How to Invest in Retail Treasury Bond (Over the Counter)

Are you interested in investing on Retail Treasury Bonds?

Yes? Then you are in the right place!

This guide will show you how to invest in Retail Treasury Bonds (over the counter).

But first you need know the basics about RTBs.

We have detailed this in our previous post here.

Check it out first so you can be familiar with RTBs.

Now, let us go to the details on how to invest in Retail Treasury Bonds.

There are two ways to invest: over the counter and online.

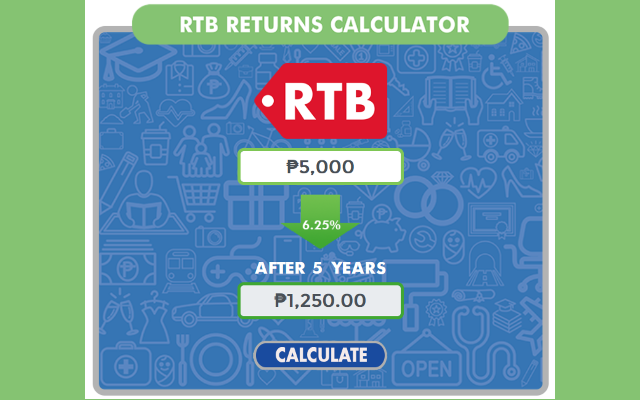

Basically, you can invest in RTB for a minimum amount of Php 5,000.

The first option is to invest over the counter.

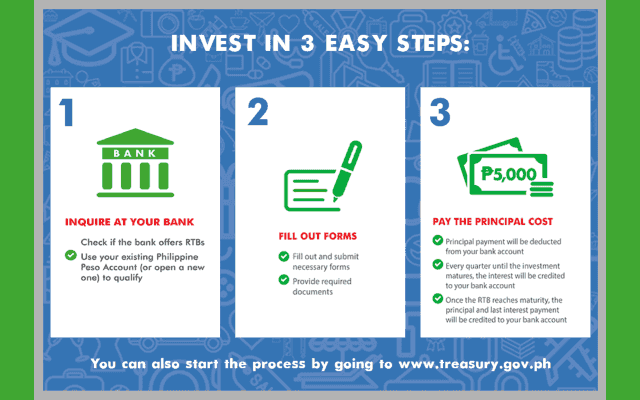

In this way, you need to go to an accredited selling agent or bank.

Take note that each RTB offering has a different set of selling agents as the accredited agents can opt not to join the offering.

Second option is through online.

If you have an online banking account with Land Bank or ADB, you can choose this option.

Since I do not have an account yet with any of these banks, my only option is to invest through over the counter.

I chose Security Bank as my selling agent since I already have an account with them.

Here are the steps to invest in RTB (over the counter).

This is based on my experience and it may vary per bank requirements but it should be almost similar.

I visited the bank twice.

First was to reserve the fund and second visit was to sign the documents.

Step 1: Visit your chosen selling agent.

Go to your chosen selling agent or bank and inform the bank officer or manager that you are interested to invest in RTB.

Step 2: Provide the amount to invest and your contact number.

You will need to tell them the amount that you are investing and your contact number.

They will need these for the next steps.

Step 3: The bank will verify bond allocation.

The bank manager or the bank officer will need to do a reservation first.

This is the process where in they need to verify if a RTB can be allocated to you.

They will also check if full allocation is possible based on the amount that you are willing to invest.

For example, you are willing to invest Php 100,000.

There is a chance that it will not be fully allocated to you.

It could possibly be only half of it would be invested depending on the Retail Treasury Bond availability.

Sir Al from Security Bank assisted me in investing to RTB 🙂

Step 4: The bank will contact you to confirm if you got the RTB allocation.

In my case, it took another day to confirm if the reservation or allocation was successfully designated to me.

The bank officer contacted me and informed me that I can invest the full Php 20,000.

He also instructed me to come visit the branch back for the next steps.

Step 5: Go back to the selling agent to sign the documents.

I went back to the bank and signed the documents that they prepared.

Here is a list of the documents I signed:

- Investor’s Undertaking

- Risk Disclosure for Fixed Income Securities

- Special Power of Attorney

- Letter of Instruction for PHP fixed income securities

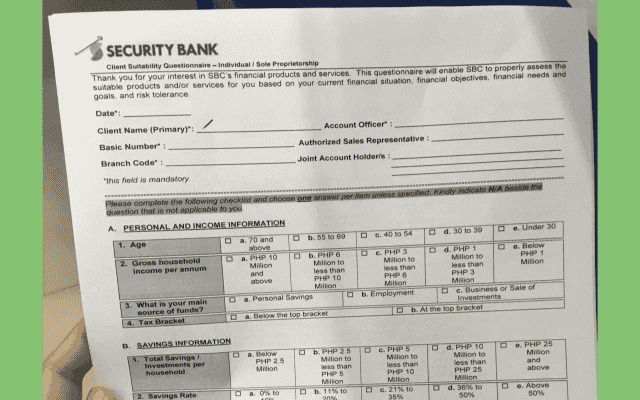

- Client Sustainability Questionnaire

Client Sustainability Questionnaire

Step 6: Open a Peso Savings account (if you do not have yet).

One of the main requirements for the RTB is to have a peso savings account with the selling agent as this is where your interest earnings would be deposited to you.

You will be receiving the interest earnings every quarter through this peso savings account.

Since my existing savings account with them is a joint account, I did not use it since that might need the other person’s signature on the documents (Although, I am not sure if they allow joint accounts for RTB investments).

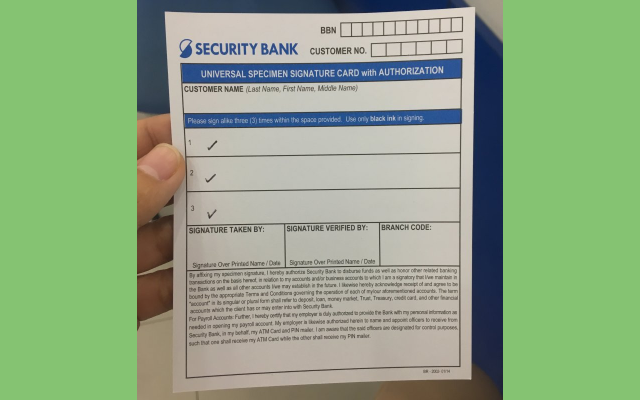

I had to open a new peso savings account.

What is nice with Security Bank is that while I was signing the documents, they had my account opened right there. Pretty efficient! 🙂

Universal Specimen Signature Card

Step 7: Pay the investment amount.

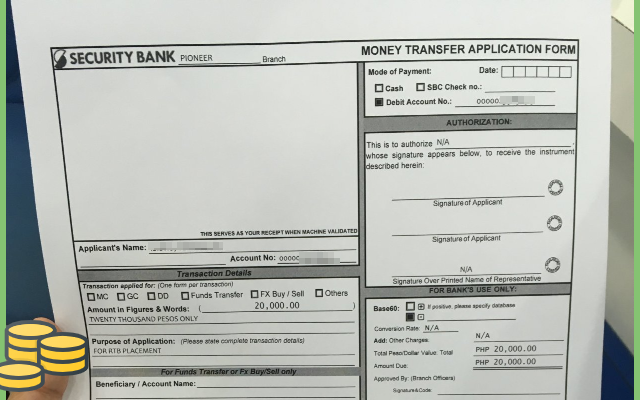

I signed another document which is the Money Transfer Application Form.

This will serve as my investment to RTB.

Also, one of the requirements for the SPA (Special Power of Attorney) and another document above (I forgot what it was) was that it needed to be notarized.

Since I do not have time to do that, you can ask them to do it for you with a 200 pesos fee (100 pesos for each document).

Money Transfer Application Form

That’s it! For the second day, I was able to process all the needed requirements in just less than an hour.

Fully decided now in investing to RTBs? Let us know how it turned out in the comments below! 🙂

Financial Transactions Made Easy!

More on our Youtube Channel.

Subscribe Now!

Financial Transactions Made Easy!

More on our Youtube Channel.

Subscribe Now!