How to Use PesoNet Philippines for Bank to Bank Transfer

Let PesoNet help you!

What is PesoNet?

Under the Philippine Government’s National Retail Payment System initiative, PesoNet was formed:

PesoNet is an electronic funds transfer service that enables customers of participating banks, electronic money (e-money) issuers or mobile money operators transfer Philippine Peso currency funds to other account which is not the same as the source bank or institution.

To learn more, you can watch this video from BSP.

If you are on the technical side or things, here are key information that you might want to know:

What does PesoNet ACH stands for?

PesoNet ACH stands for the Philippine Electronic Fund Transfer System and Operations Network Automated Clearing House.

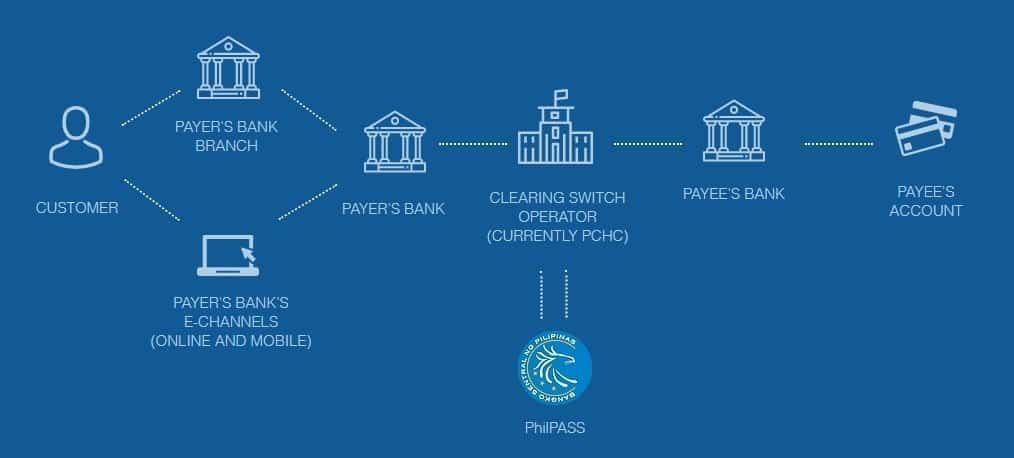

Who will be the clearing switch operator (CSO)?

The Philippine Clearing House Corporation (PCHC) is the designated CSO for PesoNet.

Here is a flowchart diagram taken from the PesoNet.info website which shows where PCHC is in the PesoNet fund transfer transaction.

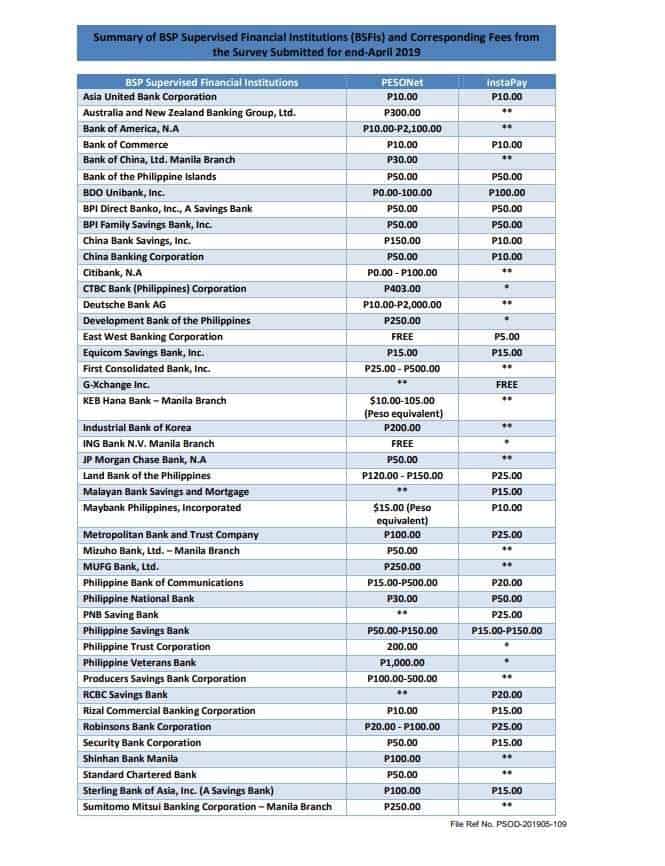

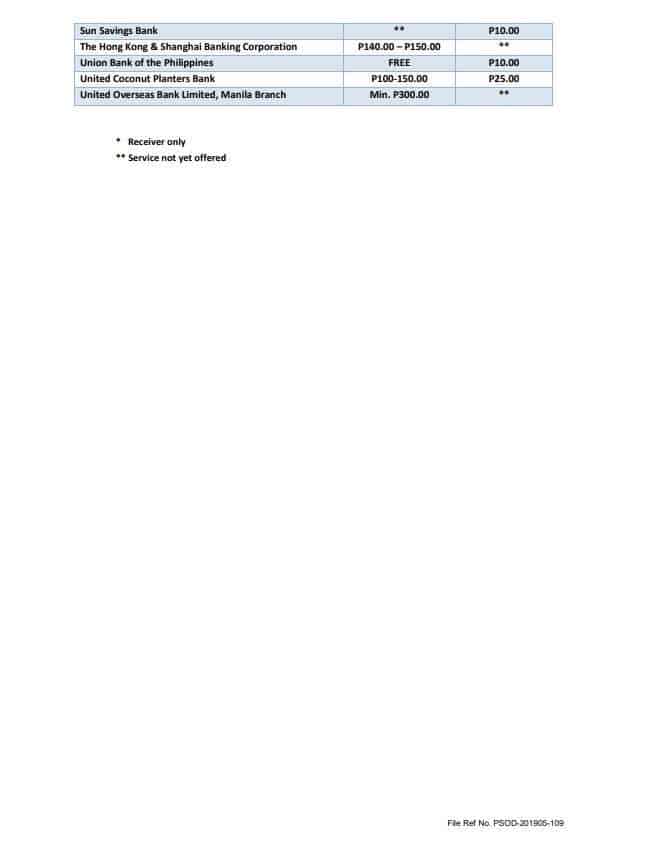

Are there any fees involved in Fund Transfers?

Yes, BSP allows banks to impose a fee for fund transfer.

You can check out this link for the latest amount of transaction fees per bank or financial institution.

The pictures below shows the transaction fees as of the end of April 2019:

How is Peso Net different with InstaPay?

These two entities have different purposes.

PesoNet was created to handle account to account fund transfer in bulk, recurring and non-time sensitive payment transactions.

On the other hand, InstaPay provides a venue for real-time and low-value payment transactions.

You can check out our blog post about InstaPay to learn more.

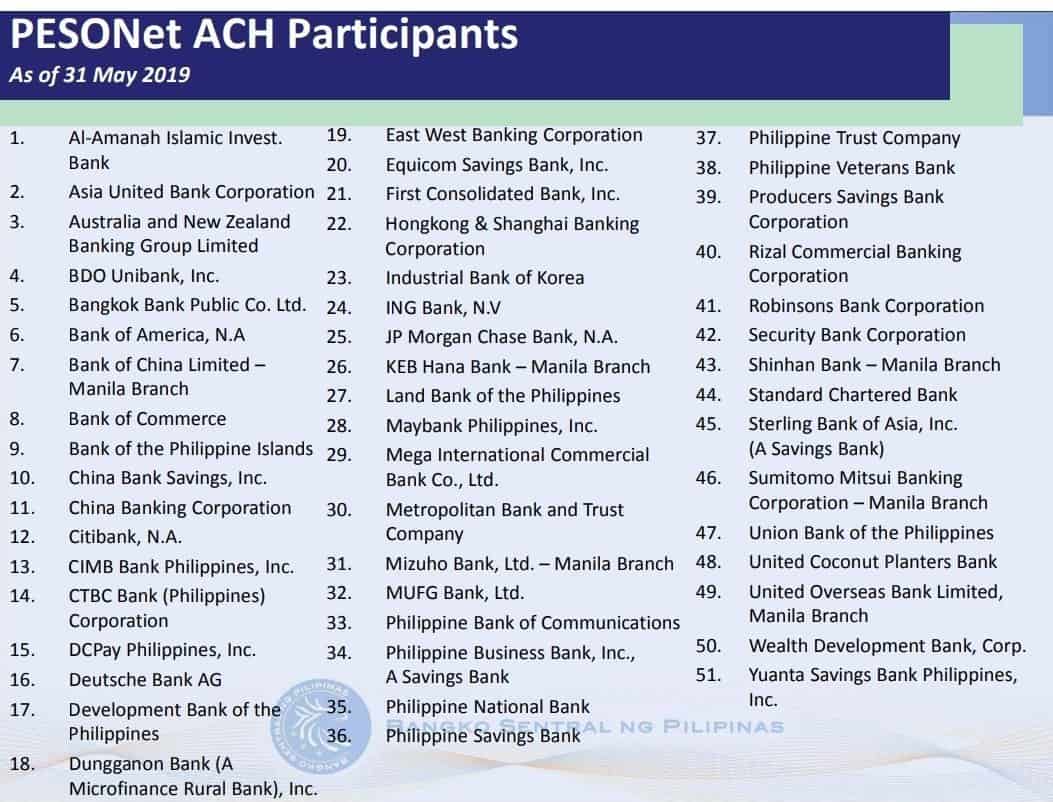

Peso Net Send Money Transfer Enabled Banks

Are you wondering which banks have PesoNet integrated in their system now?

Look no further as we will be listing them for you.

Here are the participants as of May 31, 2019 (Taken from the BSP website):

- Al-Amanah Islamic Invest. Bank

- Asia United Bank Corporation

- Australia and New Zealand Banking Group Limited

- Bangkok Bank Public Co. Ltd.

- Bank of America, N.A

- Bank of China Limited – Manila Branch

- Bank of Commerce

- Bank of the Philippine Islands

- BDO Unibank, Inc.

- China Bank Savings, Inc.

- China Banking Corporation

- CIMB Bank Philippines, Inc.

- Citibank, N.A.

- CTBC Bank (Philippines) Corporation

- DCPay Philippines, Inc.

- Deutsche Bank AG

- Development Bank of the Philippines

- Dungganon Bank (A Microfinance Rural Bank), Inc.

- East West Banking Corporation

- Equicom Savings Bank, Inc.

- First Consolidated Bank, Inc.

- Hongkong & Shanghai Banking Corporation

- Industrial Bank of Korea

- ING Bank, N.V

- JP Morgan Chase Bank, N.A.

- KEB Hana Bank – Manila Branch

- Land Bank of the Philippines

- Maybank Philippines, Inc.

- Mega International Commercial Bank Co., Ltd.

- Metropolitan Bank and Trust Company

- Mizuho Bank, Ltd. – Manila Branch

- MUFG Bank, Ltd.

- Philippine Bank of Communications

- Philippine Business Bank, Inc. (A Savings Bank)

- Philippine National Bank

- Philippine Savings Bank

- Philippine Trust Company

- Philippine Veterans Bank

- Producers Savings Bank Corporation

- Rizal Commercial Banking Corporation

- Robinsons Bank Corporation

- Security Bank Corporation

- Shinhan Bank – Manila Branch

- Standard Chartered Bank

- Sterling Bank of Asia, Inc. (A Savings Bank)

- Sumitomo Mitsui Banking Corporation – Manila Branch

- Union Bank of the Philippines

- United Coconut Planters Bank

- United Overseas Bank Limited, Manila Branch

- Wealth Development Bank, Corp.

- Yuanta Savings Bank Philippines, Inc.

How to Use Peso Net Bank Transfer via PSBank

PesoNet bank transfer is available in PSBank!

Let me show you how to use PesoNet Bank Transfer through your PSBank account.

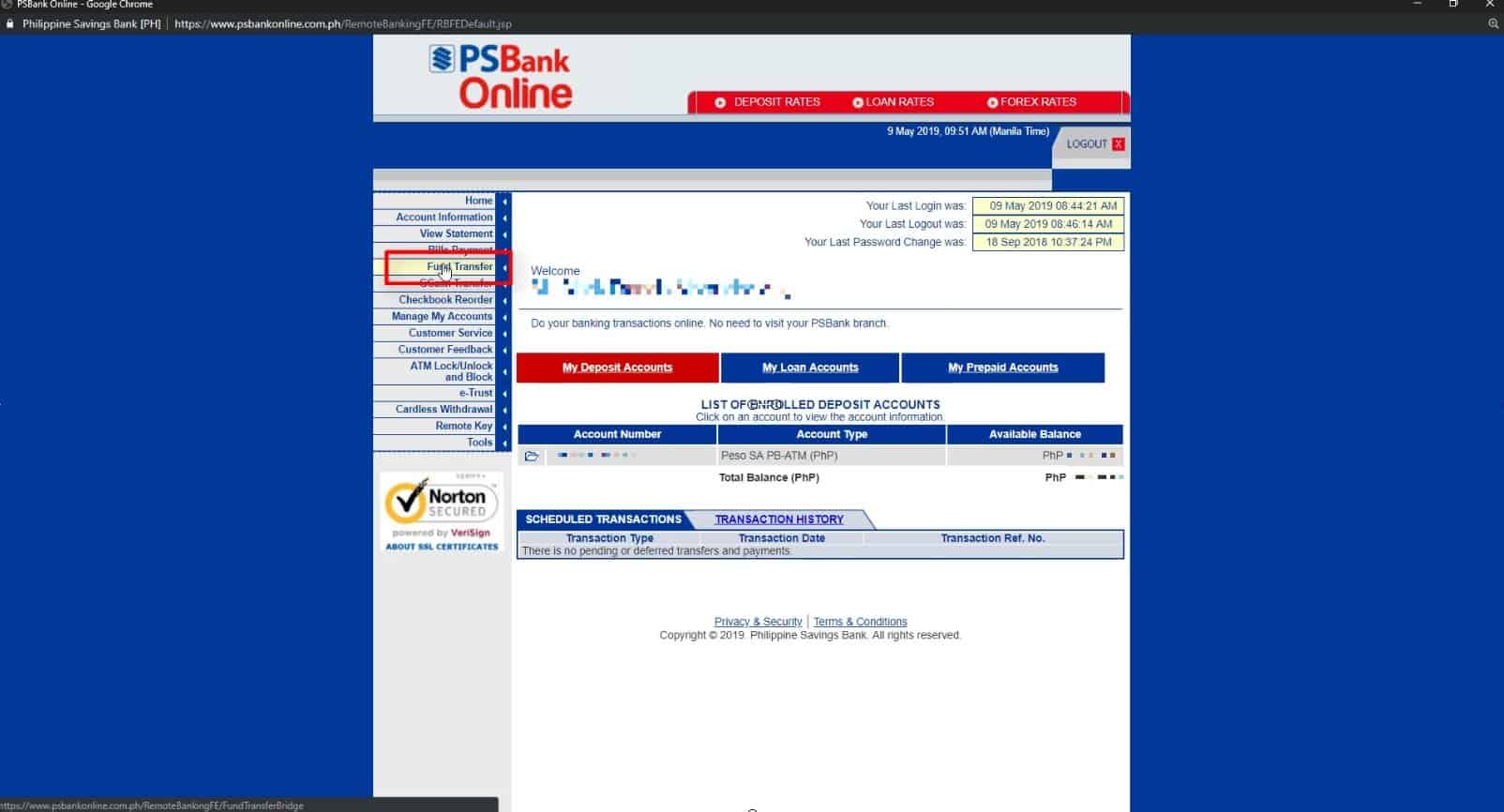

1. Login to the PSBank Online website.

Type in the following URL: psbank.com.ph

2. Select Fund Transfer from the menu options.

Click on the Fund Transfer option.

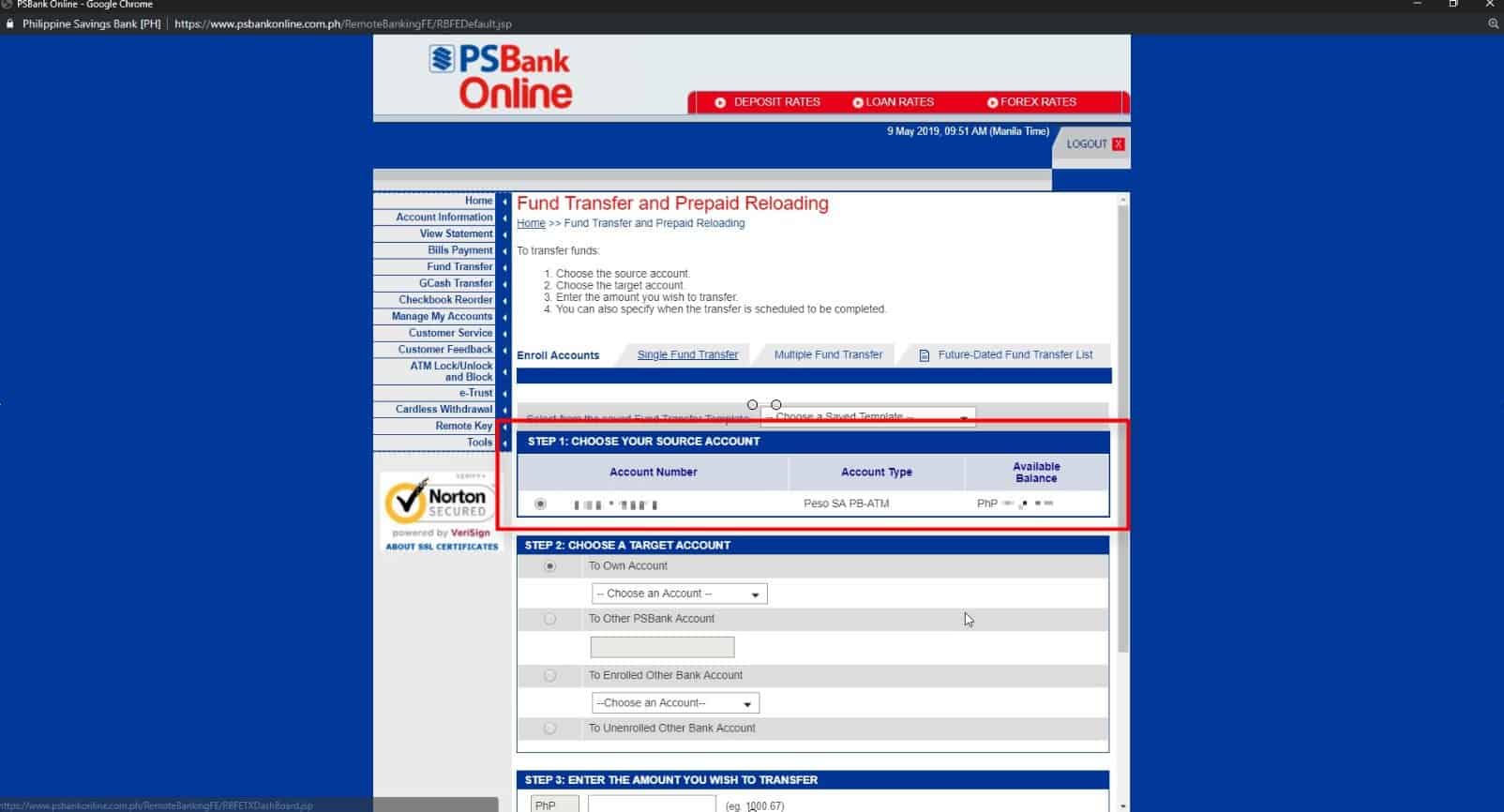

3. Choose your Source Account.

If you have multiple PSBank account, it will be shown here.

Since we only have one account, that peso savings account is the only one shown here.

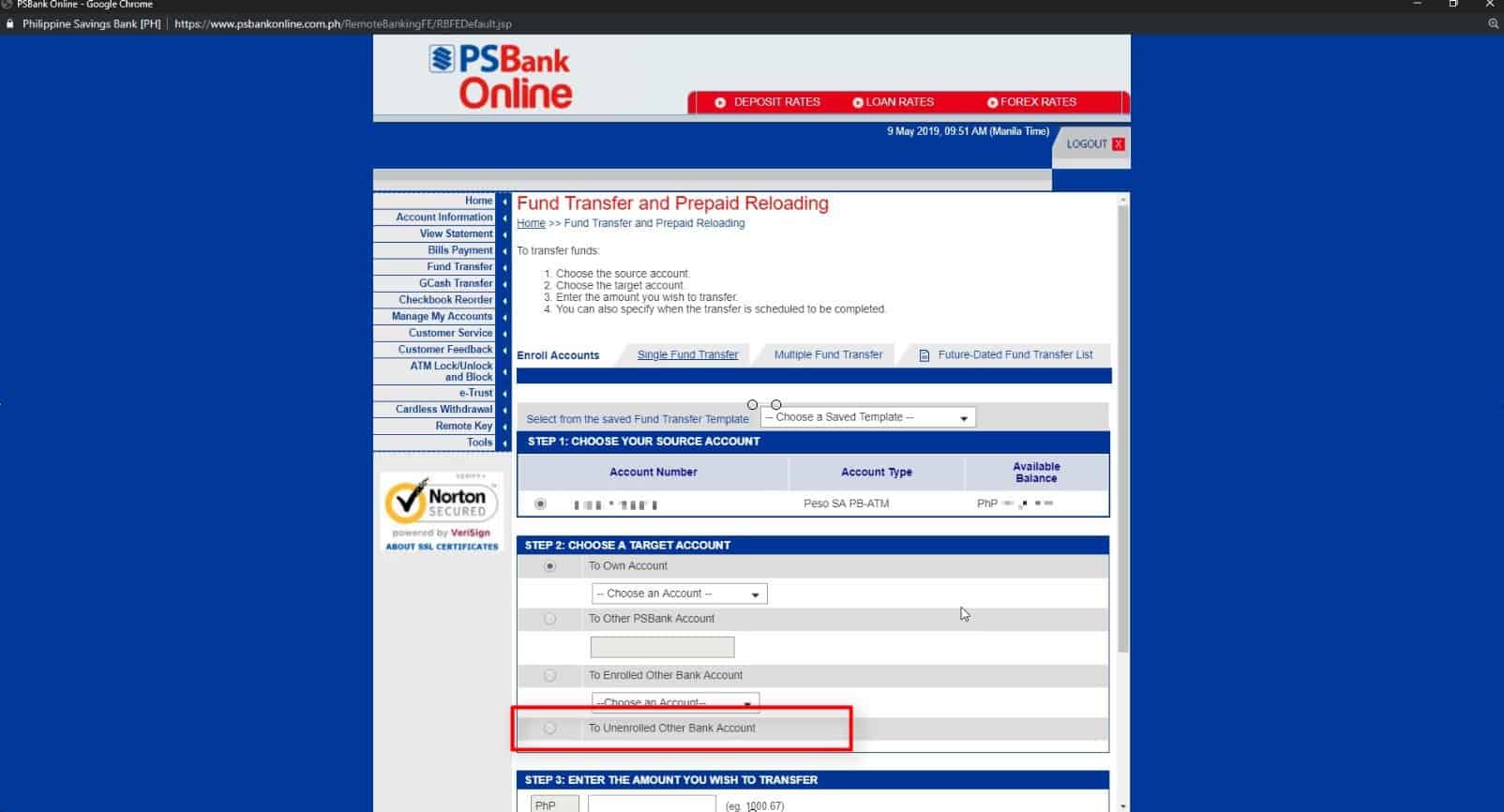

For this tutorial, we will select To Unenrolled Other Bank Account.

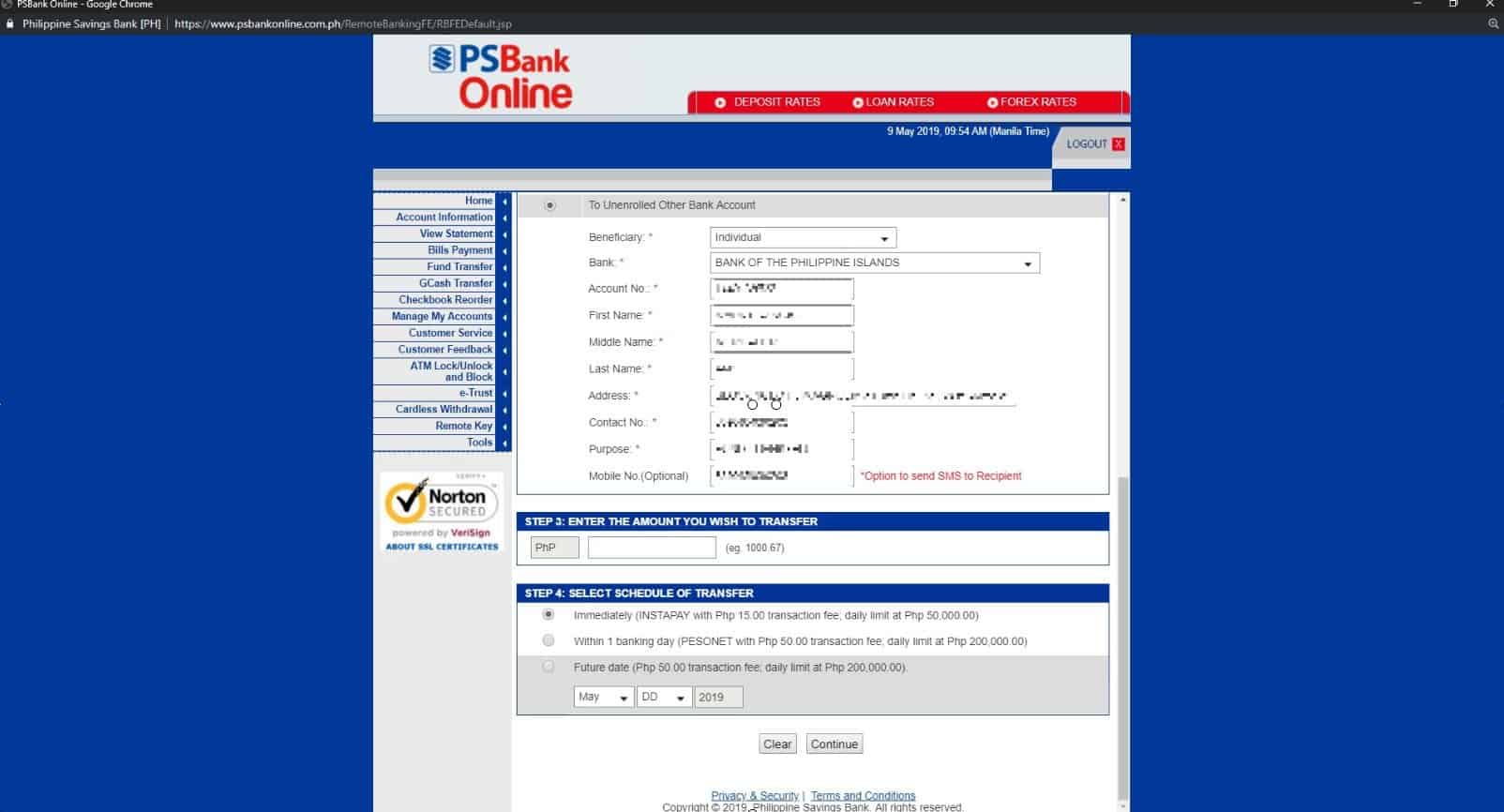

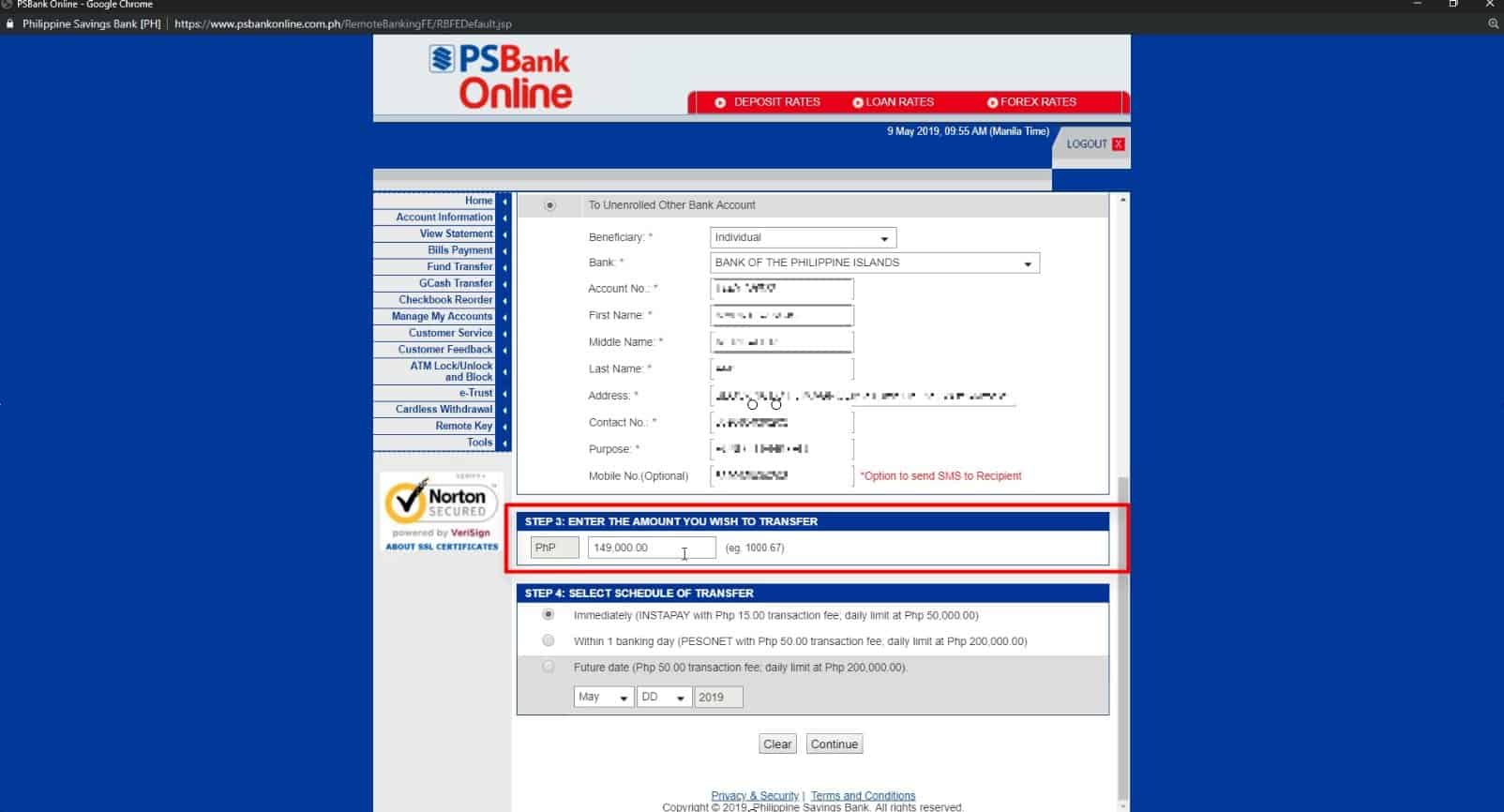

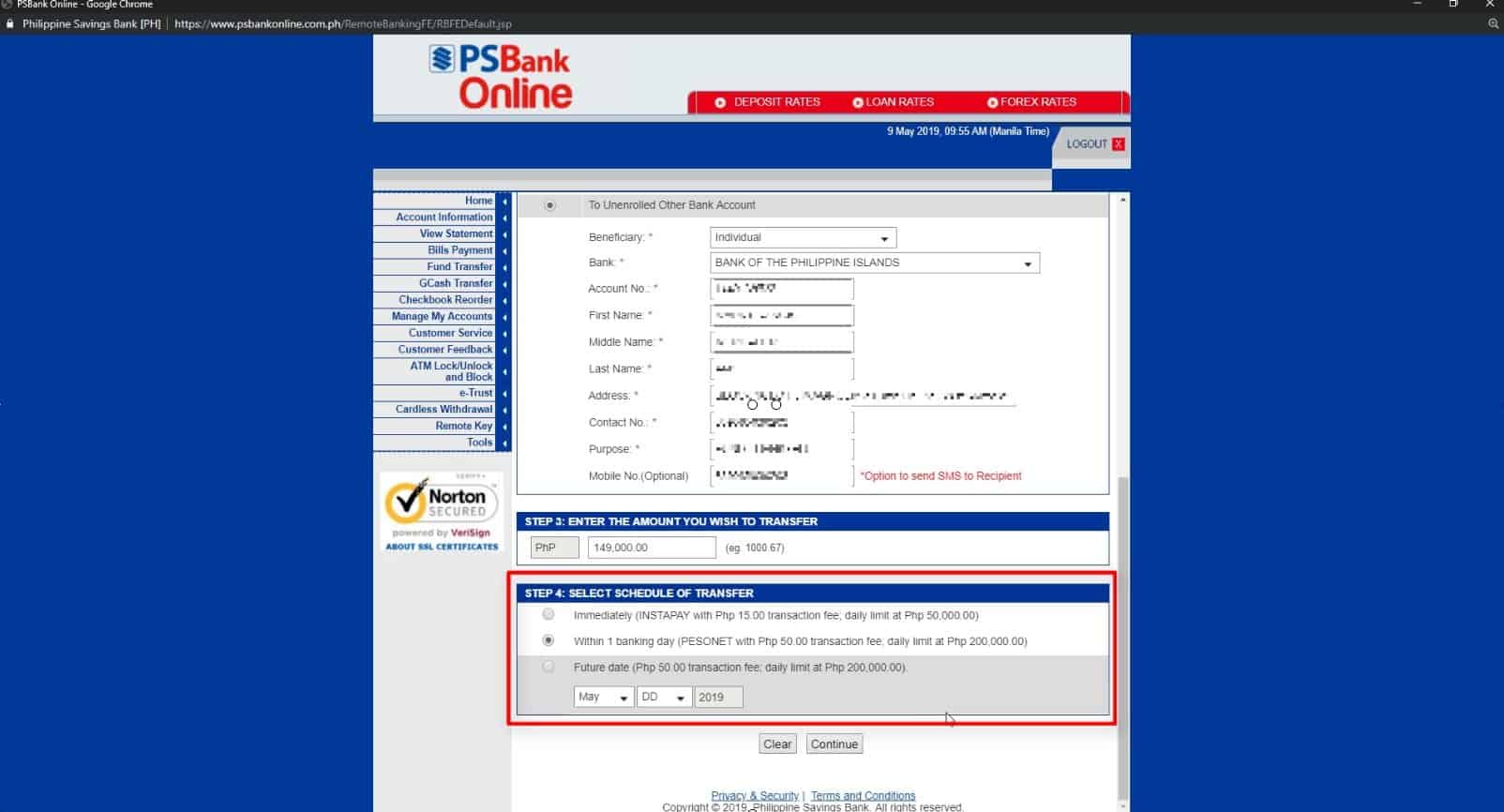

5. Complete the needed information.

Additional fields will show up.

Enter all the required fields.

Make sure to double check the target account number.

The mobile number here is only optional but for this example, we will use this feature so that the recipient will receive an SMS regarding the transfer.

6. Enter the amount that you want to transfer.

On the text box, input the amount that you will be transferring.

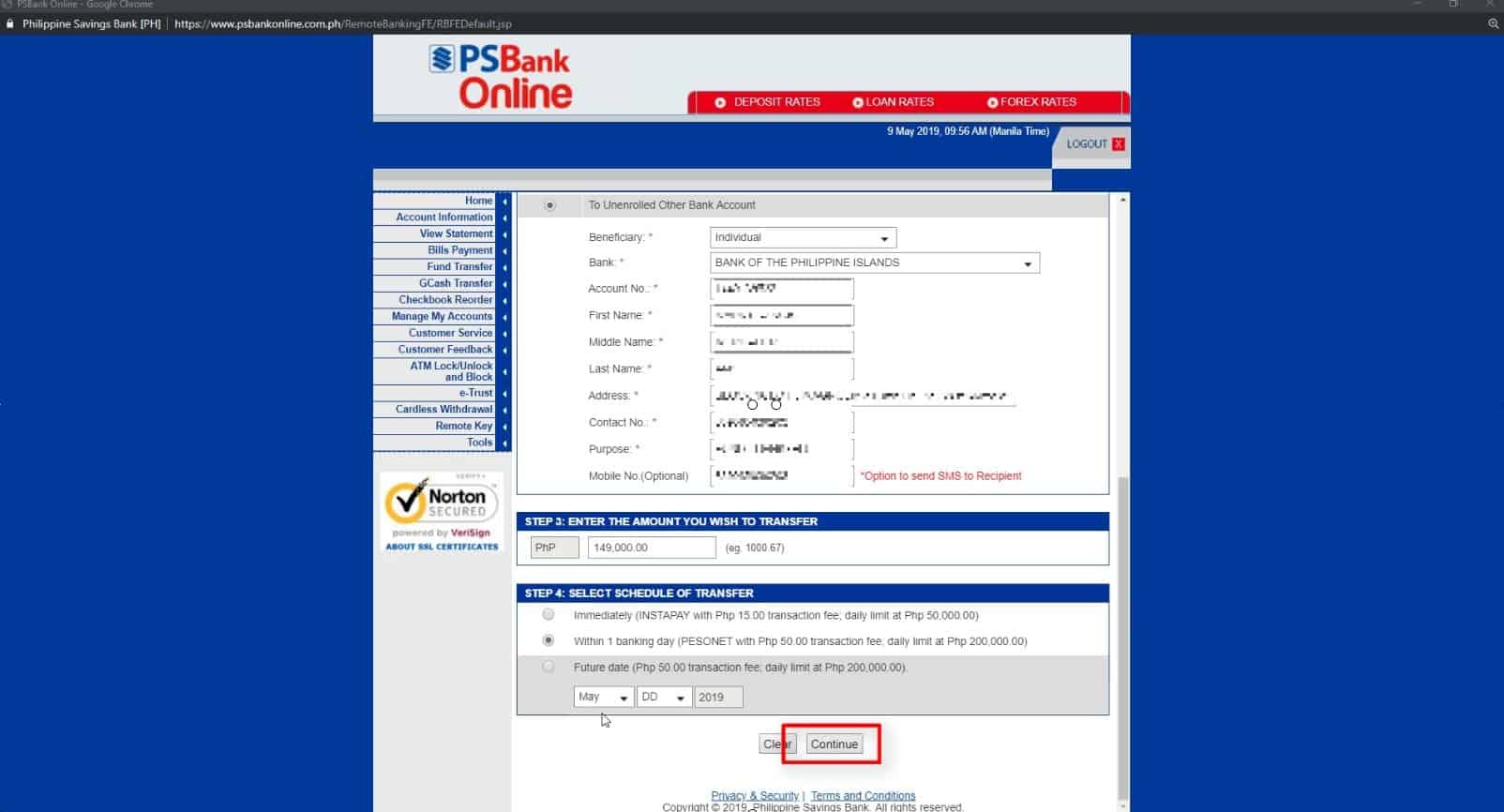

7. Select Within one banking day for the schedule of transfer.

You will be shown several options for the schedule of transfer.

Sine this guide is focused on PesoNet, we will choose the Within one banking day option.

Take note that PesoNet has a 50 pesos transaction fee for PSBank and with a daily transfer limit of 200,000 pesos.

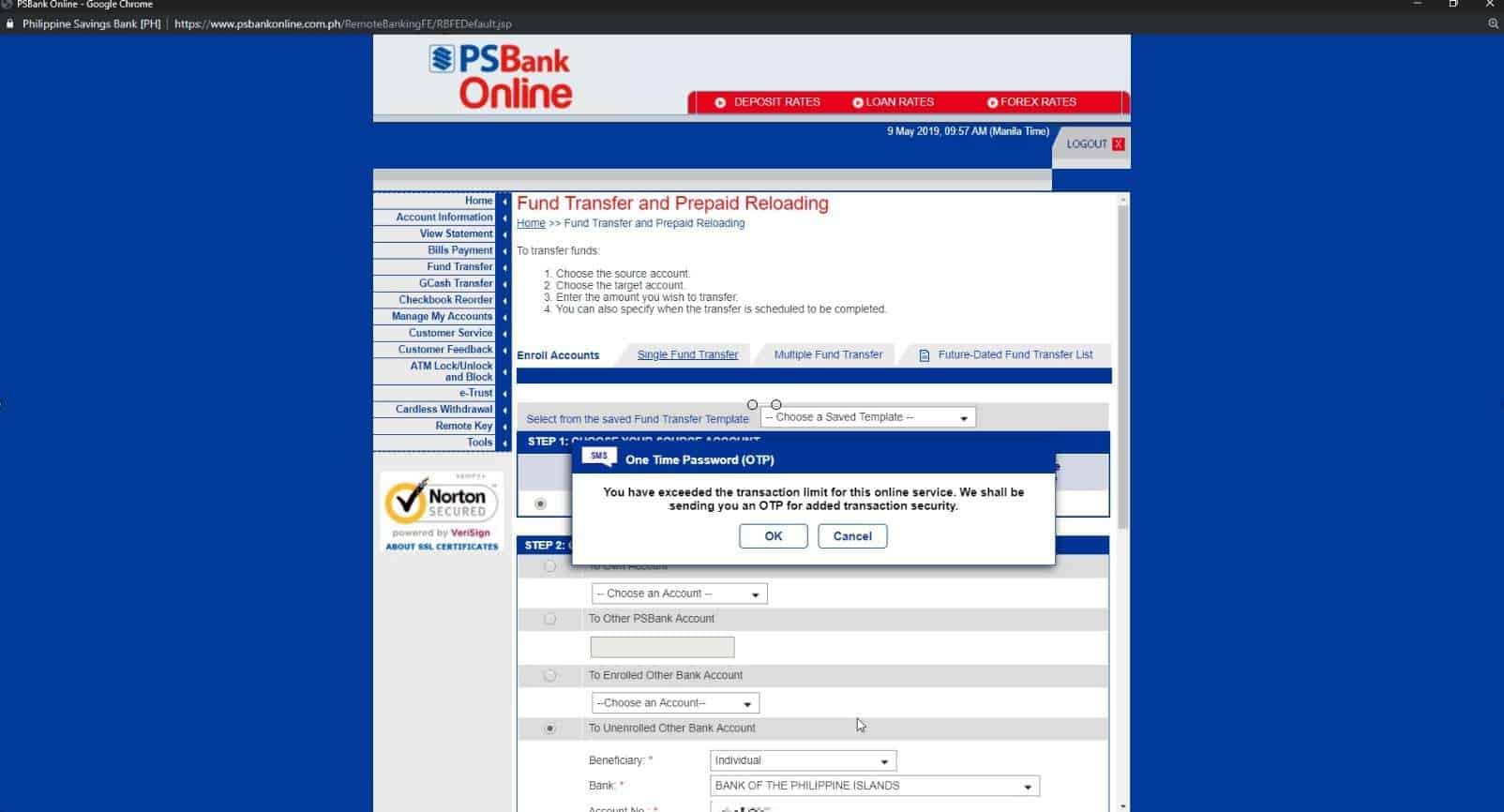

8. Click on the OK button on the OTP prompt that is shown.

Actually this is our first transaction for the day so I’m not sure why it is saying that we have exceeded the transaction limit.

I think they have enabled OTP as default regardless of the number of transaction that you already made possibly for additional security.

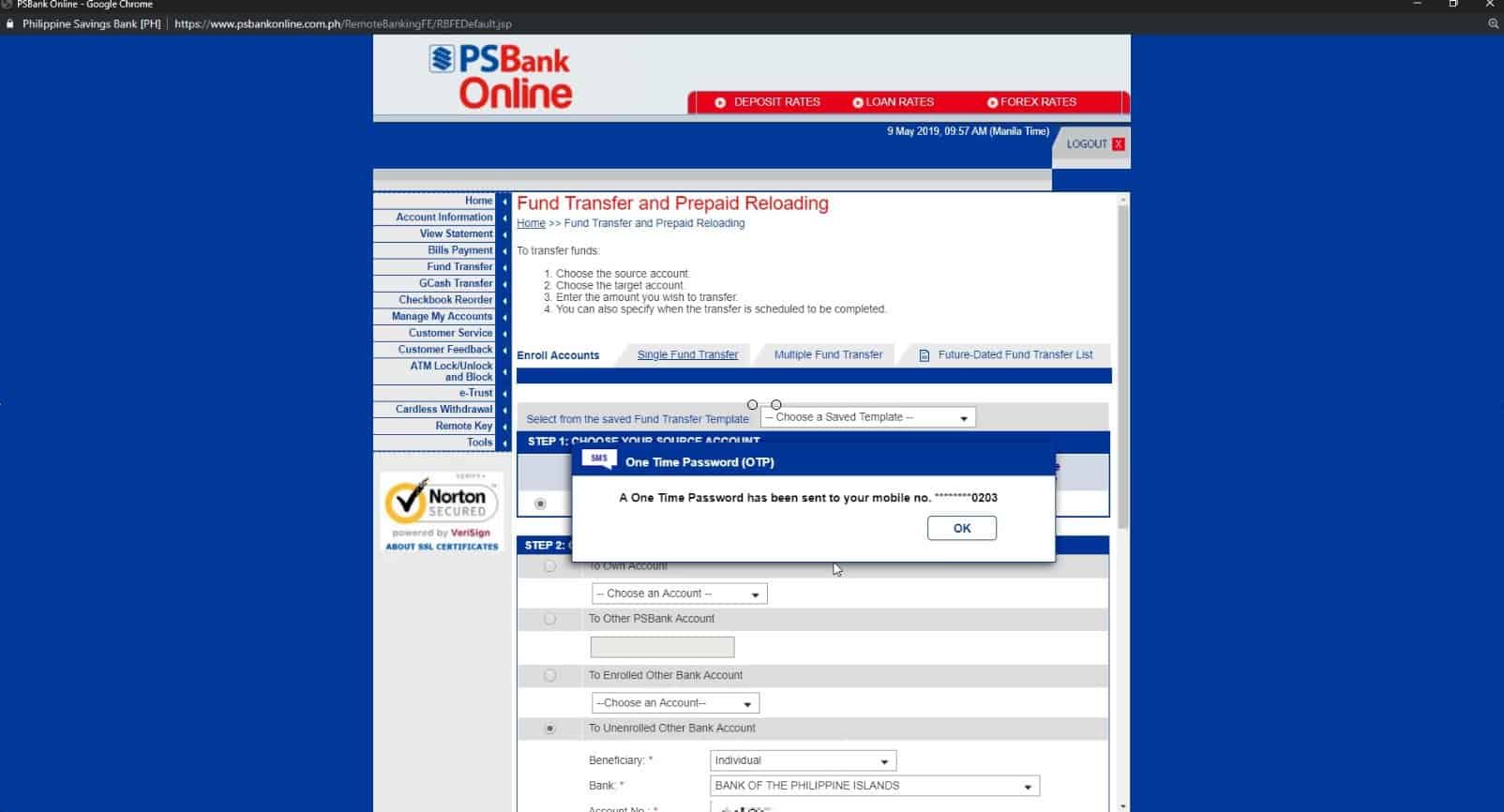

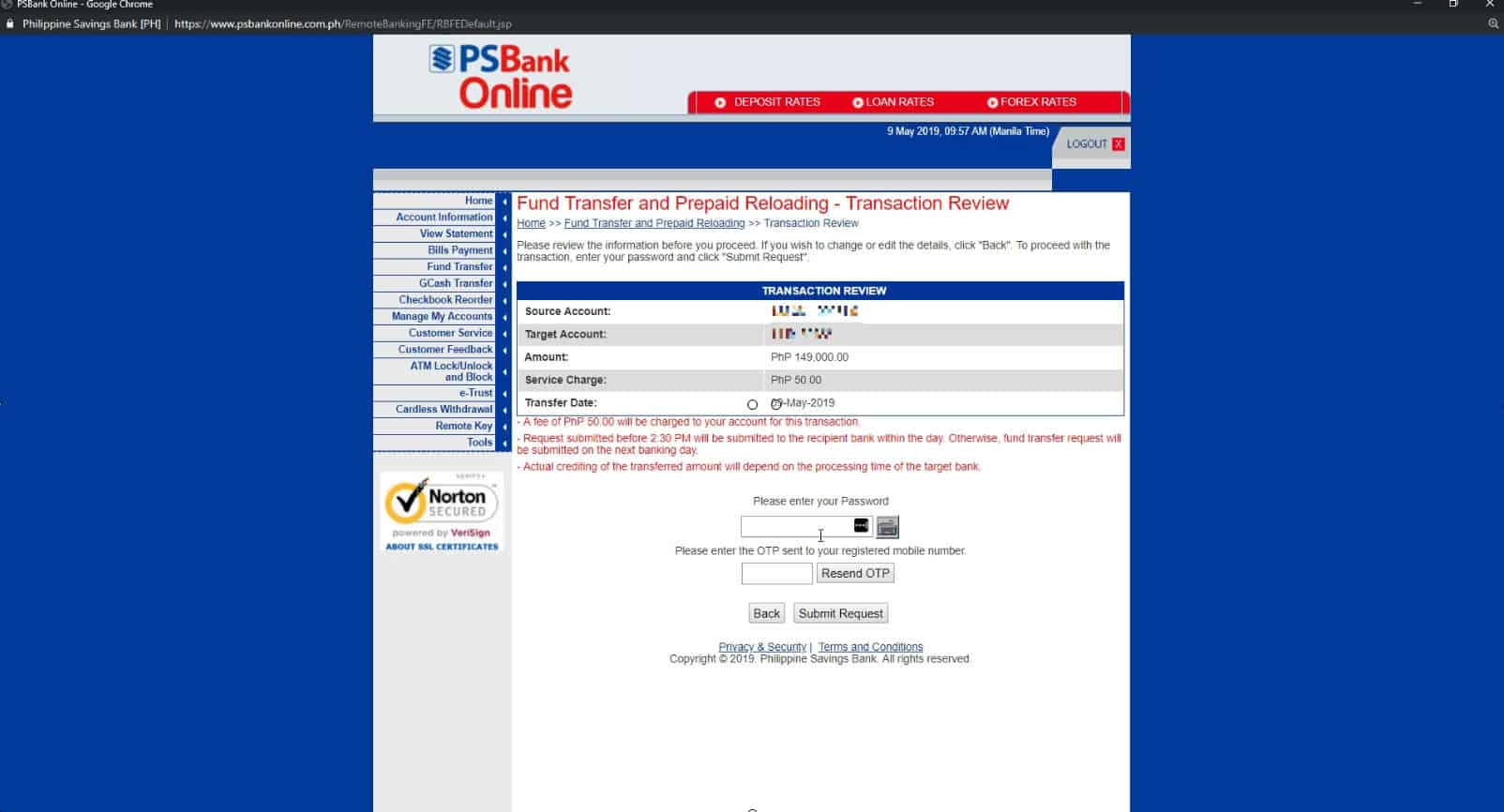

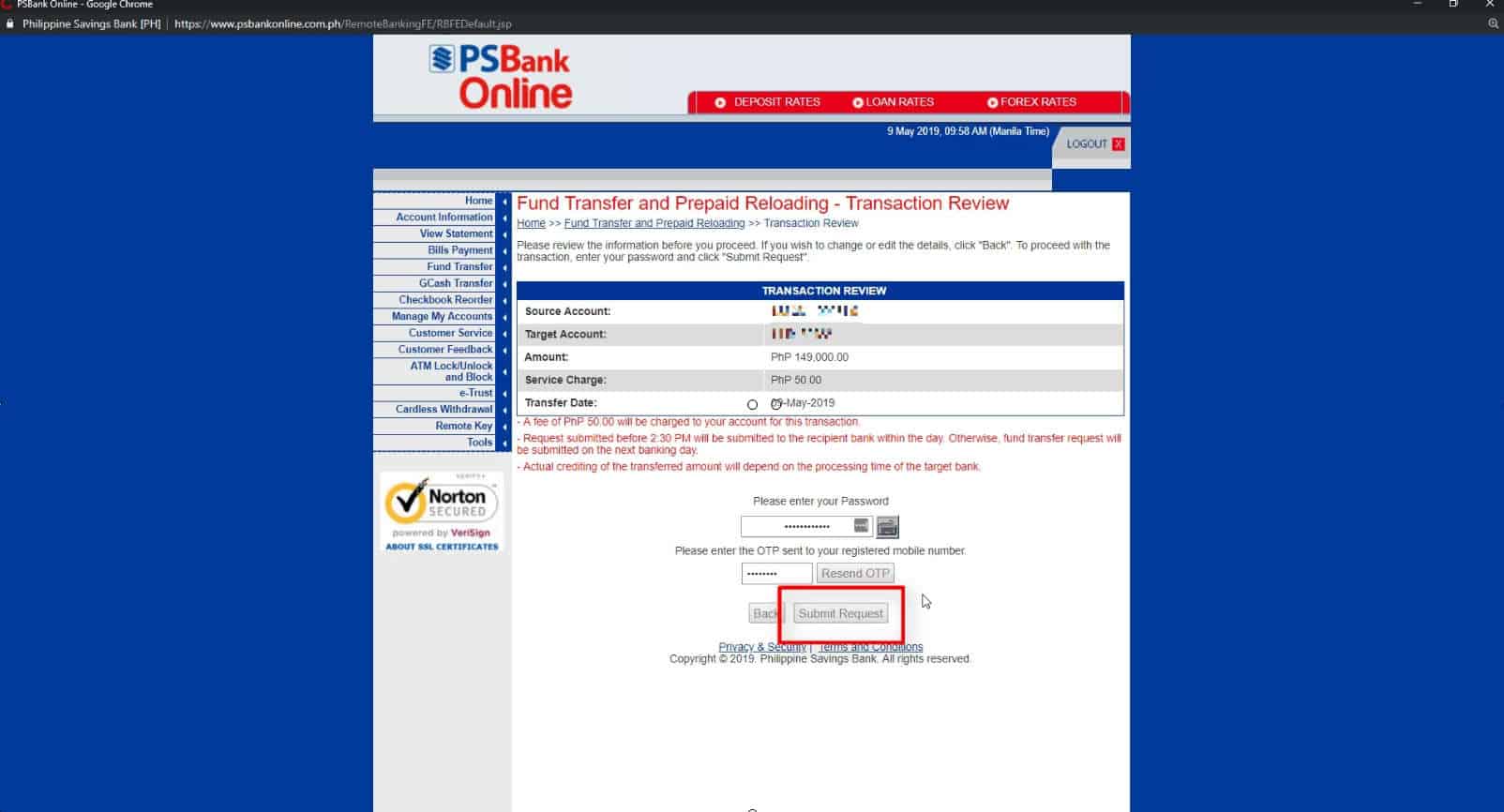

9. Enter your Password and the OTP sent to your registered mobile number.

In this window, you will have the option to review the details of the transfer transaction that you will be making.

You can click on the back button if you have any modification that needs to be done.

Since PesoNet is not a real-time transaction, transfer requests submitted before 2:30pm will be submitted to the recipient bank within the day.

If you submit it after 2:30pm, the fund transfer request will be submitted on the next banking day.

The actual crediting of the transaction amount will depend on the processing time of the target bank.

Then click on the Submit Request button.

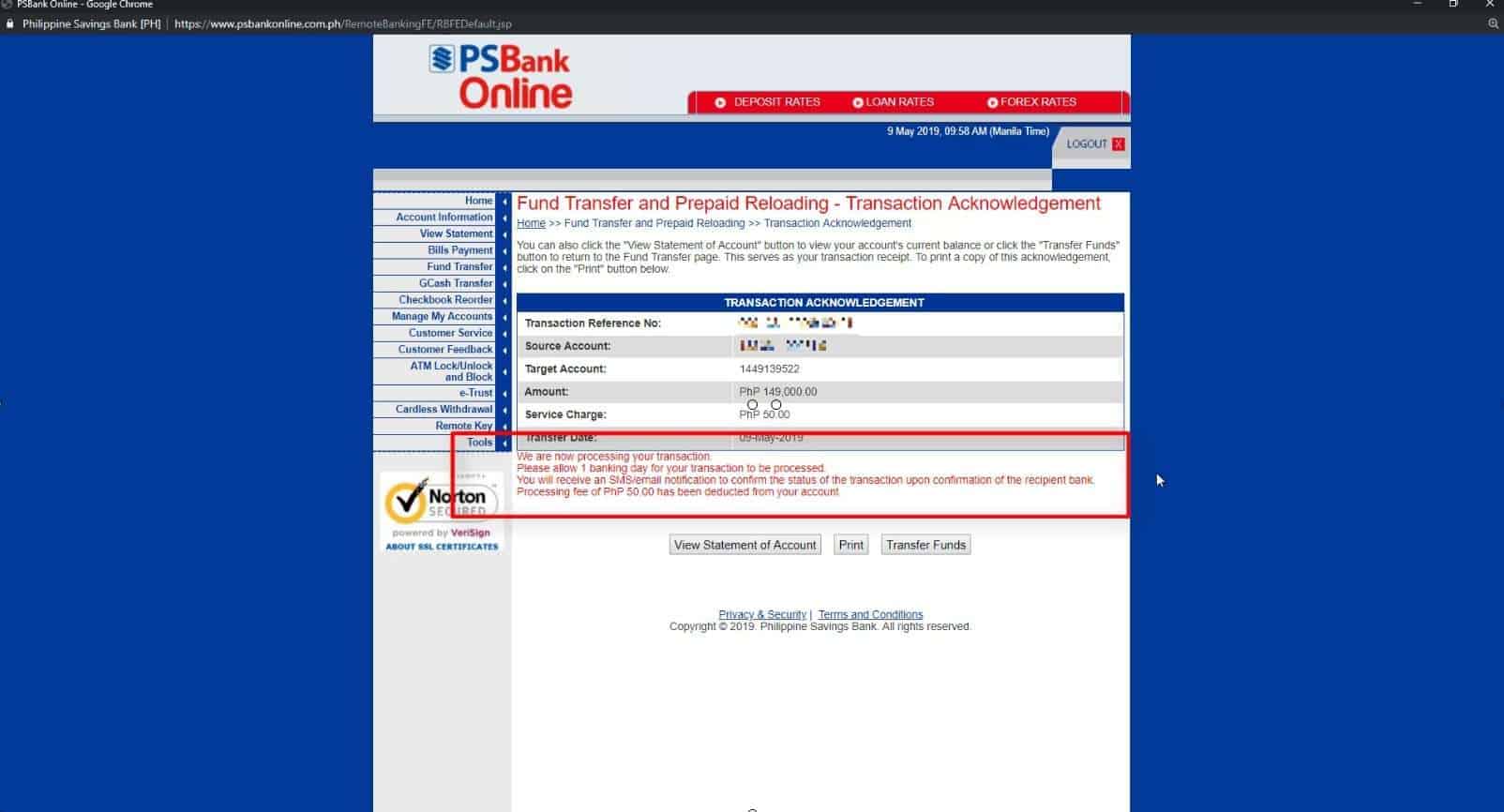

10. You will see a Fund Transfer Acknowledgement note on your screen.

If everything went well, you will see a transaction acknowledgement note on your screen with the transaction reference number.

Take note that you will be receiving an SMS or email notification to confirm the status of the transaction upon confirmation of the receiving bank.

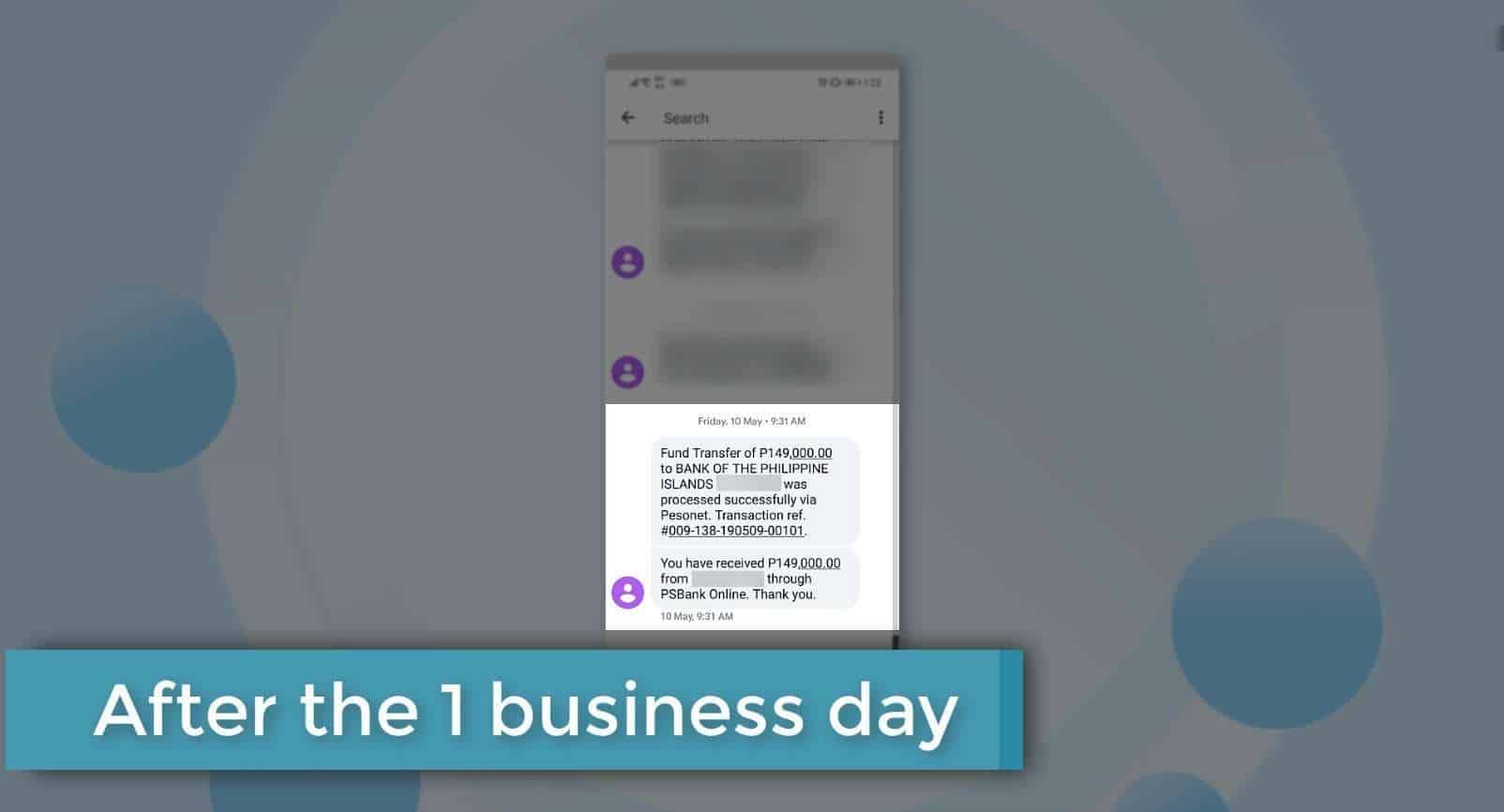

11. We received an SMS as transfer confirmation.

In our case, we got the transfer confirmation via SMS the following day.

How about you, were you able to transfer your funds successfully with PesoNet?

Financial Transactions Made Easy!

More on our Youtube Channel.

Subscribe Now!

Do you have any further questions on how to use PesoNet for bank transfer?

Let us know in the comments below! 🙂