasury Bonds.

Check out the [Where to Invest in Treasury Bonds?] section for more details.

RTBs have a higher yield compared with most time deposit rates.

Interest rates for RTBs are mostly competitively priced taking into consideration the prevailing market rate at the time of public offering.

Interest is paid quarterly.

For Retail Treasury Bonds, interest payments are made quarterly compared to regular treasury bonds which are paid semi-annually.

RTBs are transferrable.

RTBs can be bought and sold in the secondary market through the selling agents.

Although, it is subject to minimum requirements and market rate charges.

How much can I earn or make money with Retail Treasury Bonds?

Since Retail Treasury Bonds are low-risk type of investments, they have lower potential returns if you compare it with other high risk investments such as investing in the stock market.

Although, if you compare it with other low-risk investment types, RTBs yields much higher – ranging from 4 – 6% per annum interest rate.

The rates are definitely much higher than just placing your money in savings account.

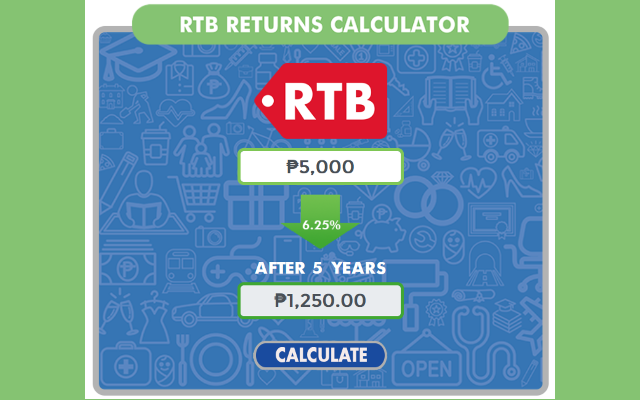

Let me give you an example. Here are the things to consider:

Invest amount = Php 5,000

RTB offer interest rate = 6.25% per year

20% withholding tax

Interest payment are quarterly (4 times a year)

Computation:

Php 5,000 x 6.25% interest rate = Php 312.50

Php 312.50 x 20% withholding tax = Php 62.50

Php 62.50 x 4 (quarterly; 4 times a year) = Php 250 per year

In this scenario, your Php 5,000 will yield Php 250 per year.

Imagine if initially invest Php 100,000 – that would yield Php 5,000 per year or Php 1250 per quarter.

Not bad if you compare it with just letting your money sit on your bank’s savings account.

If you want to faster compute for the returns, head over to the Bureau of the Treasury website as they have a calculator tool there.

Take note that the yield amount is assured if the investor holds on to it until maturity.

If you decide to withdraw your money before the maturity date, you are subjected to the interest rate risk which will depend on the prevailing market rate at that time you decide to sell your RTBs to the secondary market.

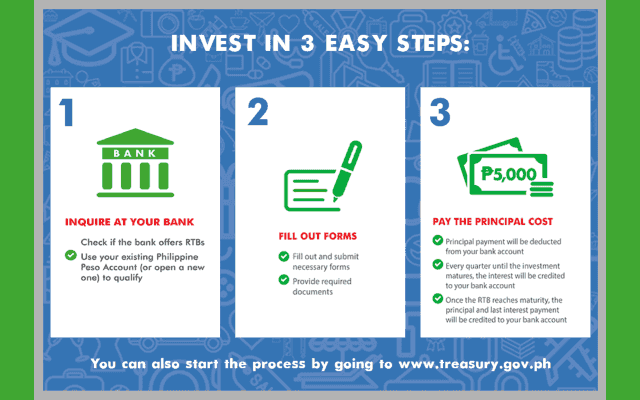

How to Invest in Treasury Bonds?

They have made investing in Retail Treasury Bonds now as easy and convenient.

You can do it by going to the nearest chosen accredited selling agent and inquire about RTBs.

Payment procedures and minimum investment requirements may vary per selling agent but all of them would require you to have a peso account.

It is through this account where you will pay for your initial investment and also receive your interest earnings.

Checkout our post on How to Invest in Retail Treasury Bond Over the Counter.

Alternatively, the Bureau of the Treasury has introduced a new ordering platform where you can purchase RTBs online.

The primary purpose of this initiative is to encourage more Filipinos to invest especially those that are abroad like the OFWs.

We also have a blog post on How to Invest in Retail Treasury Bonds Online.

Where can I Buy Treasury Bonds?

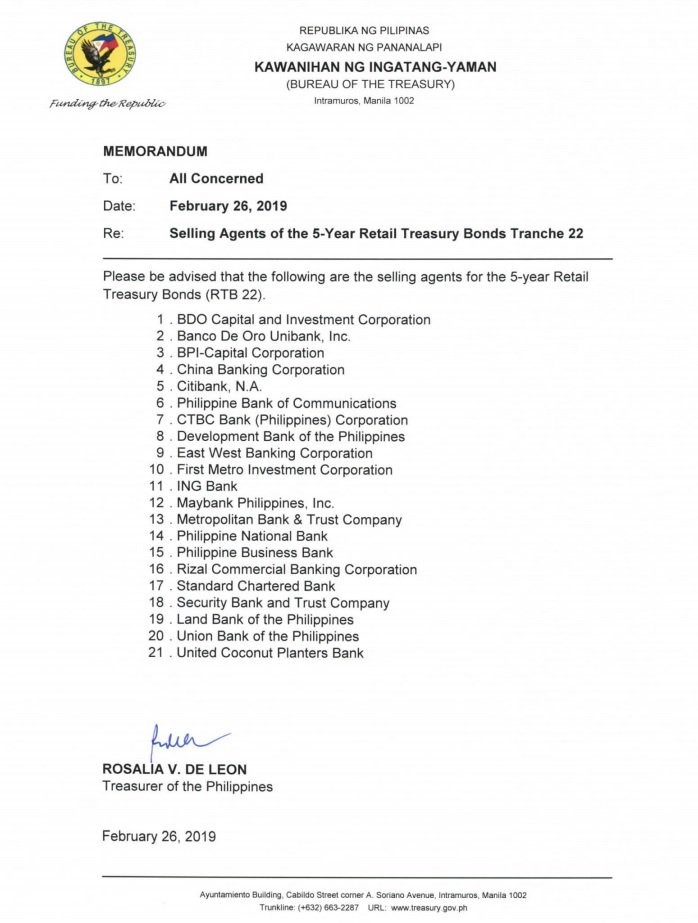

Retail Treasury Bonds are sold only by government accredited selling agents.

Be sure to verify if they are part of the list.

Typically such list is included in the RTBs offering details or press release.

Remember that an accredited selling agent can choose not to participate on an RTB offering so it is always best to check the RTB offer details or press release of the current RTB offer.

You can go to the nearest branch of your choice of bank and inquire about RTBs.

However, some bank branches are not fully knowledgeable about the RTB offerings.

You may want to confirm with their Asset Management Division or helpdesk first before physically going to the bank.

For 2019’s first 5 year Retail Treasury bonds, there are 21 selling agents from which you can contact in order to invest in the RTB offering.

Among the list are BDO, Security Bank and Chinabank.

If you need to reach out to them via phone or email, check out this list of helpdesk/ customer care support for some of the selling agents.

Other Information on Retail Treasury Bonds

There are other important details that you need to know about Retail Treasury Bonds:

- RTB interest payments are subject to 20% final withholding tax. Only tax-exempt institutions that duly certified by the Bureau of Internal Revenue are exempted from this tax.

- After the public offering period, investors may still purchase RTBs in the secondary market but the price will be based on the prevailing market rates.

- During your RTB maturity, your full initial investment amount will be credited back to your account.

List of Retail Treasury Bonds Philippines (as of 2019)

Here you will find Retail Treasury Bonds being offered.

We will do our best to update this page if new RTB our being offered in the public.

Be sure to regularly check this page! 🙂

RTB-22: 5-Year RTBs due 2024

Issue Date: March 12, 2019

Maturity Date: 5 years from issue date

Public Offer period: February 26, 2019 – March 8, 2019

Interest rate: 6.25% p.a. (subject to 20% withholding tax except for tax-exempt institutions)

Interest payments: Quarterly

Minimum amount to invest: Php5,000 (additional amount: multiples of Php 5,000)

Check their website for more information.

Financial Transactions Made Easy!

More on our Youtube Channel.

Subscribe Now!

Financial Transactions Made Easy!

More on our Youtube Channel.

Subscribe Now!