BPI Requirements and Process: How to Open BPI Savings Account?

How to Open BPI Savings Account?

Is that your question?

If yes, let us show you the BPI requirements and process.

Let’s start!

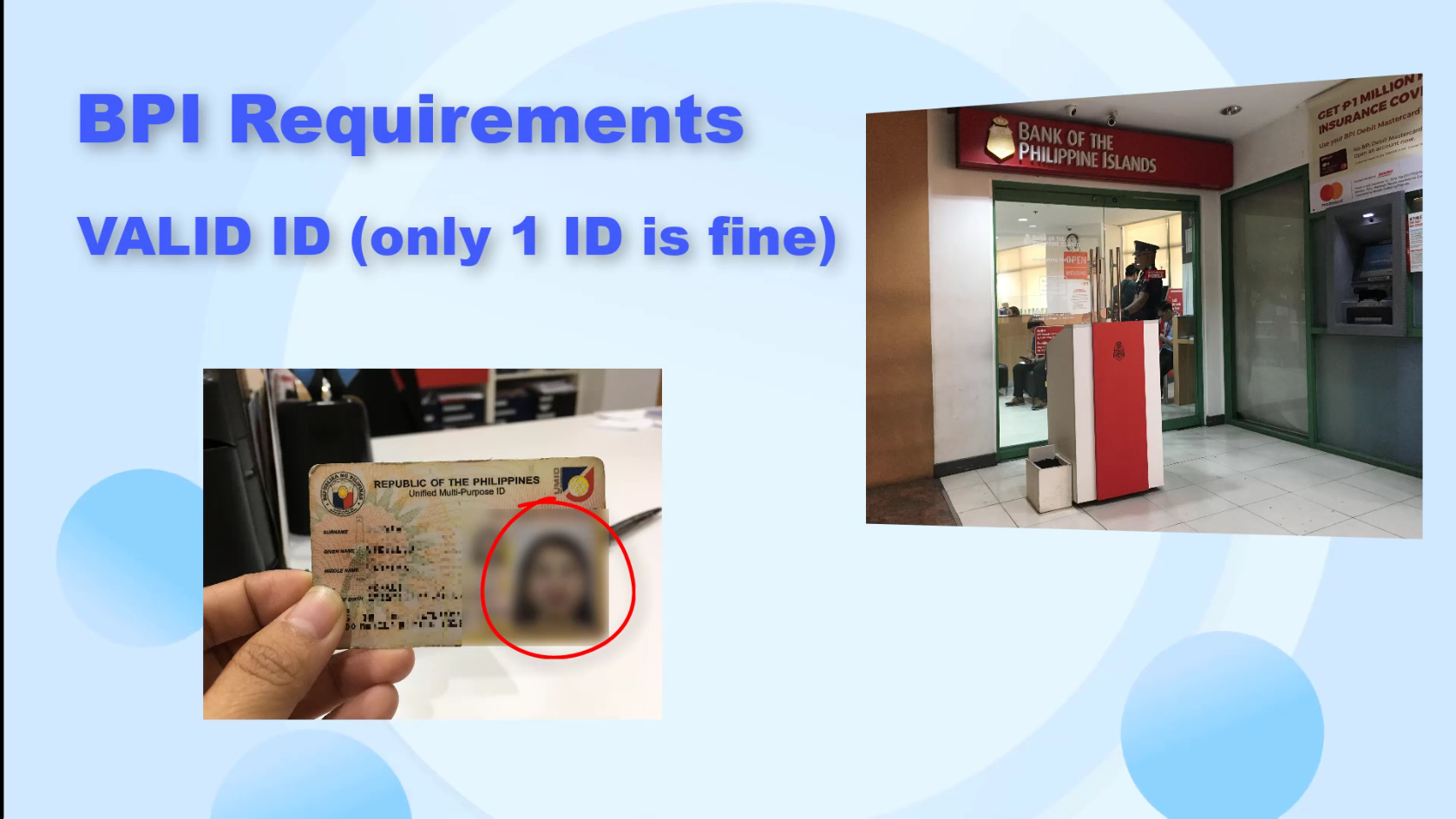

Step 1: Prepare and Bring your Requirements.

You would need to prepare your requirements beforehand so that you can ensure a smooth enrollment transaction.

Here is a list of BPI requirements that we prepared:

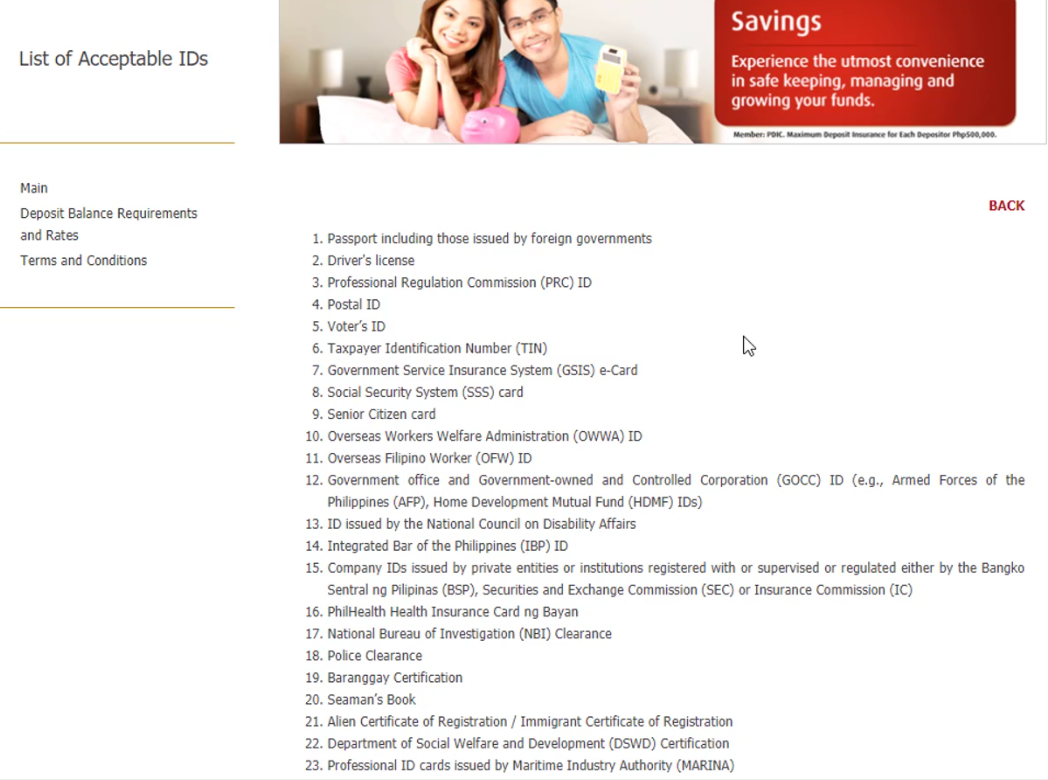

- 1 valid ID with photo and signature

- 1×1 ID Photo

- Proof of Billing

- Initial deposit

The valid ID should have your photo and signature on it.

The proof of billing should have the address that you specified in the application forms that you filled up.

If you have other IDs, please bring it.

TIN ID is optional.

Photocopy of ID and other requirements is not required.

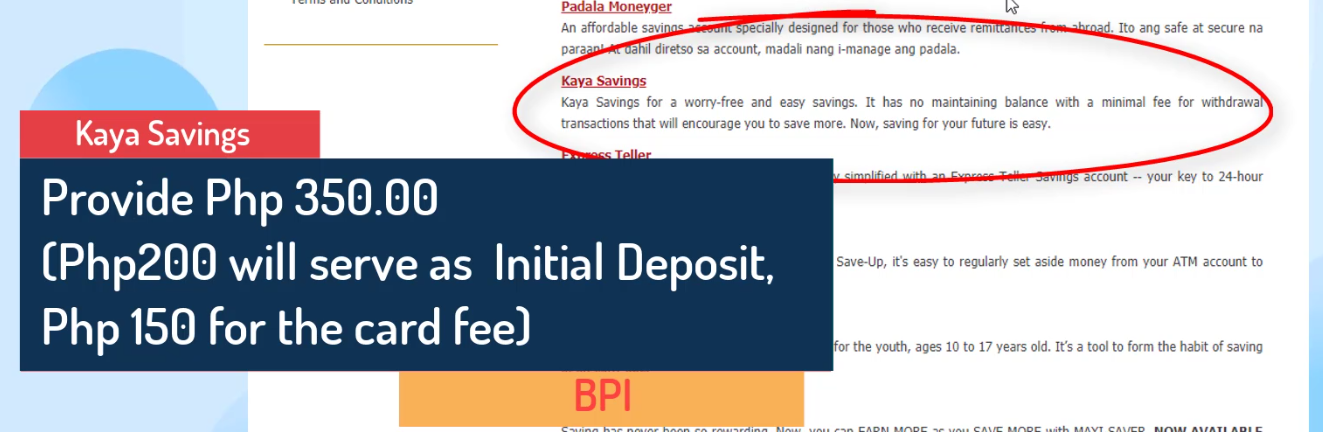

The initial deposit will depend on which BPI account you would like to open.

For example, a Kaya Savings account has a 350 pesos initial deposit.

200 pesos will serve as your initial deposit while the 150 pesos will serve as your card fee.

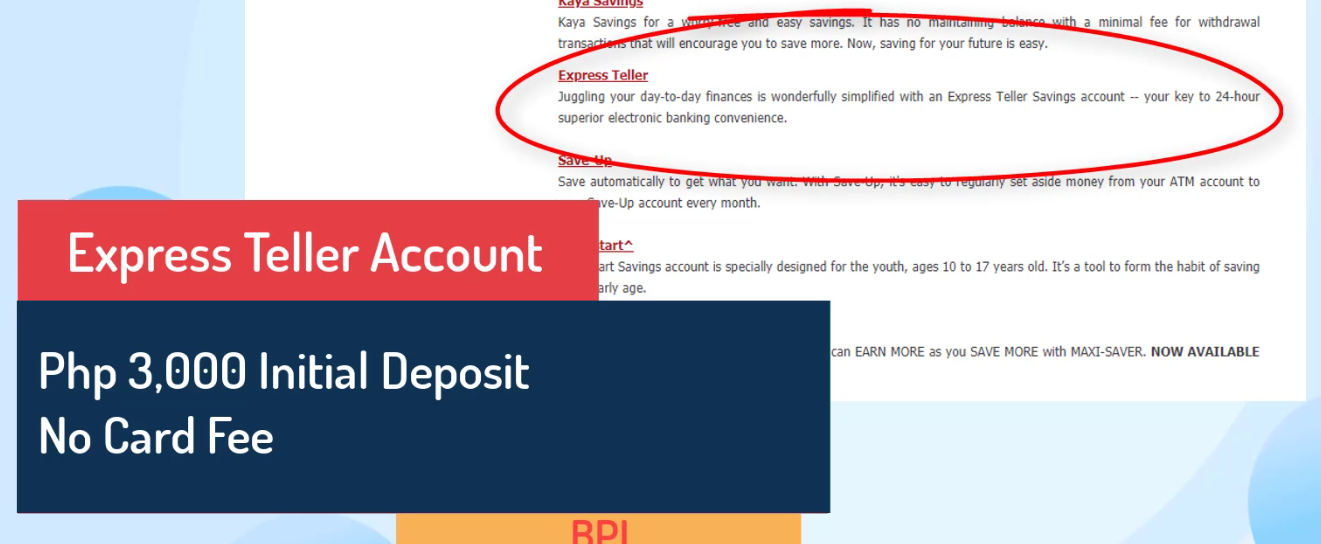

On the other hand, an Express Teller Account has an initial deposit of 3000 pesos with no card fee.

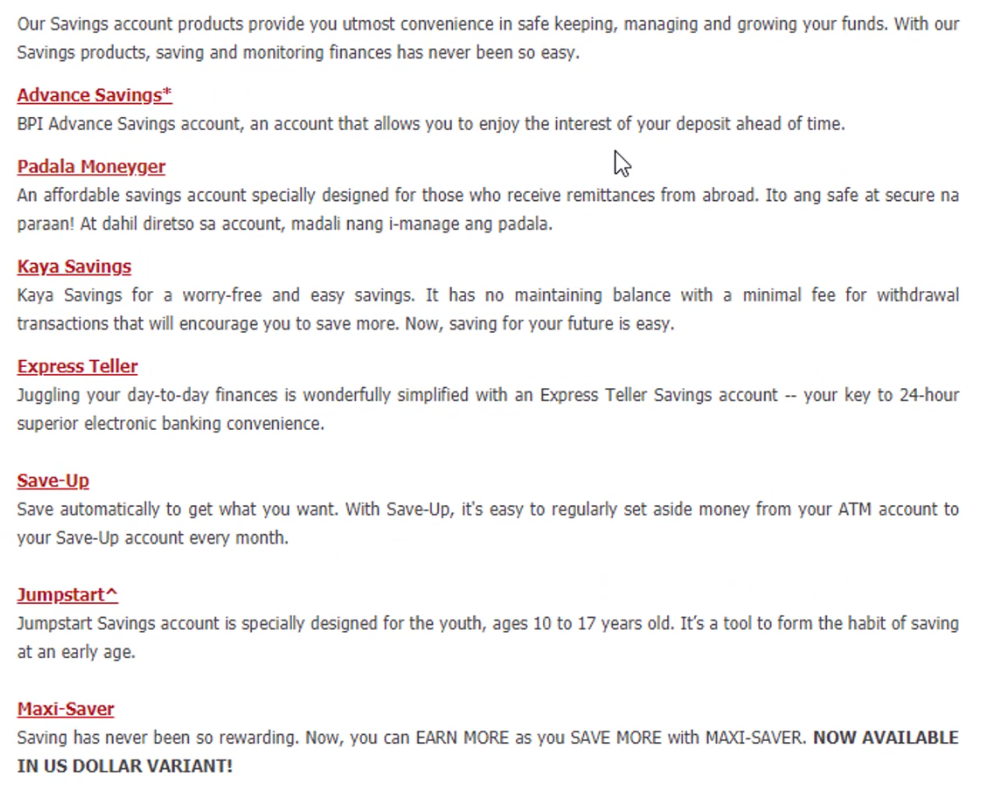

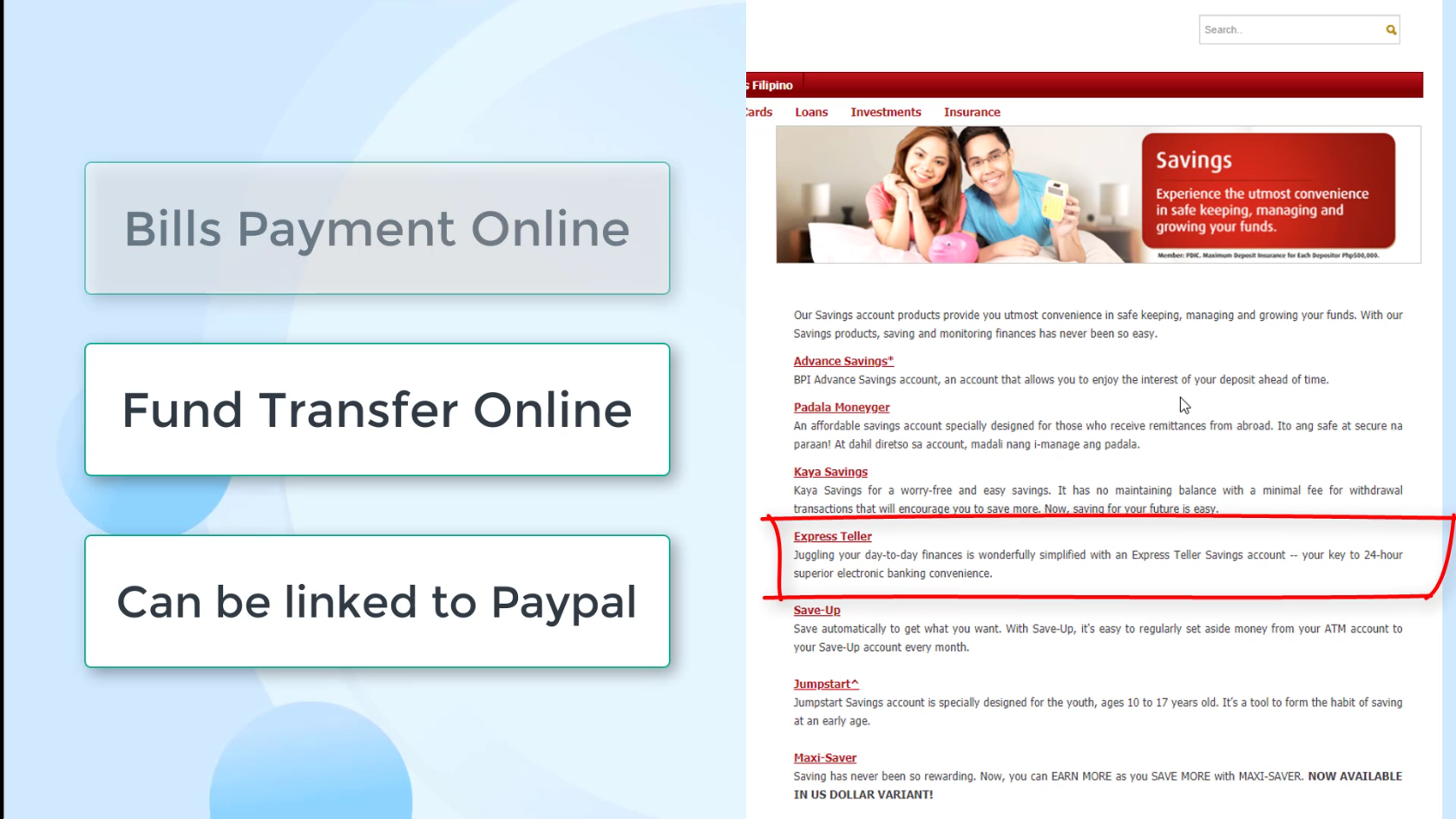

BPI also has other types of savings account.

You can refer to the image below for some of the details.

Step 2: Go to your nearest BPI Branch.

Inform the guard on duty that you will be opening a new BPI account.

They’ll give you a color coded number which you will need to wait for your turn.

Step 3: Present all the Requirements to the Bank Officer.

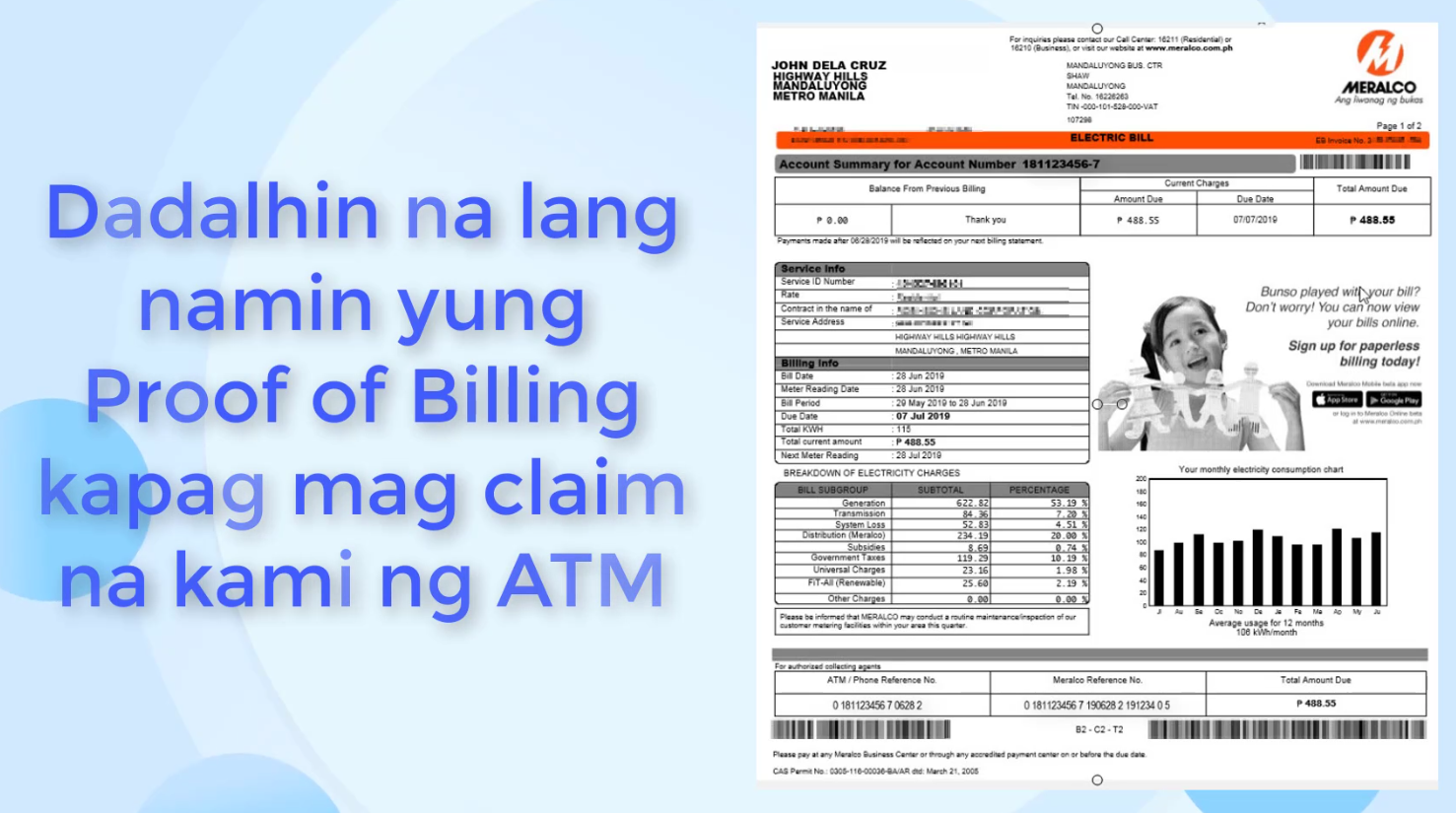

Unfortunately, we forgot to bring our proof of billing (don’t be like us :P).

We were just told to bring it when we go back to the BPI branch to claim the ATM card.

Take note that you don’t need to bring photocopies of the requirements as they’ll take care of that for you.

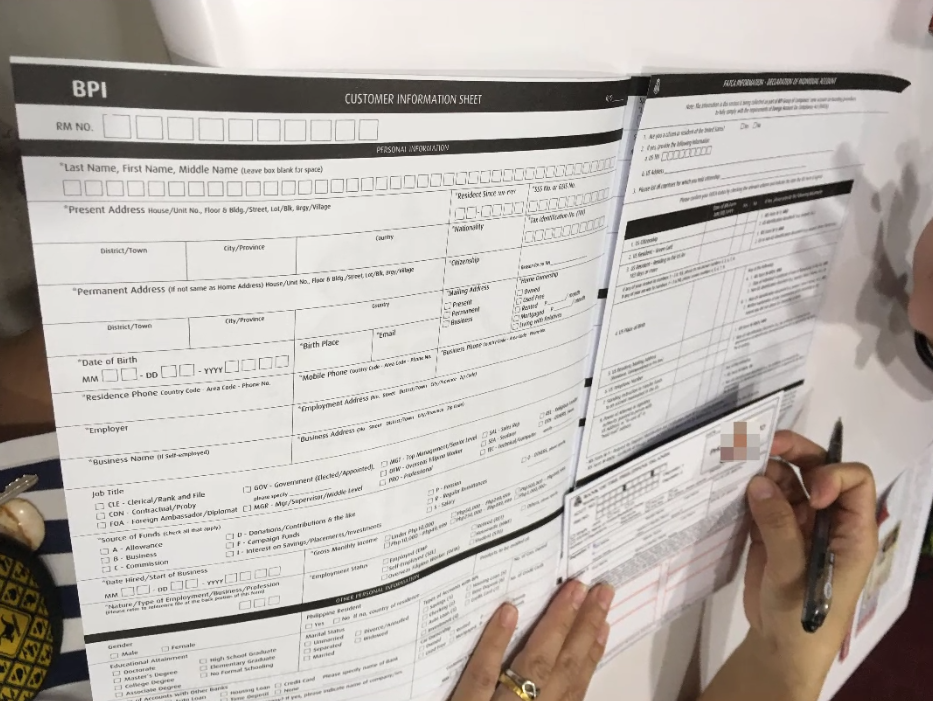

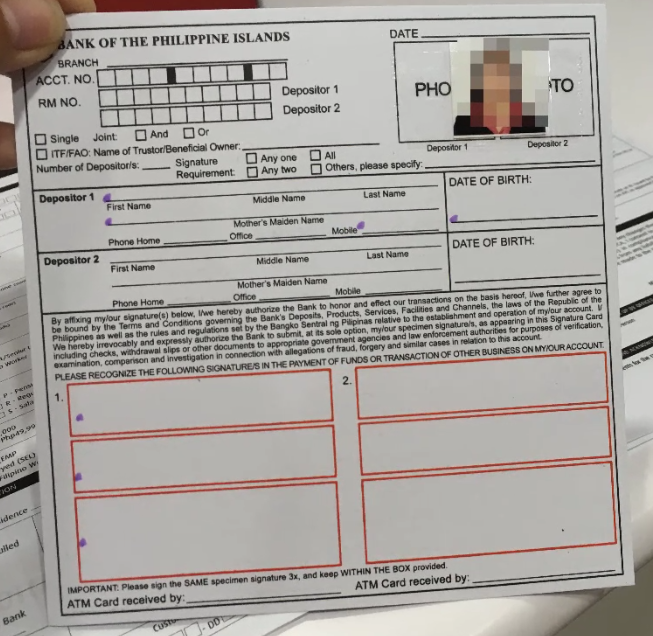

Step 4: Fill up the Customer Information Sheet and Specimen Signature Form.

Here ‘s a sample photo of the Customer Information Sheet:

Here’s a sample photo of the Specimen Signature Form:

They’ll also ask you to sign three times on the xerox copy of your ID with photo and signature.

Step 5: Inform the Bank Office of the BPI Savings Account Type that you want to open.

We asked the bank officer on which account type can do the following:

- Bills payment online

- Fund transfer online

- can be linked to paypal

With these in mind, they advise us to open an Express Teller Account.

They’ll also ask for your source of income or source of fund.

Be sure to have the answer to this question ready as they can deny your application if they are not satisfied with your answer.

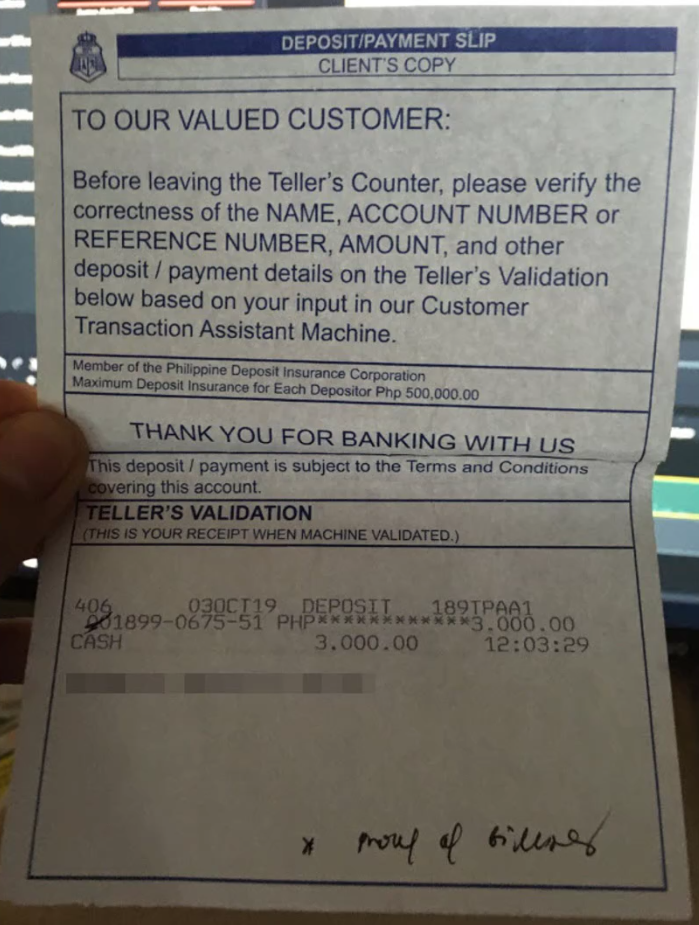

Step 6: Pay for the Initial Deposit amount.

Since the account that we opened was an Express Teller account, it has a 3000 pesos initial deposit that you need to pay.

They’ll issue you a receipt once you make the payment.

Keep this receipt as you will need to show this when you claim your BPI ATM card.

Step 7: Wait for Seven Business Days before claiming your BPI ATM Card.

Don’t forget to ask your bank officer when you could claim your ATM card.

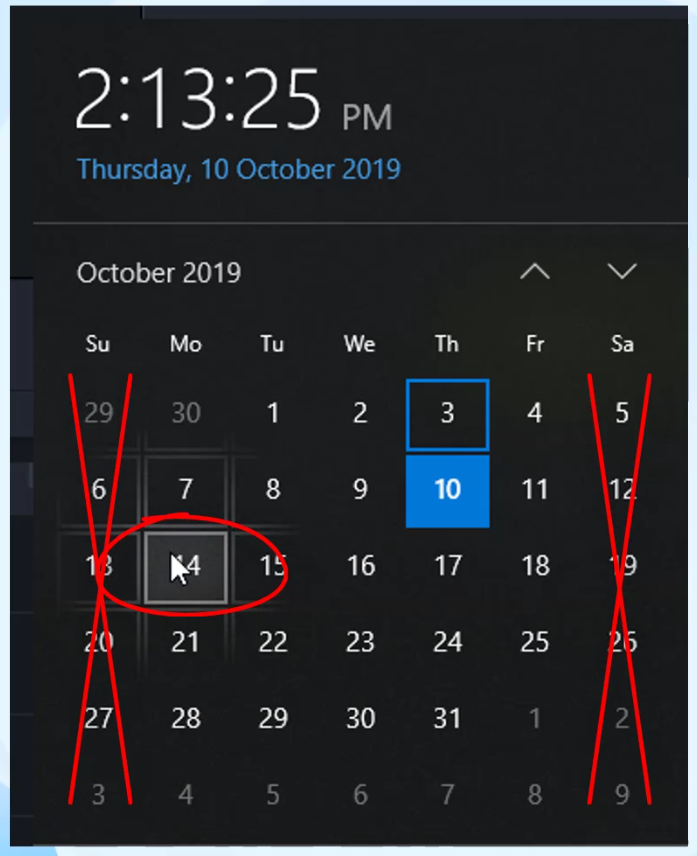

For the BPI branch where we opened an account, it will take them strictly 7 business days and it does not include Saturdays and Sundays.

We opened the account last October 3, 2019.

Adding seven business days, we can claim it by October 14, 2019.

Financial Transactions Made Easy!

More on our Youtube Channel.

Subscribe Now!

Were you able to successfully open a BPI savings account? Let us know which account did you open. Share your experience in the comments section below.

Don’t forget to subscribe to our Investlibrary YouTube channel so that you can be updated and notified for every new video that we create! 🙂

https://www.youtube.com/c/Investlibrary