InstaPay Philippines: How to Use InstaPay Bank Transfer to Other Bank

What if you can do so via online fund transfer and it will be transferred real-time?

Sounds good – with InstaPay, this is now possible!

Check out this Bangko Sentral ng Pilipinas video about InstaPay:

What is InstaPay?

InstaPay is an Electronic Fund Transfer service (EFT) that allows customers to transfer funds almost instantly between different accounts of participating BSP-supervised (Banko Sentral ng Pilipinas) banks and non-bank e-money issuers in the Philippines.

In simpler terms, it is a real-time electronic payment or credit transfer system to other banks.

There was a need to have a platform like InstaPay so that we can have an automated clearing system that would be safe, efficient, affordable and reliable especially for real-time and low value electronic fund transfer transactions.

InstaPay is part of BSP’s National Retail Payment System (NRPS) framework which aims to have an electronic retail payment system that can be interconnected and interoperable.

Here are some other details that you need to know about InstaPay Philippines:

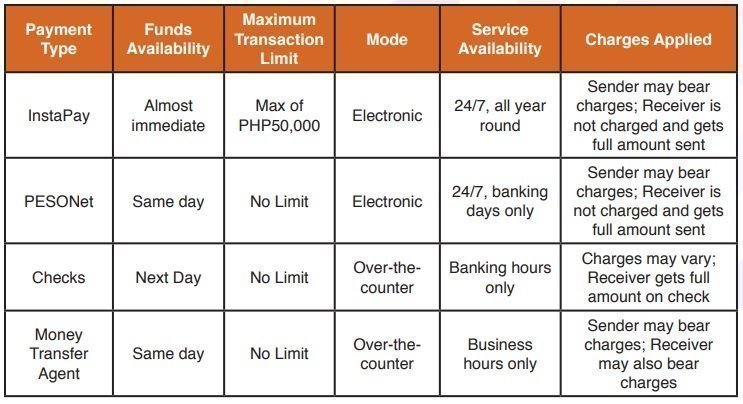

InstaPay is available 24×7 all year round.

They implemented InstaPay to be available all year round and 24×7 through mobile apps and internet banking facilities that are provided by those participating banks and e-money financial institutions.

This is a huge advantage since most of existing financial institutions only work during weekdays or business / banking hours.

If you are curious on how InstaPay compares with other fund transfer types, here is a comparison table from BSP:

InstaPay provides convenience and real-time transaction.

Since InstaPay can be used online, you do not need to physically go to bank branches just to transfer your money to another bank.

The almost real-time transaction is also a big plus factor which is especially helpful for business owners that need to have their funds readily available as payment or for operational costs.

Almost all account types can use InstaPay.

Almost all account types such as savings, current or e-money (with or without ATM / debit card) can use InstaPay.

As long as your bank or the financial institution where your money is currently located has InstaPay integrated to their system, you will be able to use InstaPay for your money transfer.

Instapay users can be individuals, businesses or government agencies / institutions.

Here is a list of InstaPay participating banks and e-money issuers as of March 31, 2019.

Take note the some banks / e-money issuers do not have the ability to send money yet – they are only able to receive the fund transfer.

Banks or e-money Issuers: Sender / Receiver

- Asia United Bank Corporation

- Bank of Commerce

- BDO Unibank, Inc.

- China Bank Savings, Inc.

- China Banking Corporation

- Dungganon Bank (A Microfinance Rural Bank), Inc.

- East West Banking Corporation

- Equicom Savings Bank, Inc.

- G-Xchange, Inc.

- Land Bank of the Philippines

- Malayan Bank Savings and Mortgage Bank, Inc.

- Maybank Philippines, Inc.

- Metropolitan Bank and Trust Company

- Philippine Bank of Communications

- Philippine National Bank

- Philippine Savings Bank

- PNB Savings Bank

- RCBC Savings Bank, Inc.

- Rizal Commercial Banking Corporation

- Robinsons Bank Corporation

- Security Bank Corporation

- Sun Savings Bank, Inc.

- Union Bank of the Philippines

- United Coconut Planters Bank

Banks or e-money Issuers: Receiver Only

- Bank of the Philippine Islands

- CTBC Bank (Philippines) Corporation

- Development Bank of the Philippines

- Isla Bank (A Thrift Bank), Inc.

- OmniPay, Inc.

- Partner Rural Bank (Cotabato), Inc.

- PayMaya Philippines, Inc.

- Philippine Business Bank, Inc. (A Savings Bank)

- Philippine Trust Company

- Philippine Veterans Bank

- Sterling Bank of Asia, Inc. (A Savings Bank)

- UCPB Savings Bank, Inc.

- Yuanta Savings Bank Philippines, Inc.

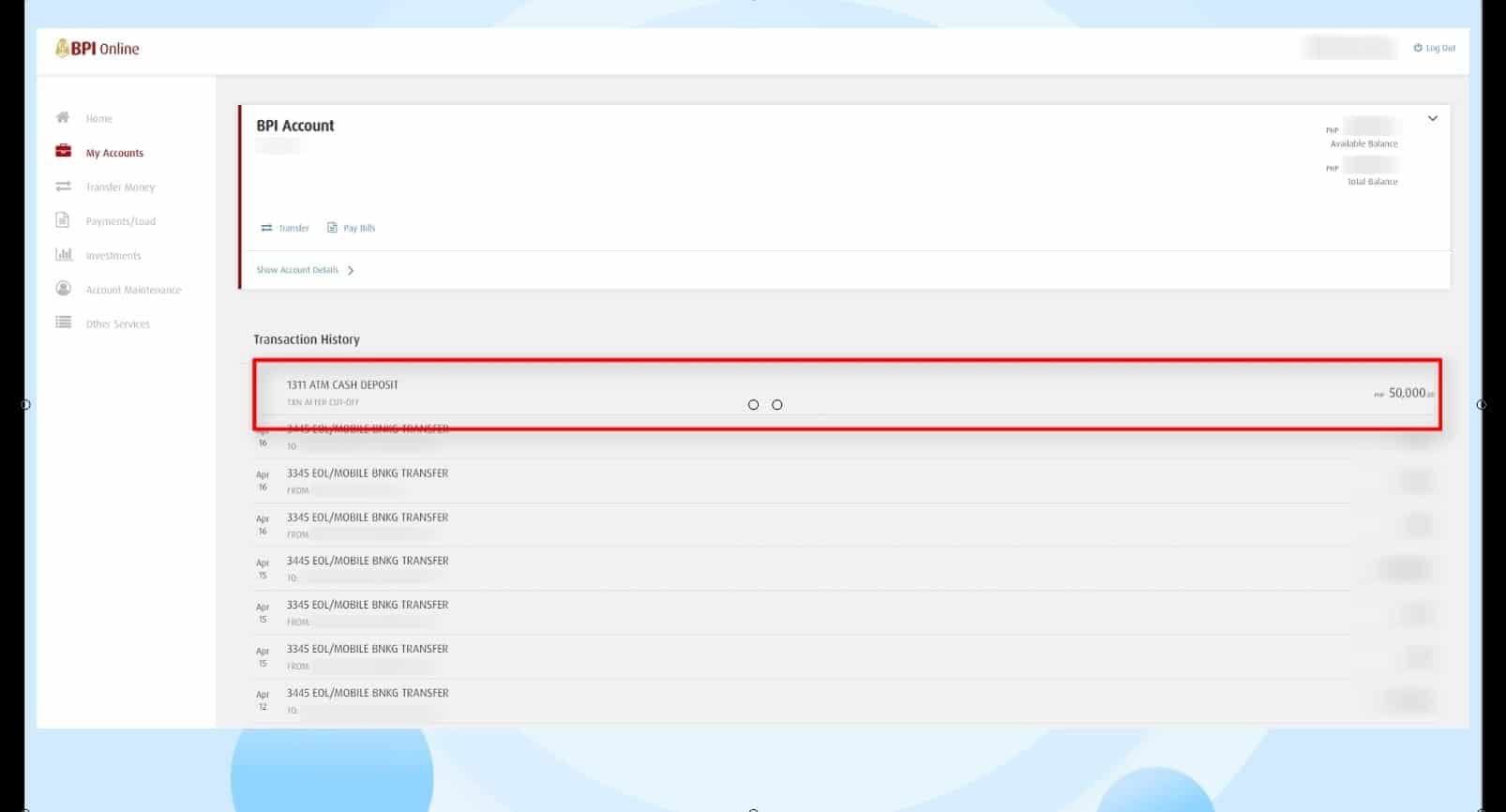

You can transfer funds up to Php 50,000 per transaction as many times during the day.

InstaPay has a maximum transfer limit of Php 50,000 per transaction.

Take note that this limit is on a per transaction basis only.

This means that you can do multiple transfer transaction within the day as long as the amount per transaction do not exceed Php 50,000.

There is no minimum limit for InstaPay.

However, your bank or e-money issuer can impose a minimum transaction amount limit or a daily limit on the combined amount (adding the amount on all of your transactions) a customer may transact in a day.

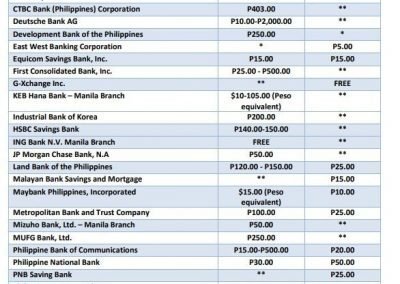

InstaPay transaction fees varies per participating bank or financial institution.

The banks or e-money issuers may impose sending fees when using InstaPay.

It will depend on their pricing strategy.

Typically, the fees will be debited from your source account.

On the other hand, receiving funds via InstaPay is free of charge – you will receive the amount in full.

For the latest list, you can check out this link for the summary of fees which was survey submitted to BSP.

The picture below also shows the fees on the link (As of March 2019).

InstaPay cannot be used transfer funds to an account overseas.

InstaPay is only available for fund transfers between accounts that are maintained in the Philippines.

Furthermore, it can only be used with our local currecy: Philippine peso (PHP).

You cannot transfer funds to any non-participating institution.

As a example:

- Sending account = participating bank or institution.

- Receiving account = non-participating bank or institution.

InstaPay cannot be used in this scenario as it should only be used between accounts that are maintained with InstaPay participating institutions.

For incorrect InstaPay fund transfers, contact your bank or e-money issuer.

Since InstaPay transactions are almost real-time, you must be extra careful in providing the correct recipient information and amount to be transferred during your transaction.

If it so happened that you transferred it to a wrong account, you should inform your bank as soon as possible to reverse the transaction.

If your complaints are left unattended or was not sufficiently addressed by your bank, you can contact the Consumer Empowerment Group of the BSP via this link.

InstaPay is managed by the Philippine Payment Management, Inc.

The Philippine Payment Management, Inc administers InstaPay under the supervision and oversight of the Bangko Sentral ng Pilipinas.

InstaPay is powered by BancNet.

If you have further questions, comments or clarifications about InstaPay, you can contact BSP PSO Department:

Payment System Oversight Department (PSOD)

Finance Supervision Sector

Banko Sentral ng Pilipinas

Contact number: (632) 708-7701 local 2744

Email address: [email protected]

How to Use InstaPay Philippines Bank Transfer to Other Bank from PSBank to BPI

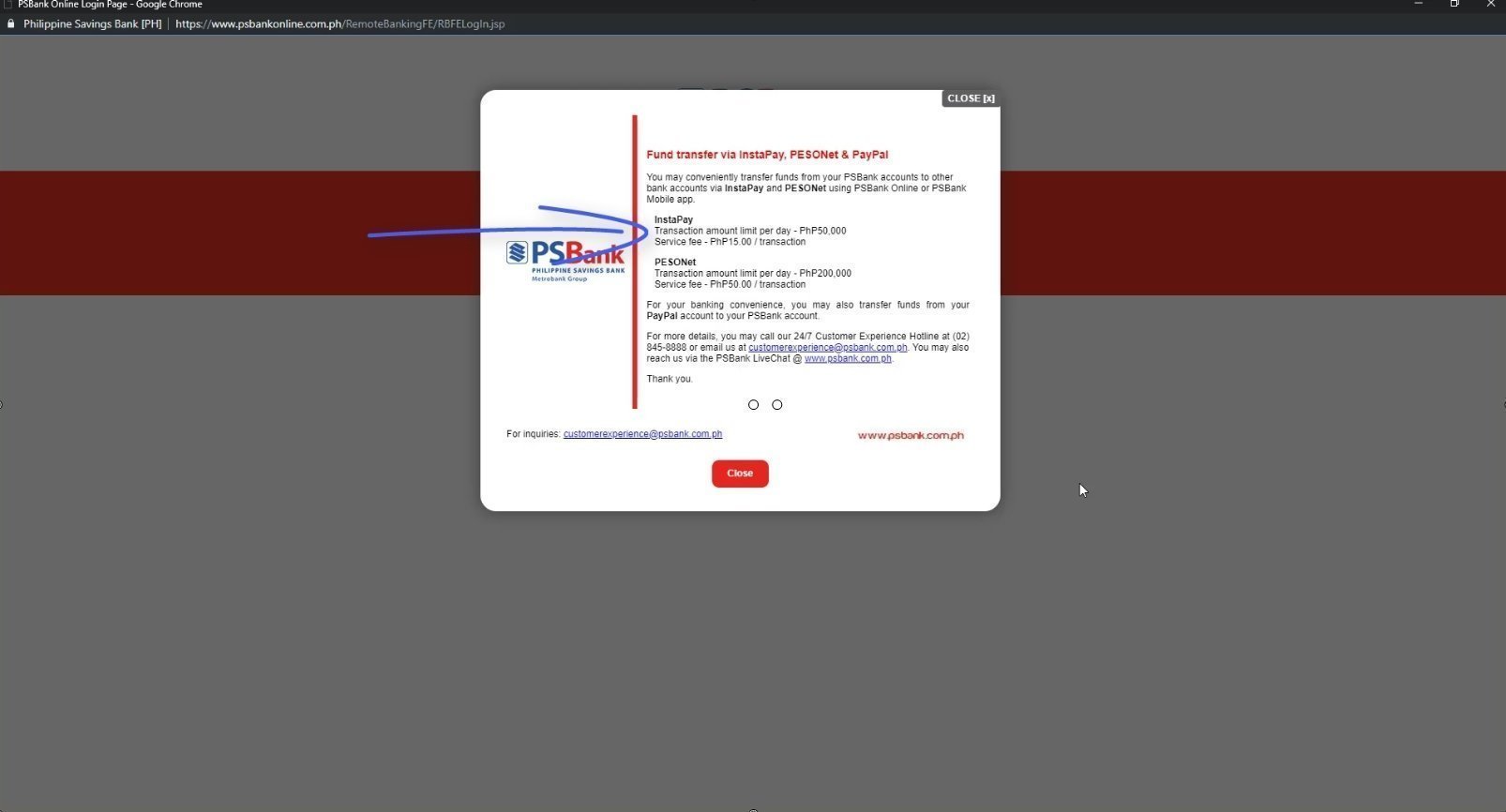

Step 1: Login to the PSBank website.

PSBank website: psbank.com.ph

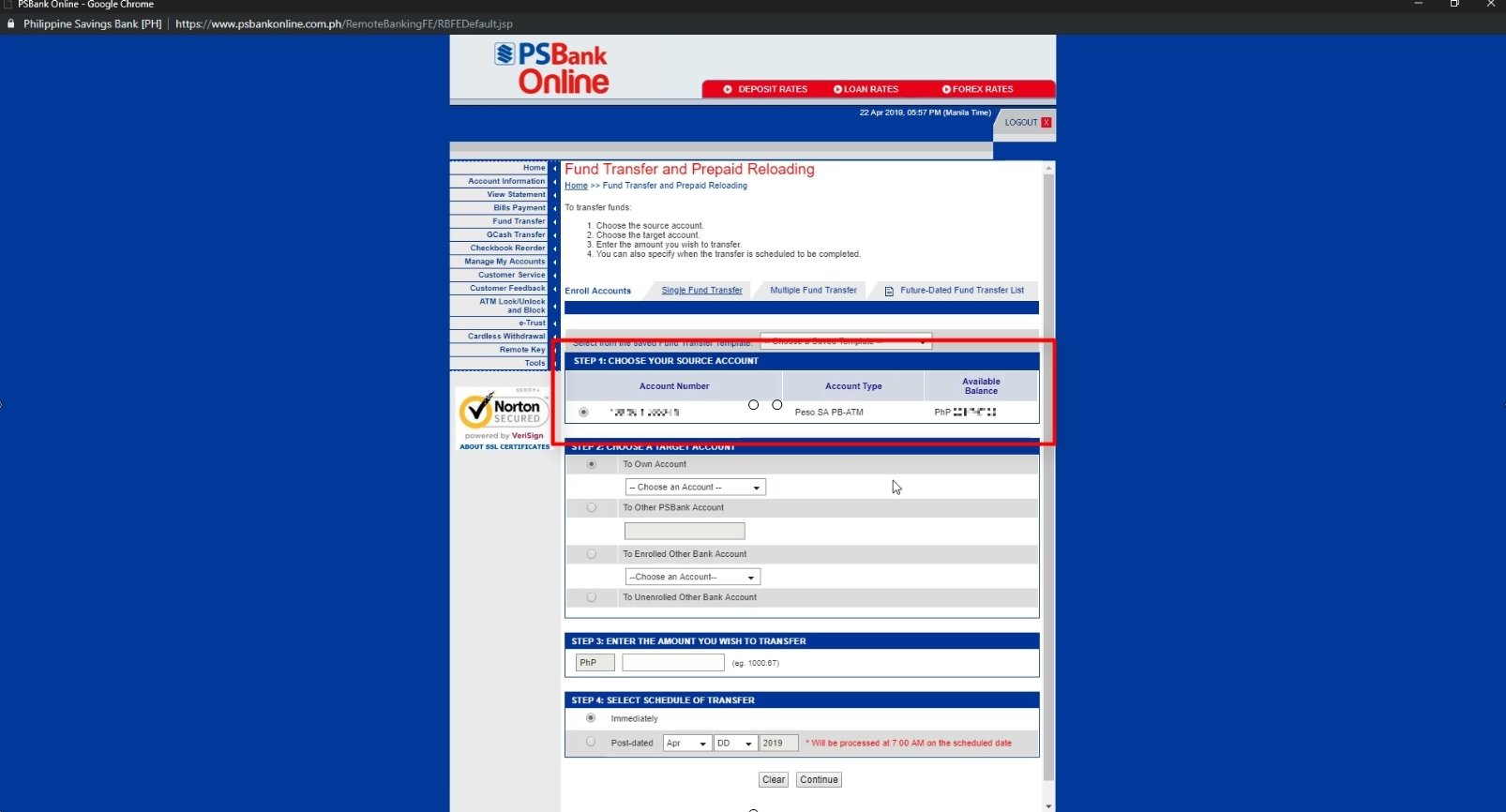

Step 2: Select Fund Transfer from the menu and choose your source account.

In our case, we only have one account in PSBank so we didn’t have to choose.

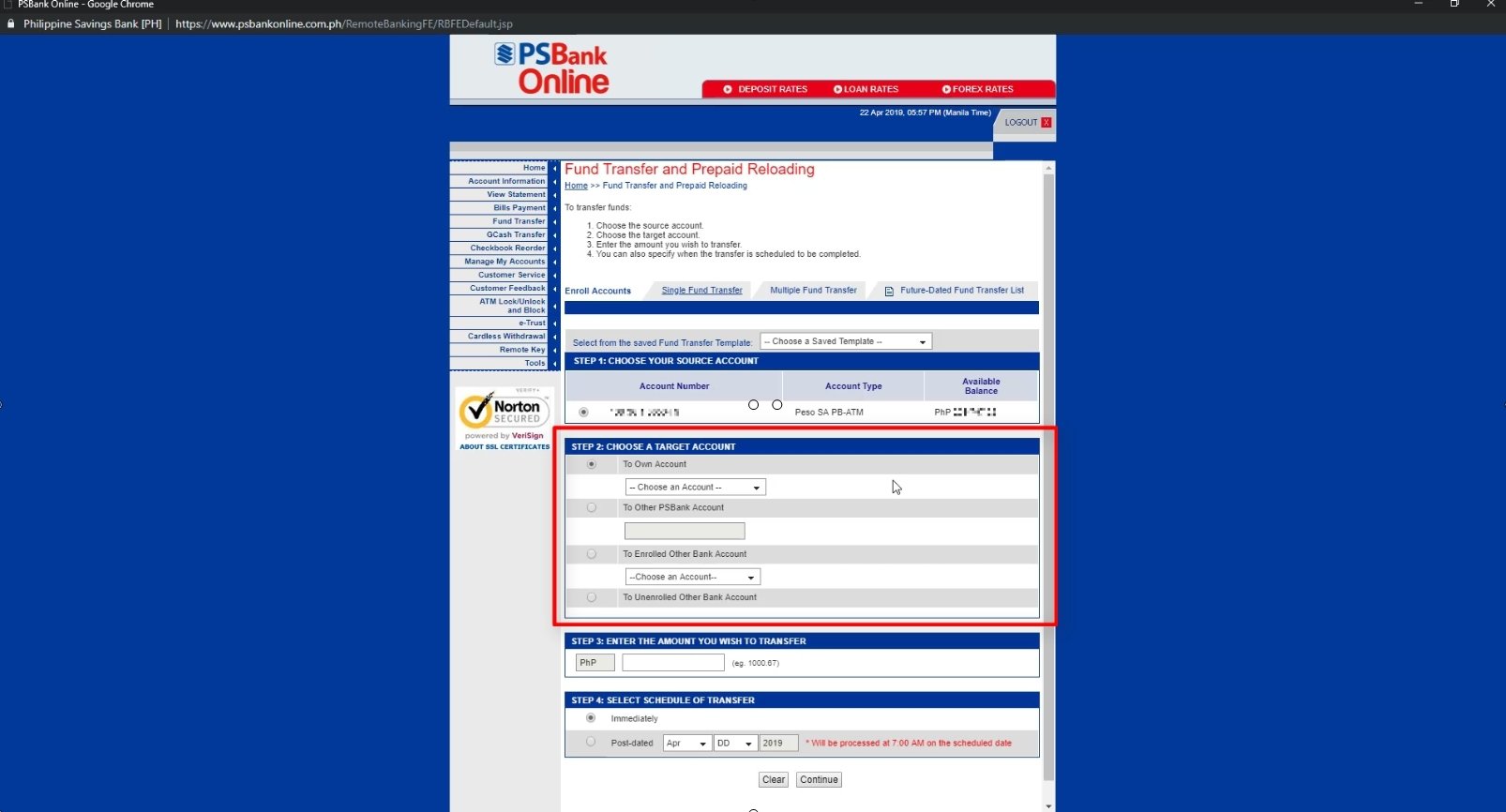

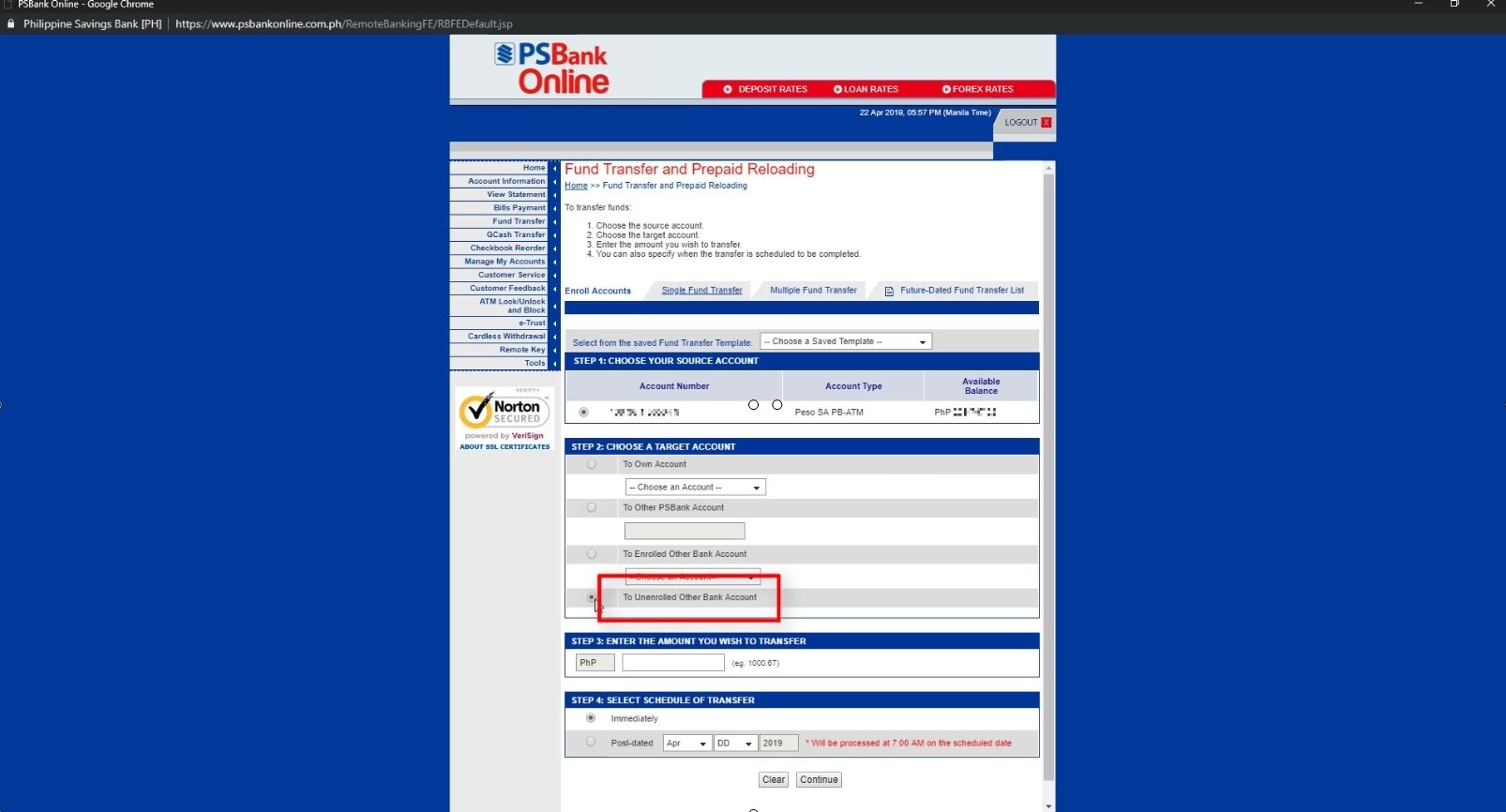

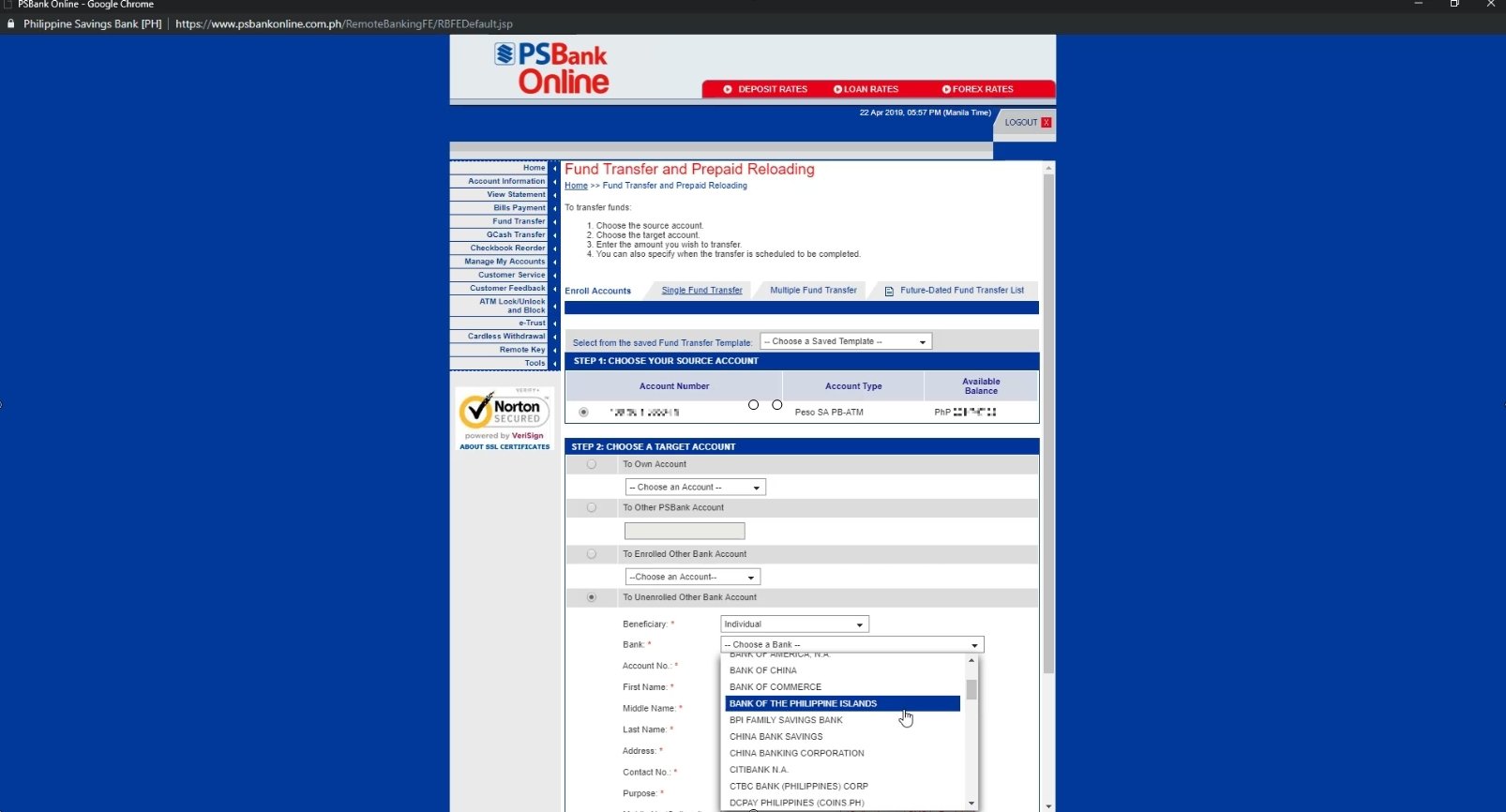

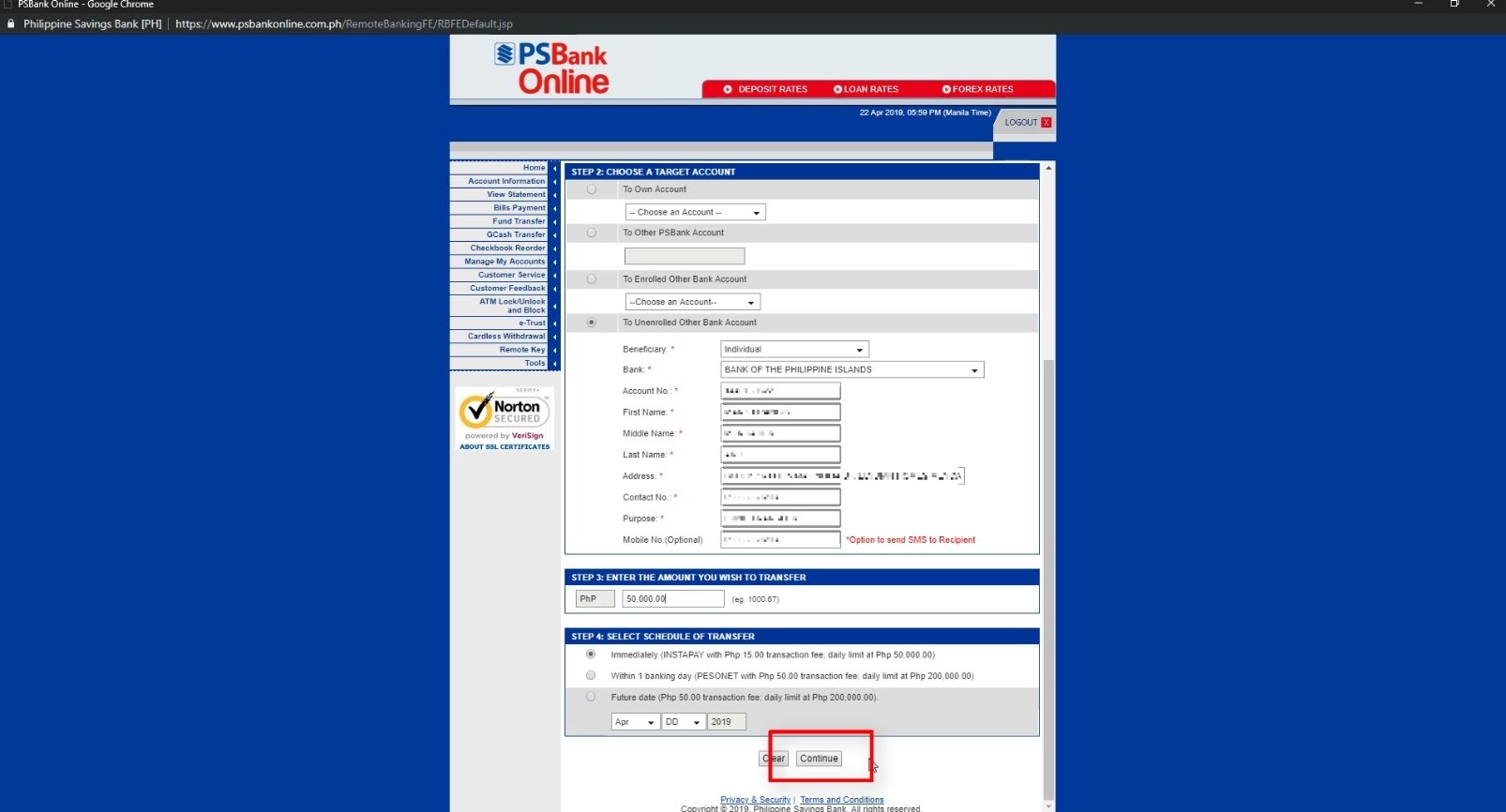

Step 3: Select the correct target or receiving account type.

Since we are transferring funds to other bank, there are only two options here that are relevant: To Enrolled Other Bank Account and To Unenrolled Other Bank Account.

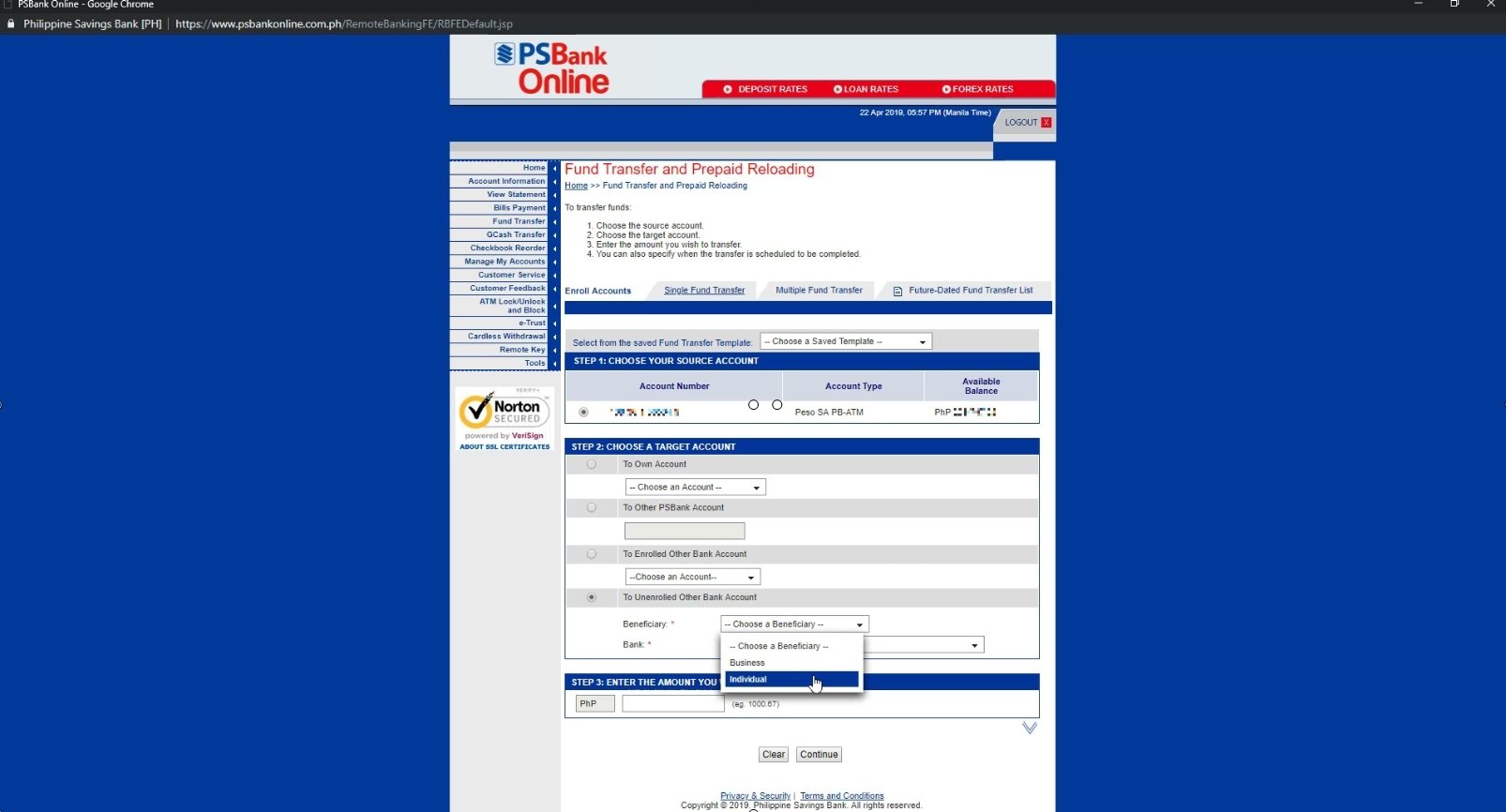

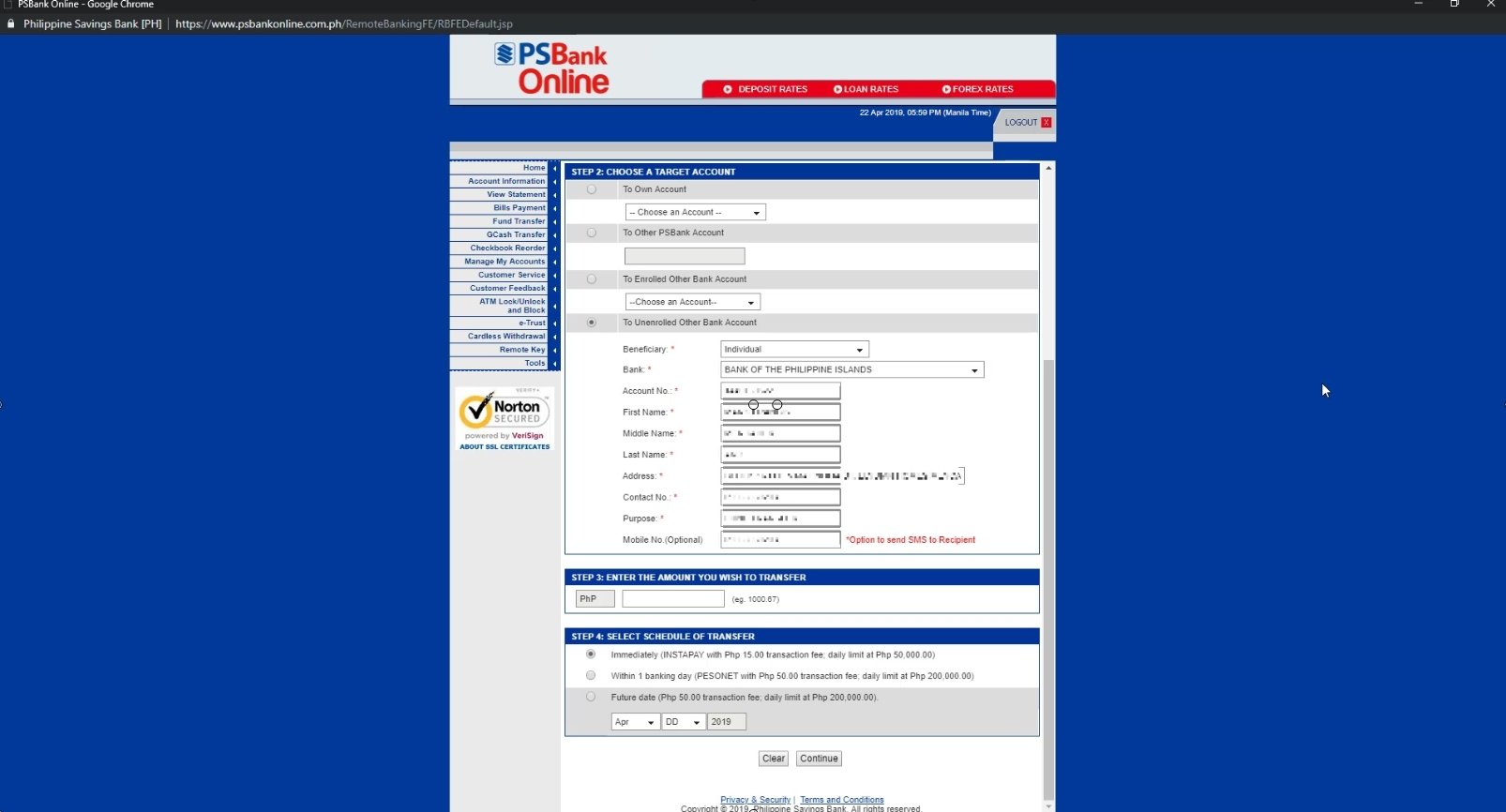

Step 4: Complete all the needed receiving account information correctly.

Fill out all the needed receiving account information.

Double check every entry here as your money might end up with some other person’s bank account if your details are incorrect here!

For this guide, we will be choosing Individual as the beneficiary.

- Account number

- First name

- Middle name

- Last name

- Address

- Contact number

- Purpose

Mobile number is not required but I still opted to place my number there.

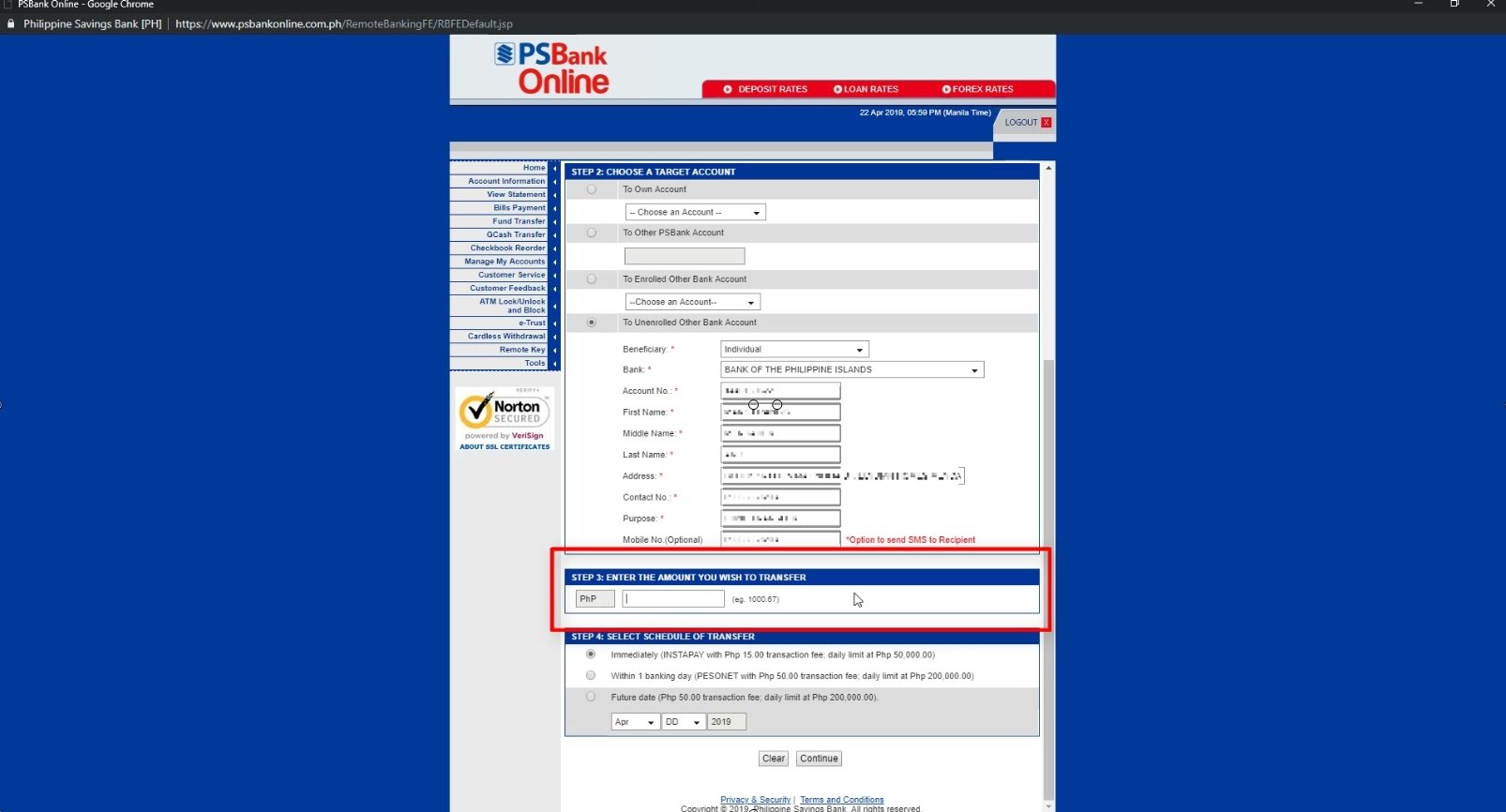

Step 5: Enter the amount that you want to transfer.

Of course, make sure the amount that you will enter here is within the available amount on your chosen source account.

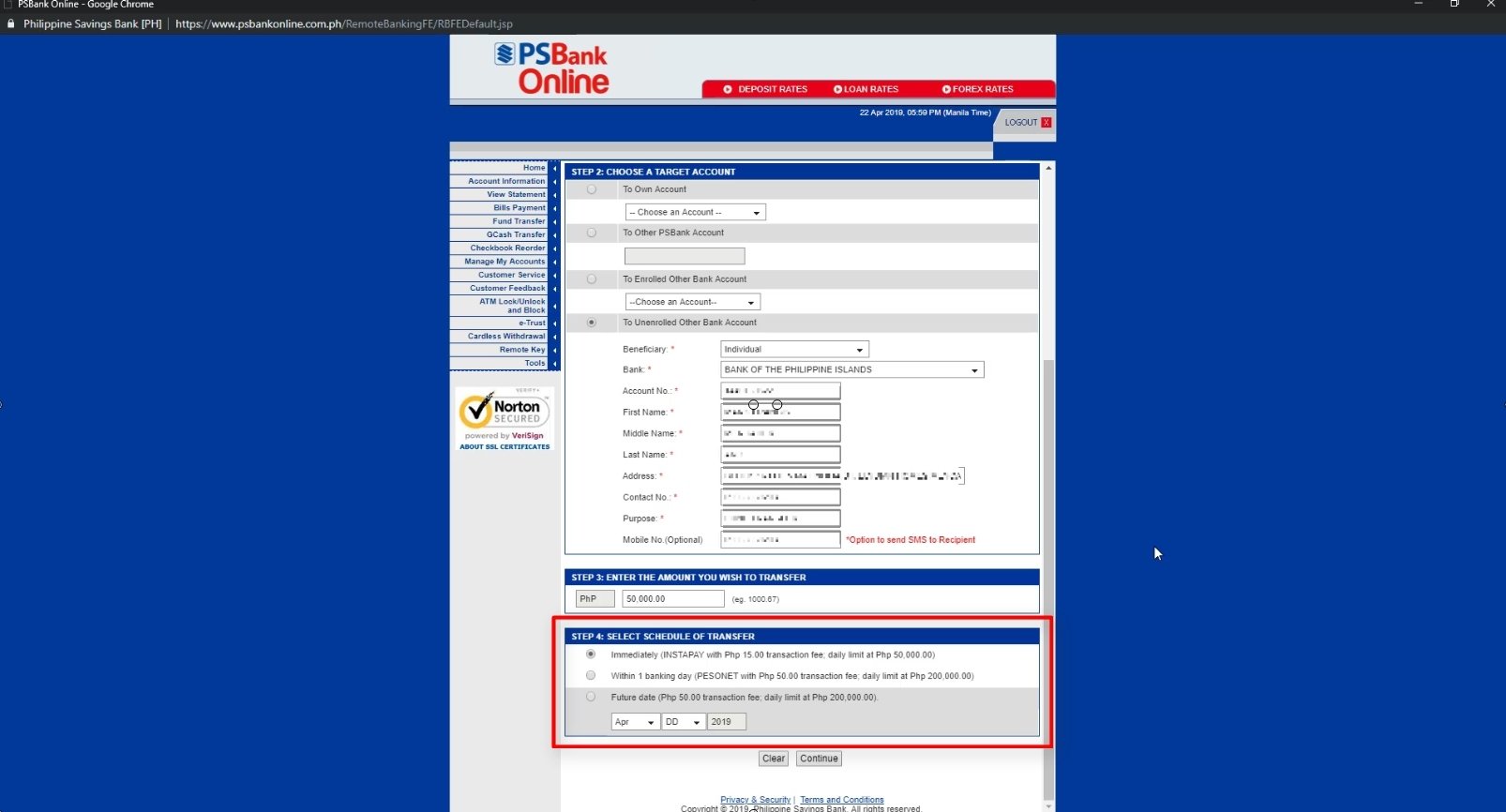

Step 6: Select your preferred Schedule of Transfer type.

Since we want to use InstaPay, we will select the “Immediately” transfer type.

Take note for PSBank, the transaction fee is Php 15 with a daily limit of Php 50,000.

The transaction fee and combined daily limit may vary per bank.

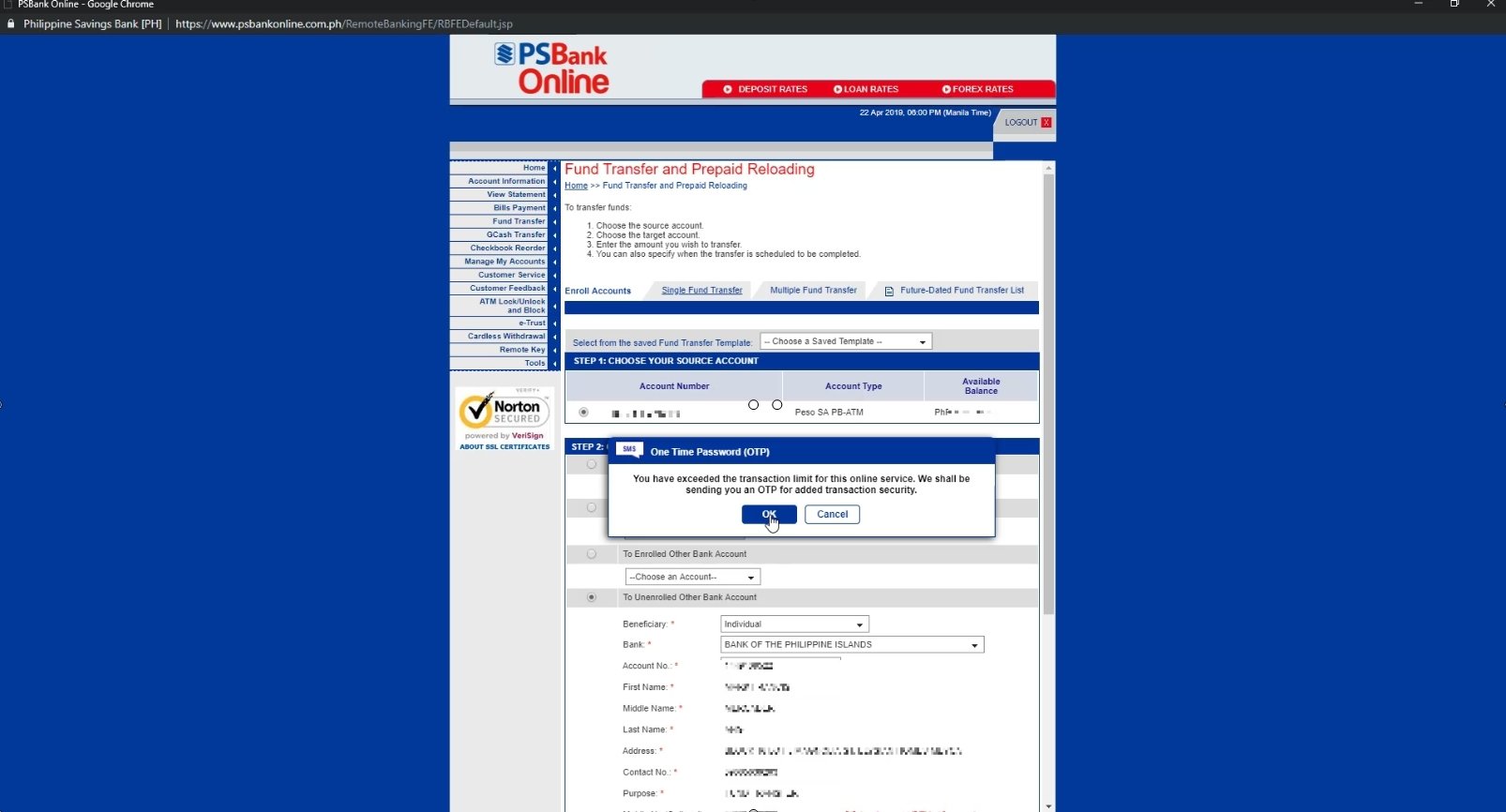

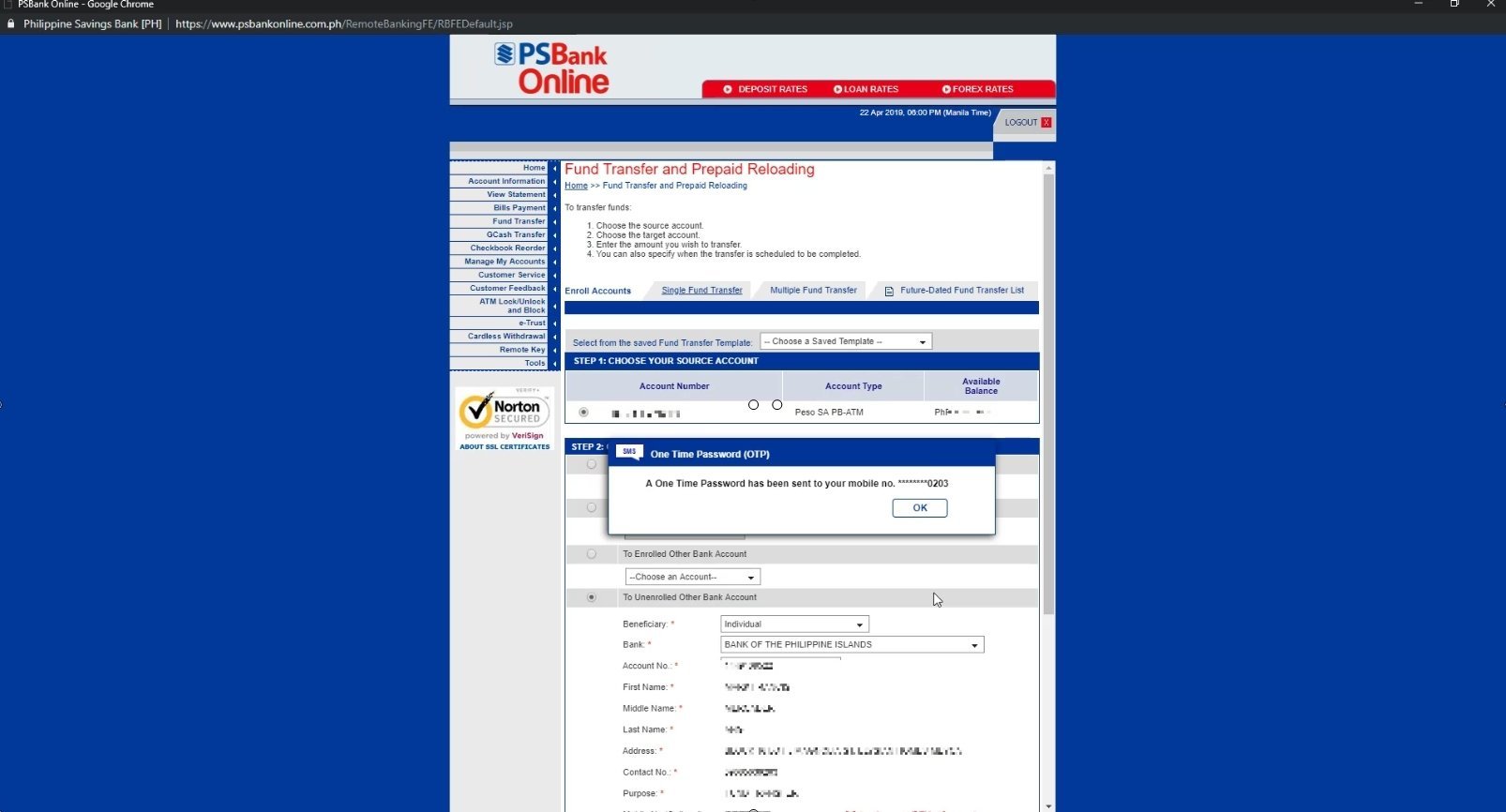

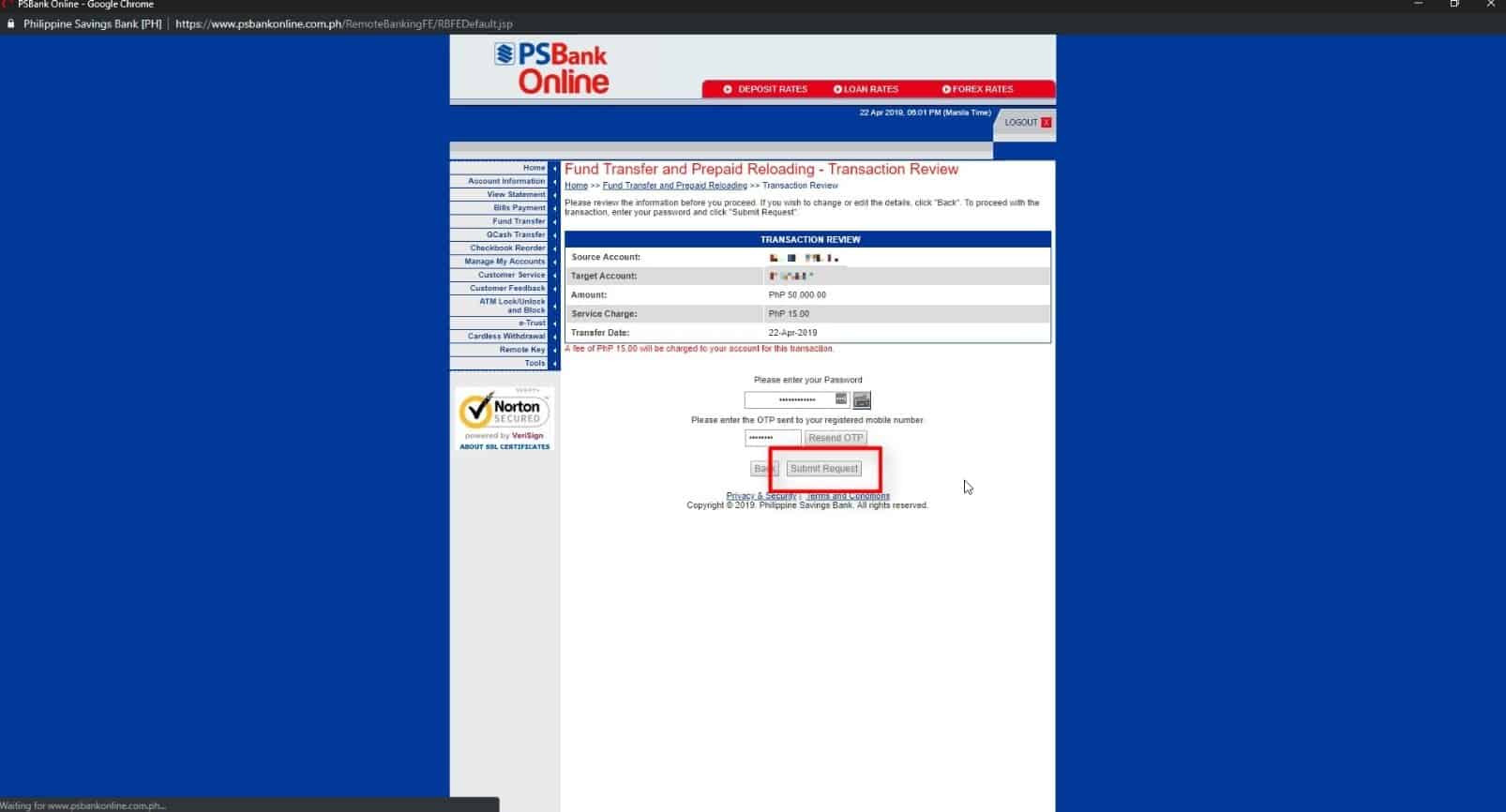

Step 7: Review your transaction details and enter your password and OTP to submit the fund transfer request.

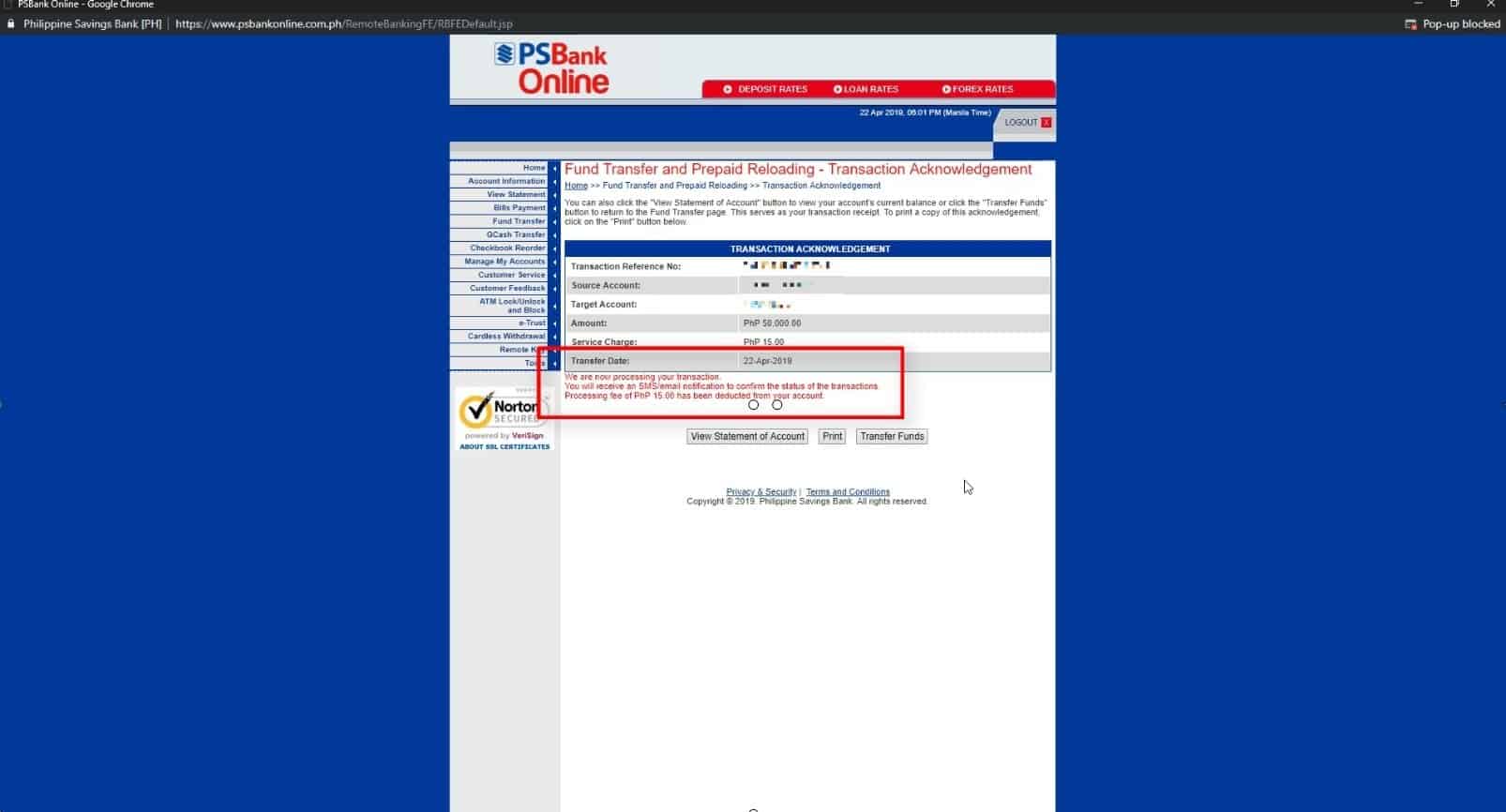

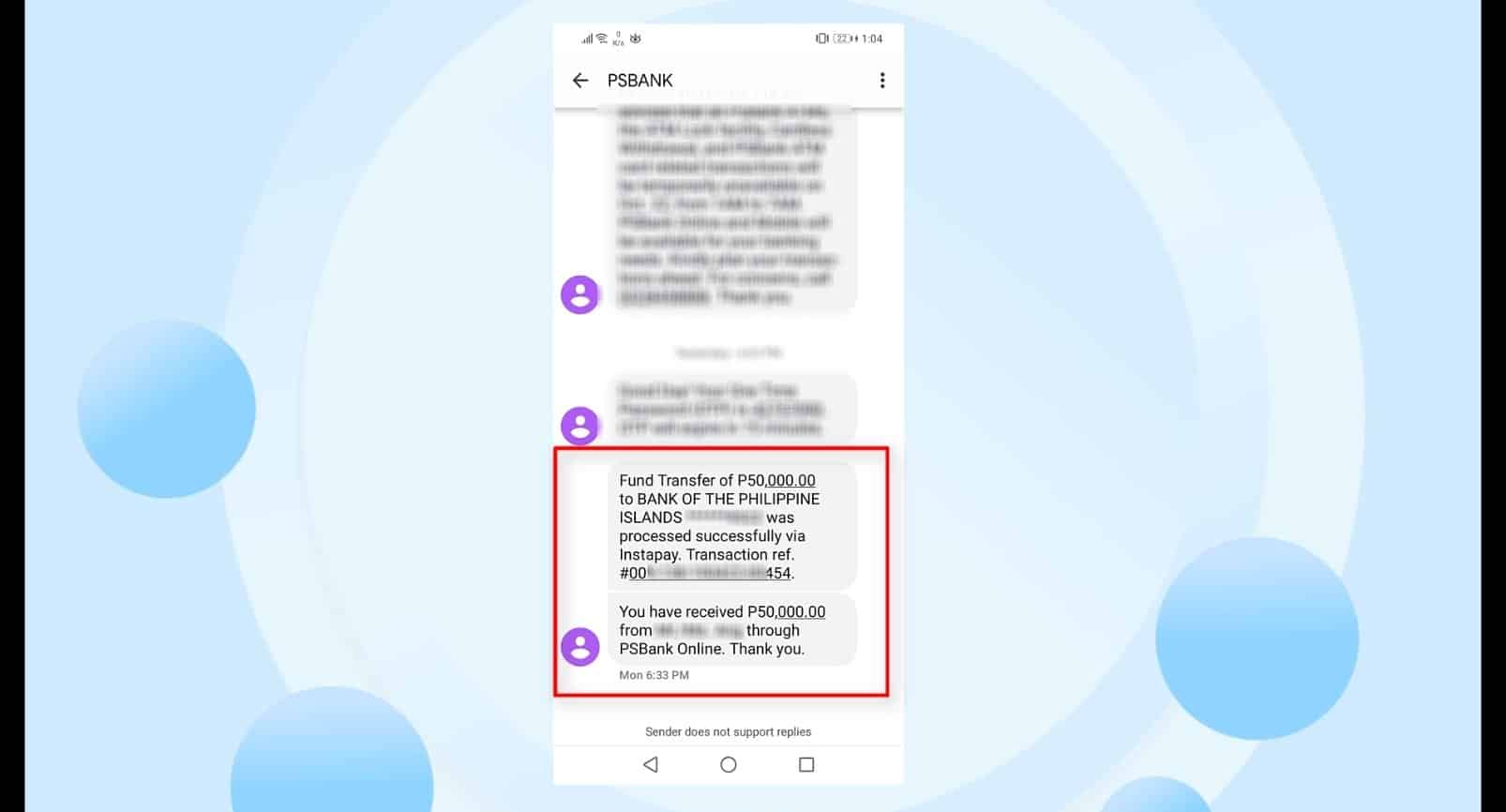

Step 8: Wait for their SMS confirmation or email notification on your InstaPay Bank Transfer.

You will see a transaction acknowledgement note.

You then need to wait for their SMS confirmation as they process the request.

Take note that the processing fee will already be deducted from your account at this point.

What about you? Let us know if you encountered any issues with InstaPay in the comments below.

Financial Transactions Made Easy!

More on our Youtube Channel.

Subscribe Now!

Do you have any questions? Let us know in the comments below! We will be happy to help 🙂