How to Open Savings Account in Landbank of the Philippines

Are you interested in opening a Landbank Savings Account?

Let me guide you on how to open savings account in Landbank of the Philippines.

But first, let us learn all the details of a Landbank ATM Savings Account.

All about Landbank Savings Account

Land Bank of the Philippines is a universal bank that is owned by the Philippine Government.

One of its service offering is the Landbank ATM Savings account.

It is a peso savings account where you can earn interest over time.

What are its features?

Deposit Transactions

Deposit transactions can be done over-the-counter or through cash deposit machines.

Withdrawal Transactions

Same as deposit transactions, withdrawals can be done over-the-counter or through any Bancnet ATMs.

Cashless Payments

Landbank savings account also allows cashless purchase transactions through Point of Sale (POS) terminals from partner merchants such as department stores, supermarket among others.

Who can open a Land bank ATM Savings Account?

The following individuals can open a savings account:

- A person who is at least 7 years old

- Able to read and write

- Not suffering from any legal disability

- With credible identification

Minimum Initial Deposit

The minimum initial deposit is 500 pesos.

Required Monthly Minimum Maintaining Balance

The required average daily minimum maintaining balance for the Land bank Savings Account is 500 pesos.

Required Daily Balance to Earn Interest

The savings account needs to have 2,000 pesos daily in order it to earn interest.

Interest Rate per year

As of August 1, 2017: 0.10%

ATM Withdrawal

As of September 17, 2018, the maximum withdrawal amount per day is 30,000 pesos.

Cashless Payment (POS)

For cashless payments in Point-of-Sale (POS) terminals, the maximum amount per day is 50,000 pesos.

Service Fee for Falling Below Minimum Maintaining Balance

Landbank imposes service charge if your account falls below the maintaining balance.

It will cost you 200 pesos per month.

Closing Fee

If you chose to close your account within one month from the opening date, there is a service charge of 300 pesos.

Dormancy Fee

If your account does not have any financial transaction for two years and it falls below the required average daily minimum maintaining balance, Landbank will charge you 30 pesos per month of inactivity.

PDIC Insurance

Your money in the Landbank ATM savings account is protected by PDIC up to 500,000 pesos.

That amount is the maximum deposit insurance per depositor.

Other Fees

If you are interested to know what other fees you need to watch out for, check out the Landbank website.

How to Open Savings Account in Landbank of the Philippines

Step 1: Prepare your requirements.

Get yourself ready with the requirements.

It will be much faster if you already prepared all the needed requirements before going to the bank.

Here is the list of requirements:

- 1 valid ID

- 1×1 recent photo (2 copies)

- 500 pesos for the Landbank ATM maintaining balance

- Other documents/ information (might be asked):

- Company ID

- Proof of billing

- TIN number

Important things to Remember

For the valid ID: to avoid any hassle, it will be much better if you can provide a Government ID such as UMID, passport, etc.

For the 500 pesos Landbank ATM maintaining balance, same as with other banks that have maintaining balances, make sure that the money remaining in your account does not go lower than 500 pesos.

The bank imposes penalty deductions if it goes below the minimum maintaining balance.

For the other documents/ information: it will be handy if you have these documents in the event that it would be asked.

In my case, the officer asked for my company ID and proof of billing.

Proof of billing can be your electricity (example: Meralco), internet (example: PLDT) water bills or other billing statement as long as it has your address in it.

Although, just to be sure try to bring a bill from the three mentioned above.

If you also have other IDs, bring them with you just in case it is needed.

Other Cases

For child account

Parents can opt to open an account for their children.

It will have the same feature as the normal savings account but it will just be indicated that the account is on behalf of the child.

Additional requirement for this is to bring the birth certificate of the child.

For students

There is a special case for students who are beneficiaries of remittances but are not yet of voting age.

They will be allowed to use their school ID provided that it is signed by their Principal or head of school.

Photocopy of it is also required.

For Foreigners

Foreigners can own a Land bank savings account provided that they submit the following requirements:

- Passport

- ACR (Alien Certificate of Registration)/ Diplomatic Identification Card issued by the DFA specifying your status (status example: working, business, student, etc).

- If you’re working permit is under process, you will be required to submit a Certificate of Employment.

For Single Proprietorship

If you are a single proprietor business, you can open a savings account by submitting the following requirements:

- Certificate of Registration with DTI

- City/Municipal Mayor’s Permit

Step 2: Go to the nearest Landbank branch.

In my case, Landbank Guadalupe branch was the nearest.

Step 3: Inform the Guard that you will be opening a Landbank Savings Account.

The guard on duty gave me a queue number under “Other NAC Services.”

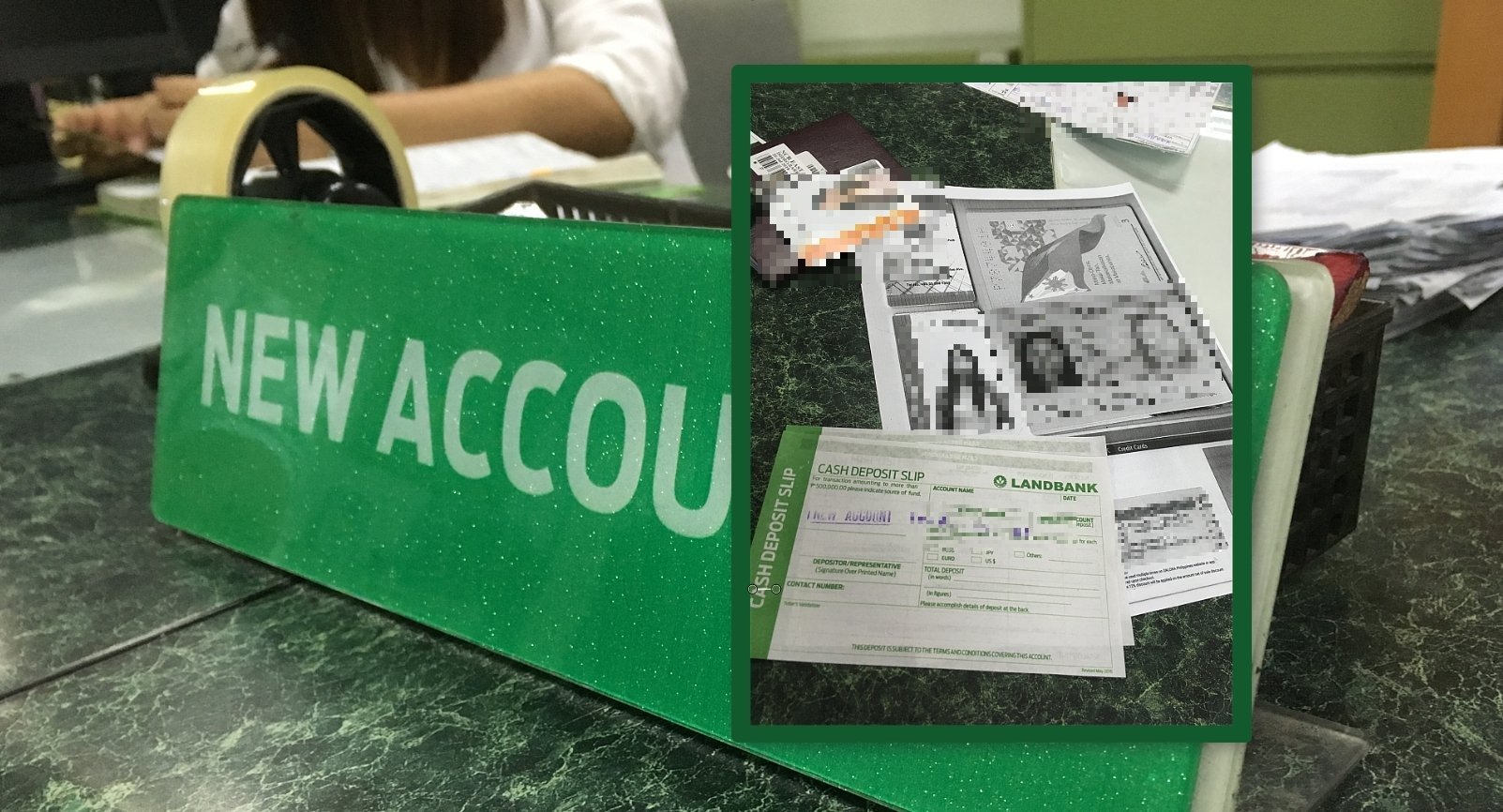

Step 4: Present the requirements to the Bank officer.

When my number was called, I showed them the Landbank ATM Savings account requirements that I brought with me.

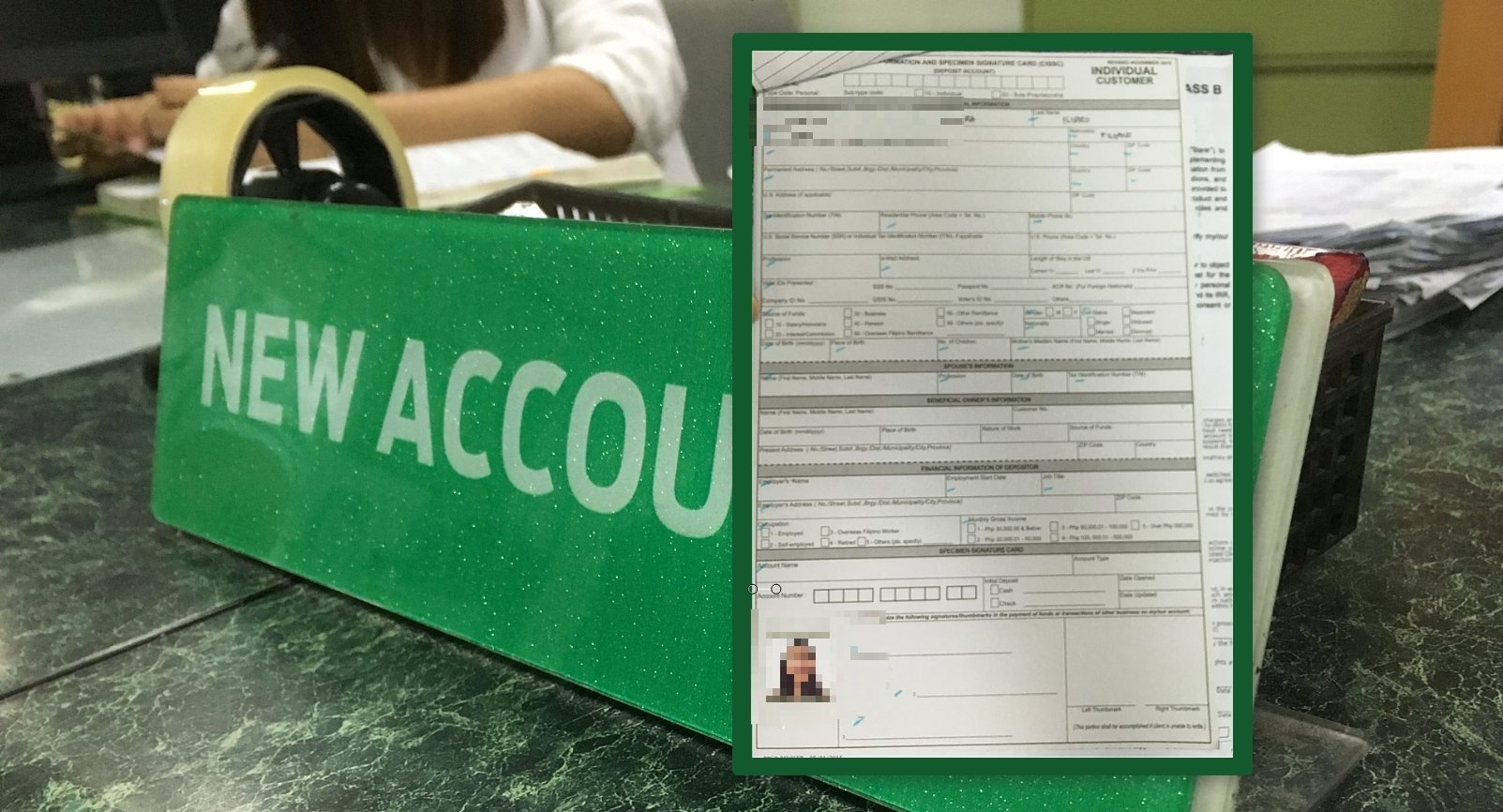

Step 5: Fill up the application forms.

The bank officer then provided me with forms that I need to fill out.

Step 6: Wait for your ATM card.

After I submitted the form, the bank officer evaluated it and when everything was okay, she handed over my new Landbank Savings Account ATM card.

She also provided a paper with instructions on how to change the ATM pin.

The entire process was pretty fast as I have the requirements already readily available.

Let us know if this guide was helpful to you so that we will be inspired to do more step by step tutorials similar to this.

Financial Transactions Made Easy!

More on our Youtube Channel.

Subscribe Now!

Financial Transactions Made Easy!

More on our Youtube Channel.

Subscribe Now!

Hello can i ask something if i open a atm card its that avail to receive remittance from Australia

Hi, Yes. May mga partner na remittance center si Landbank sa Australia.