BPI Online Banking Website and Mobile App Guide (New!)

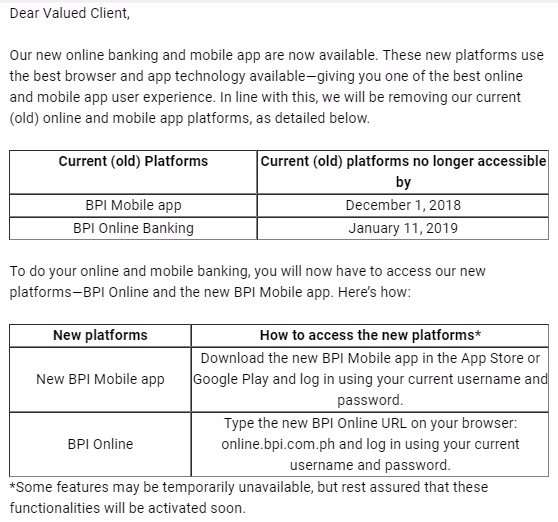

Starting December 1, 2018, the old BPI Mobile App will no longer be usable while the old BPI Express Online website will only be available until January 11, 2019.

It means that you need to download the new BPI app from the Play store (for android users) or from the App store (for iOS users).

If you haven’t seen the interface yet, let me show you what is inside the new website and mobile app.

BPI Online Banking Website

What is BPI Online Banking?

The new BPI Online Banking Website is a much needed upgrade for their online access portal coming from their old BPI Express Online website.

For those that are newly banked with BPI, the banking company provides an online portal access where functions and transactions that are normally performed at banks can be made via the internet.

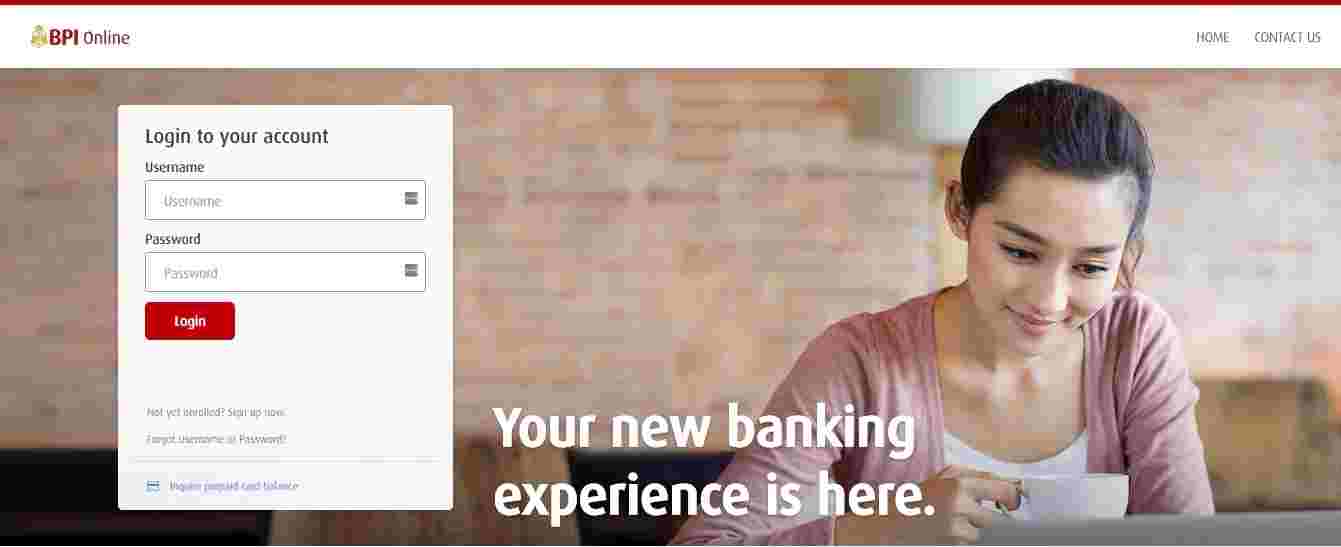

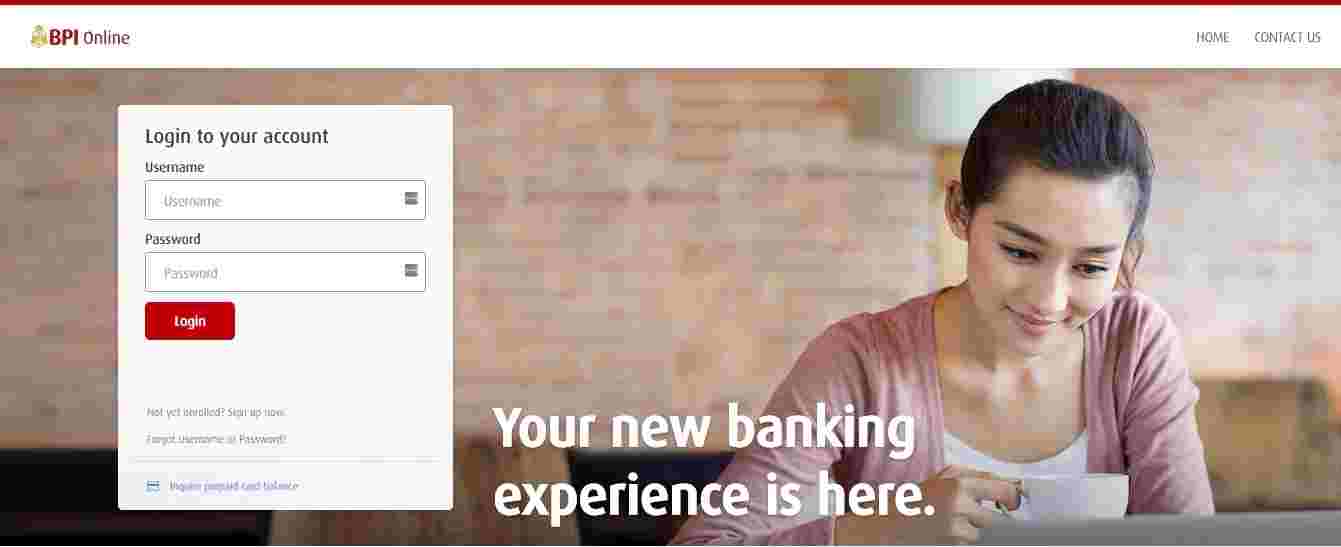

Here is the new BPI Online link: https://online.bpi.com.ph

Old BPI Express Online link: https://www.bpiexpressonline.com

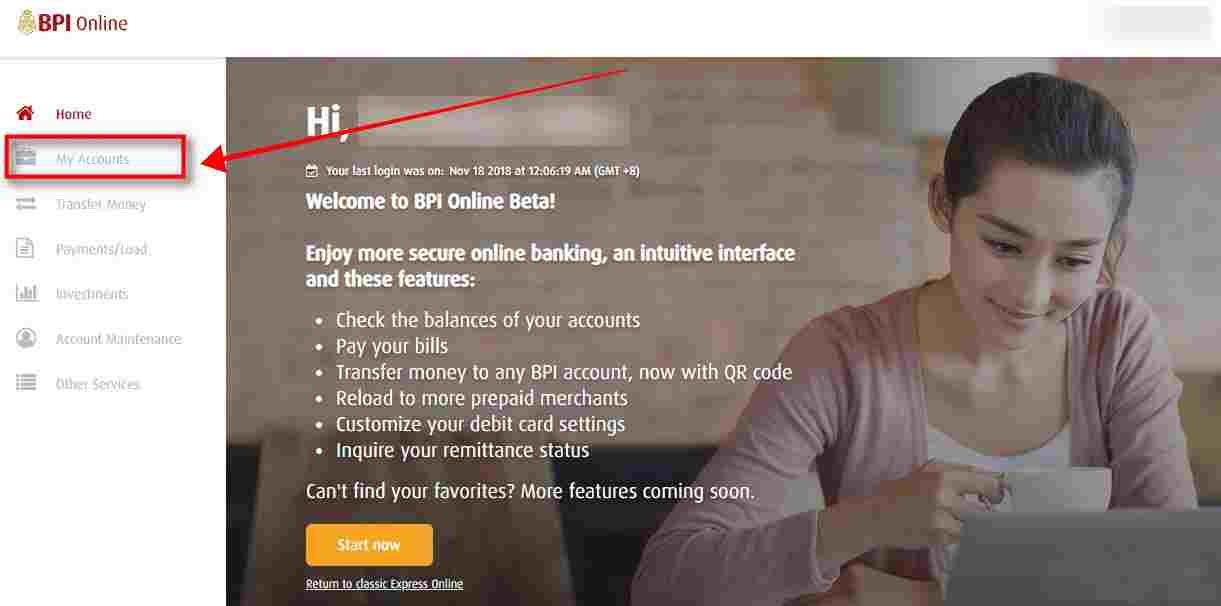

As soon as you login to the BPI Online website you will see these Menu Options:

- My Accounts

- Transfer Money

- Payments / Load

- Investments

- Account Maintenance

- Other Services

Now let’s go ahead and go through some of these features.

Features of the New BPI Online Banking Website

How to do BPI Balance Inquiry on your Accounts?

Let me guide you on how to do balance inquiry for your BPI accounts.

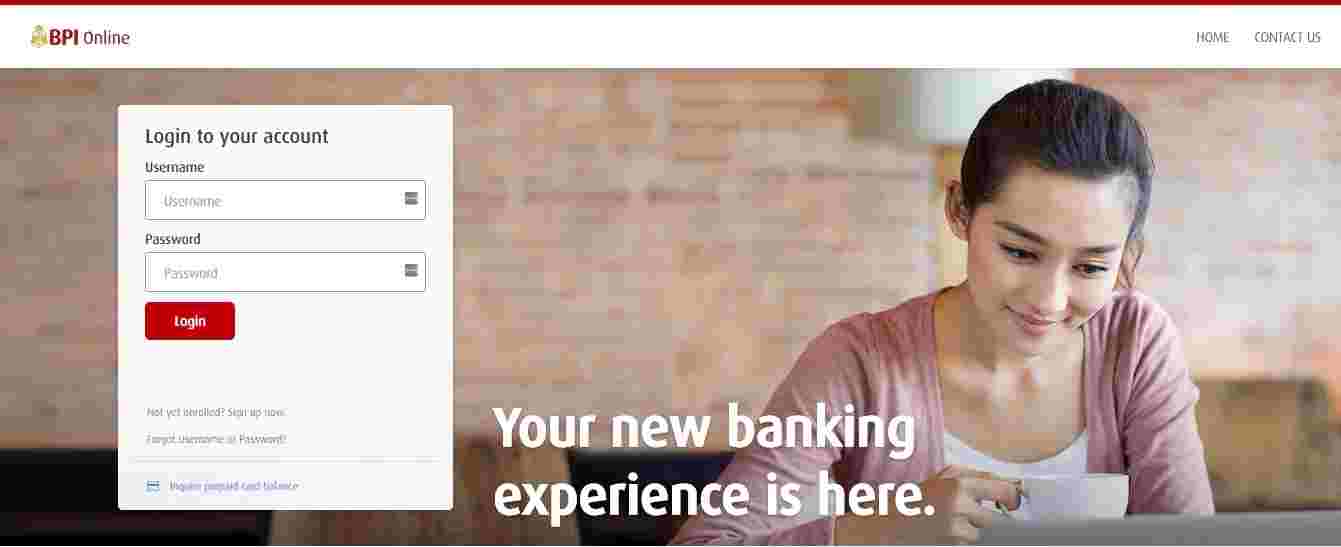

Step 1: Login to your BPI Online account.

Here is the link for the new BPI Online website: https://online.bpi.com.ph

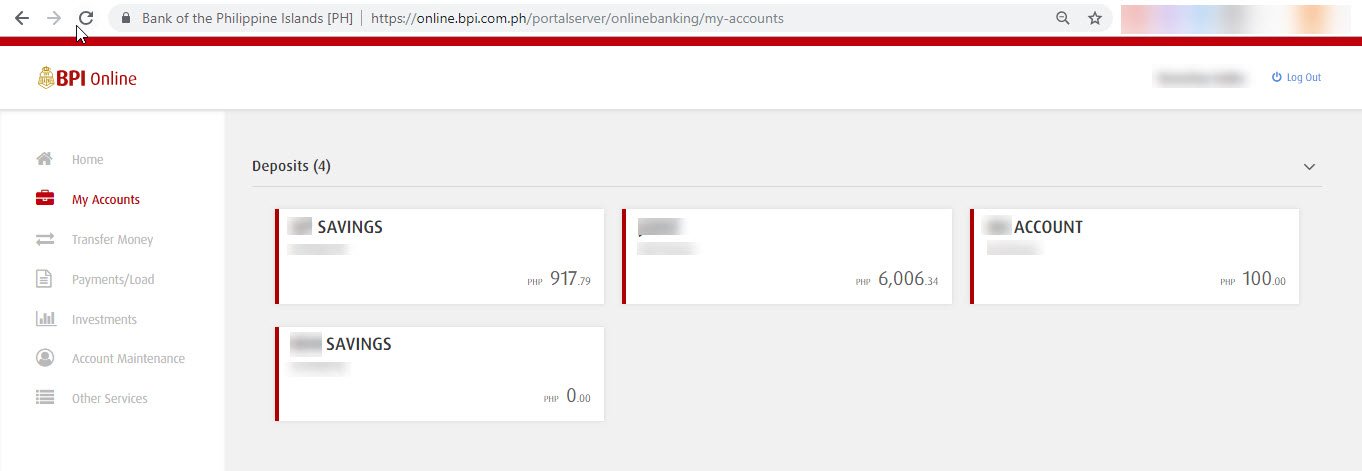

Step 2: On the left hand side, click on the My Accounts menu option.

Step 3: Select the account that you want to check.

After selecting, My Accounts, you will see the list of your BPI accounts in a tiled format with their corresponding account balances.

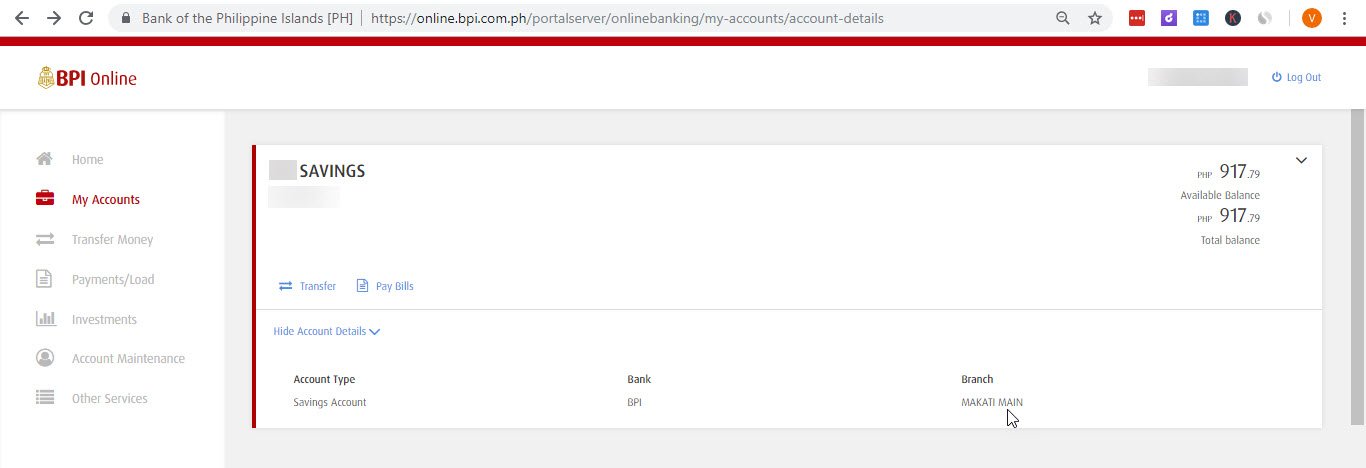

Step 4: If you want further information about your BPI account, click on the corresponding account tile on the list.

You will then see further account information such as your account type, name of the bank and branch where your account was opened.

In my case, it was opened in Makati Main branch.

You also have an option to transfer funds or pay bills in this account details window.

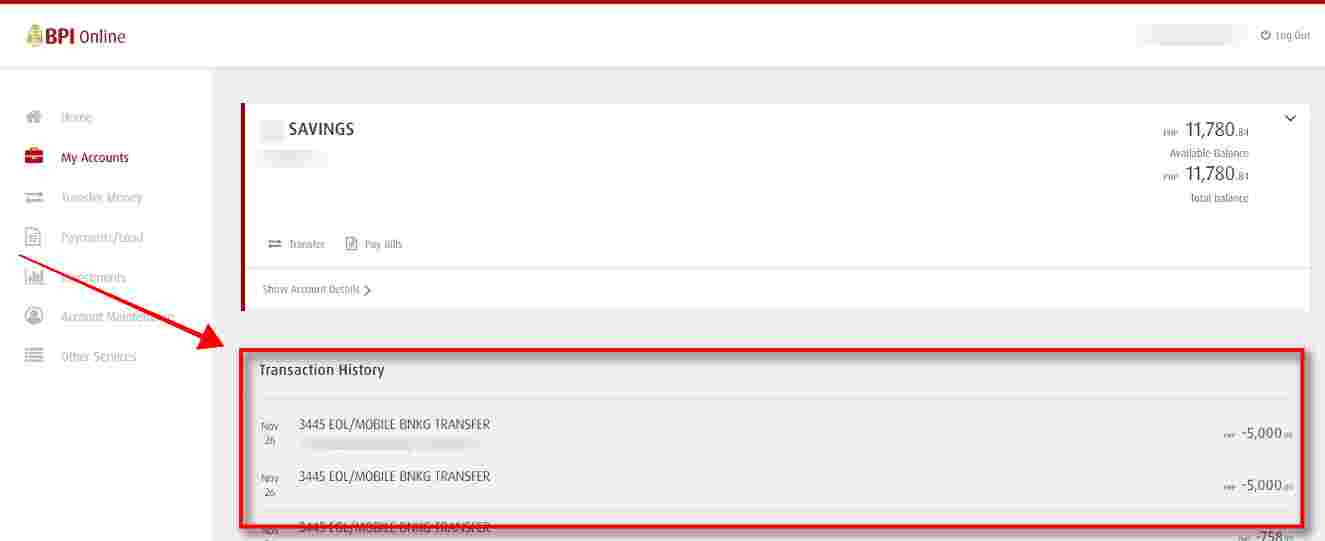

The account details page will also show your past transactions for the account.

These are included but not limited to: credit or debit transaction on your account, bills payment, fund transfers and many more.

Take note that all of your transaction history will not be loaded at the onset.

There is a “Show more transactions” link at the bottom to further list down your past transactions.

BPI Online Money Transfer

BPI Online enables you to easily transfer your money to either your own other BPI account or to 3rd party BPI accounts.

The transfer to anyone feature in the BPI Online website is an upgraded option as this was not possible in the old BPI Express Online website.

We also find the new money transfer feature as easy to follow and more secure as OTP or One Time Password authentication is being implemented when transferring to third party accounts.

Hopefully in the future, they can also implement money transfers to other banks.

How to Transfer Money to BPI Own Account?

Here are the steps on how to transfer money to your own other BPI account:

Step 1: Login to your BPI Online Account.

Here is the link for the new BPI Online website: https://online.bpi.com.ph

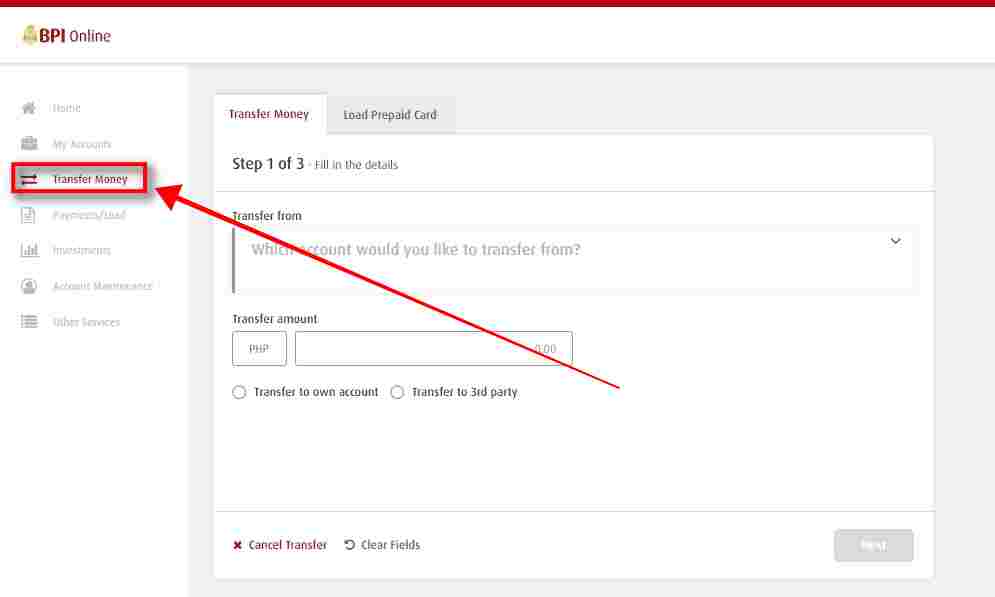

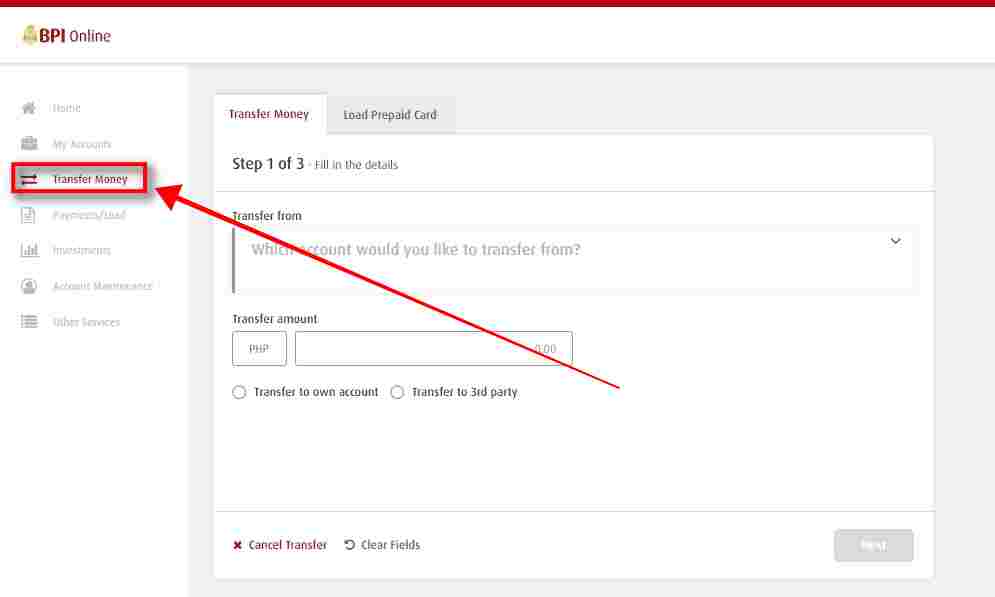

Step 2: Click on the Transfer Money menu option at the left side.

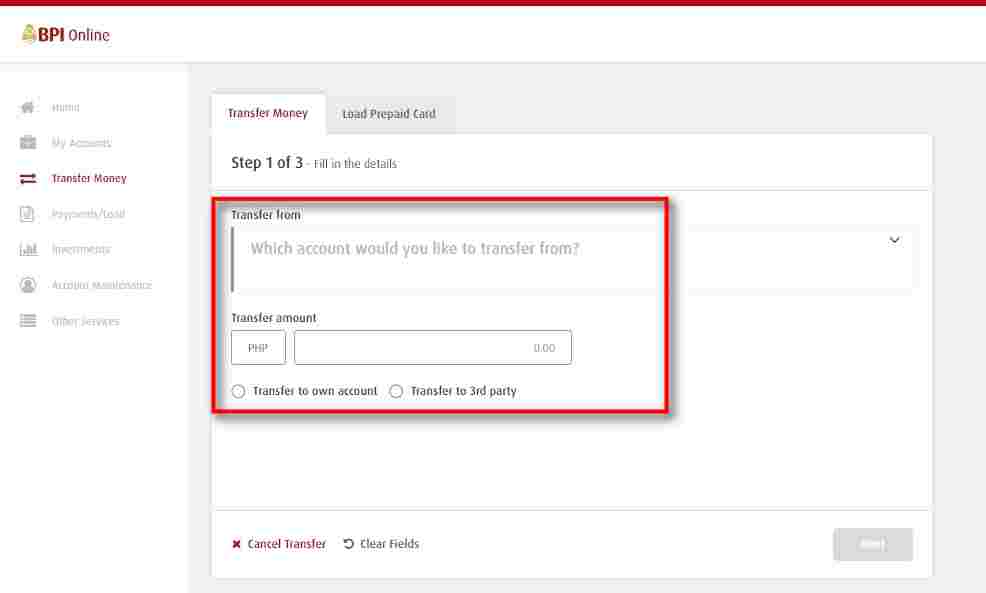

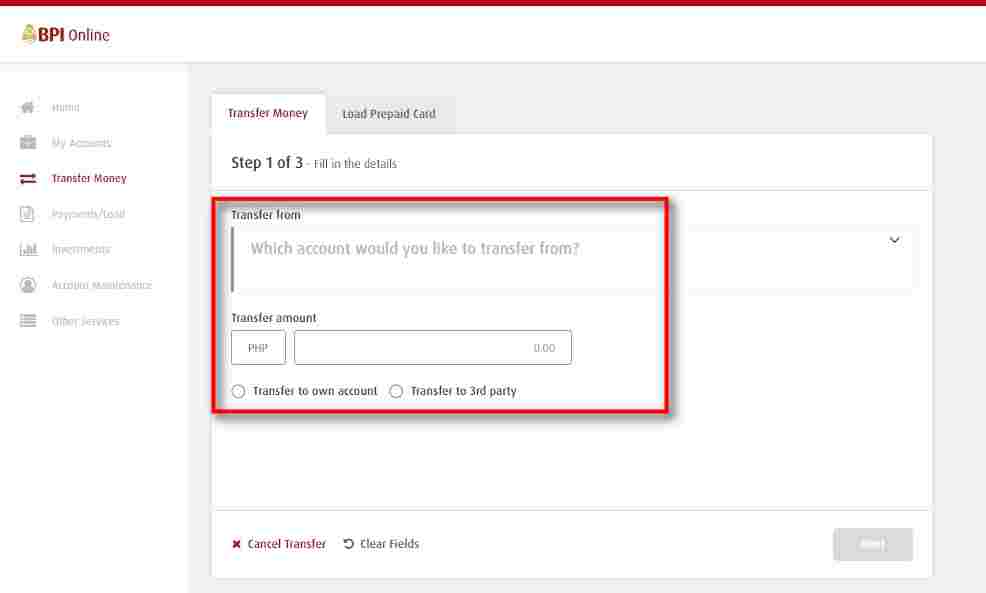

Step 3: Fill in the details needed, select Transfer to own account and complete the form.

BPI needs to know which account has the funds that you will be transferring, the transfer amount and the type of transfer that you will be doing.

You will also have options to cancel the transfer or clear the input fields in the form by clicking on the corresponding button in the bottom part of the form.

For this guide, we will be choosing the Transfer to own account option.

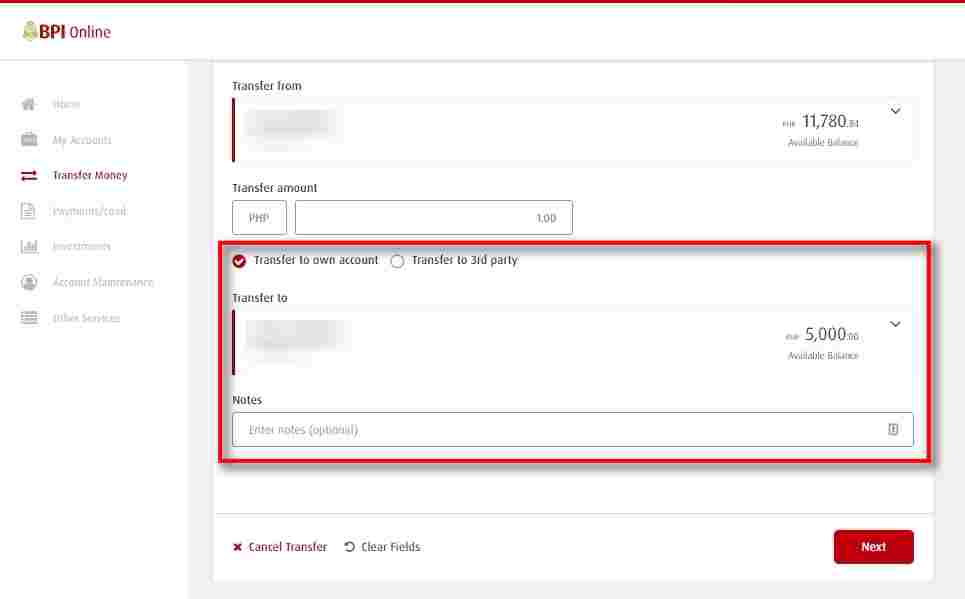

Another set of form fields will show up after you click on the transfer to own account radio button.

From the drop down, select which of your own BPI account would be receiving the funds being transferred.

You will also have an option to add Notes for your fund transfer so that you can easily track and identify the transfers that you will be making.

This can especially be helpful if you do regular money transfers.

Step 4: Click on the next button.

Once you fill up all the required fields in the form, the Next button will be clickable.

Click on it to continue.

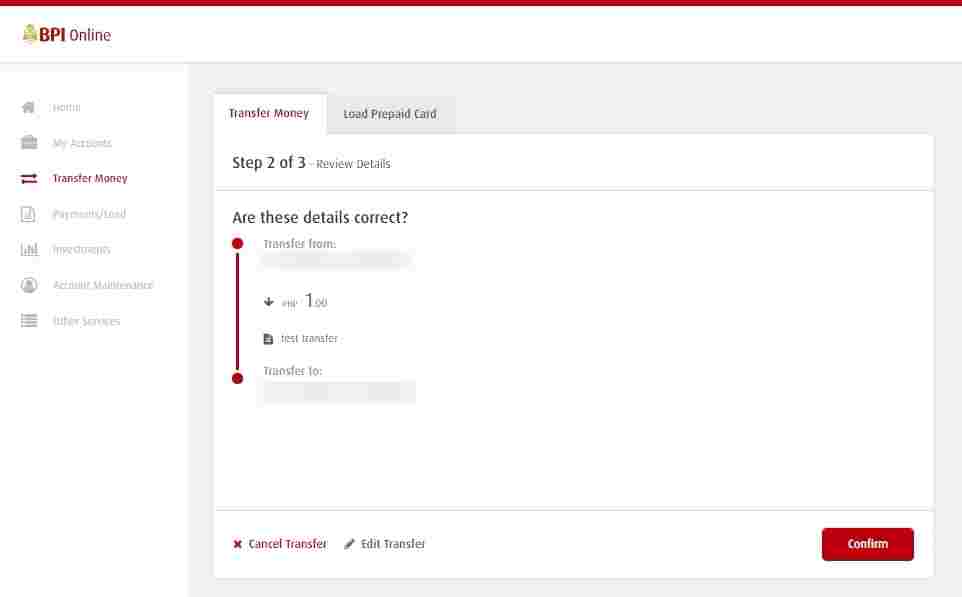

Step 5: Review the details and click on the Confirm button to continue.

Details of the pending transfer will be shown to you: transfer from account, amount to be transferred, your notes (if you added one) and the receiving account.

Review it and if all the details are correct, click on the confirm button.

On this step, you will have two buttons which are options to cancel the transfer transaction and a button to edit the transfer.

Take note that all transfers are done in real time.

The funds or credits transferred can immediately be withdrawn over the counter or via ATM.

Although, credits from fund transfers made after the system cut-off of 10:00 PM (GMT +8) will be considered part of the next banking day transaction.

This information is important especially if you want to know if you already reached your withdrawal amount limit for the day.

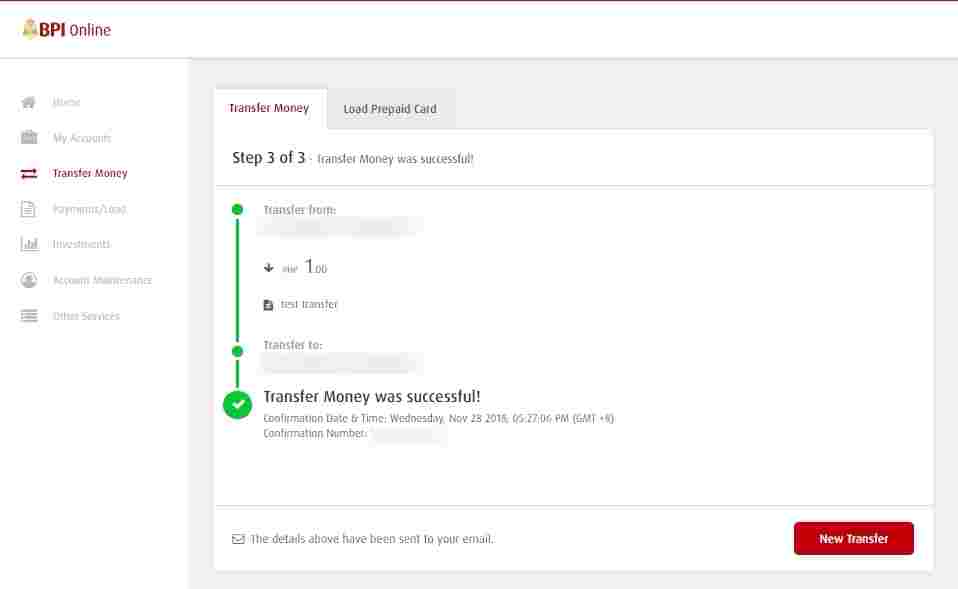

Step 6: Check if the Transfer was successful.

If the money transfer was successful, you will see the “Transfer Money was successful” confirmation note together with the confirmation date, time and number.

Details of the money transfer will also be emailed to you.

BPI Online Transfer to Anyone (Transfer to Third Party)

As I’ve mentioned earlier, the transfer to anyone feature was not possible before using the BPI Express Online website since the feature was only implemented via the BPI mobile app.

With this good news now, let us see how we can transfer to anyone using the website version.

Step 1: Login to your BPI Online Account.

Here is the link for the new BPI Online website: https://online.bpi.com.ph

Step 2: Click on the Transfer Money menu option at the left side.

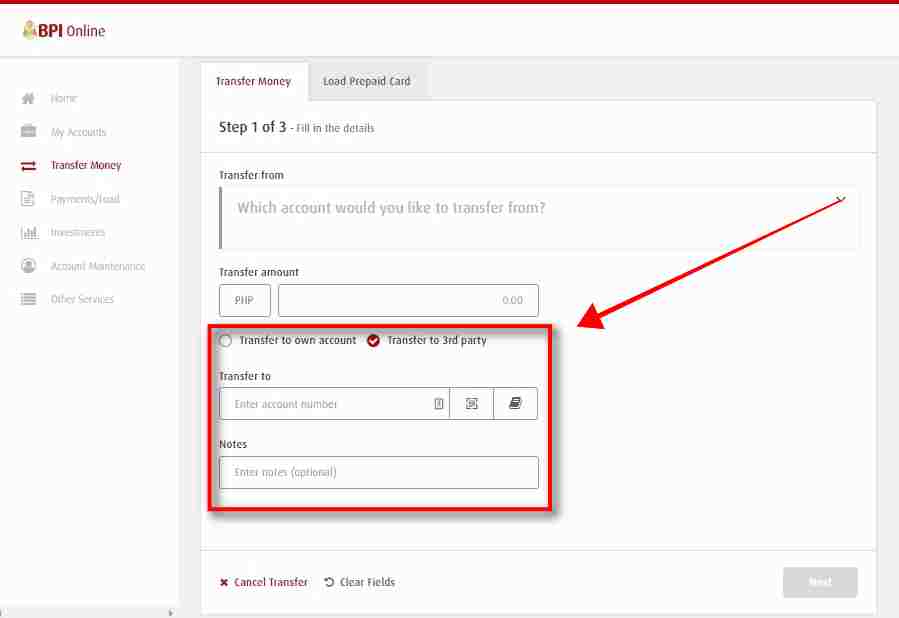

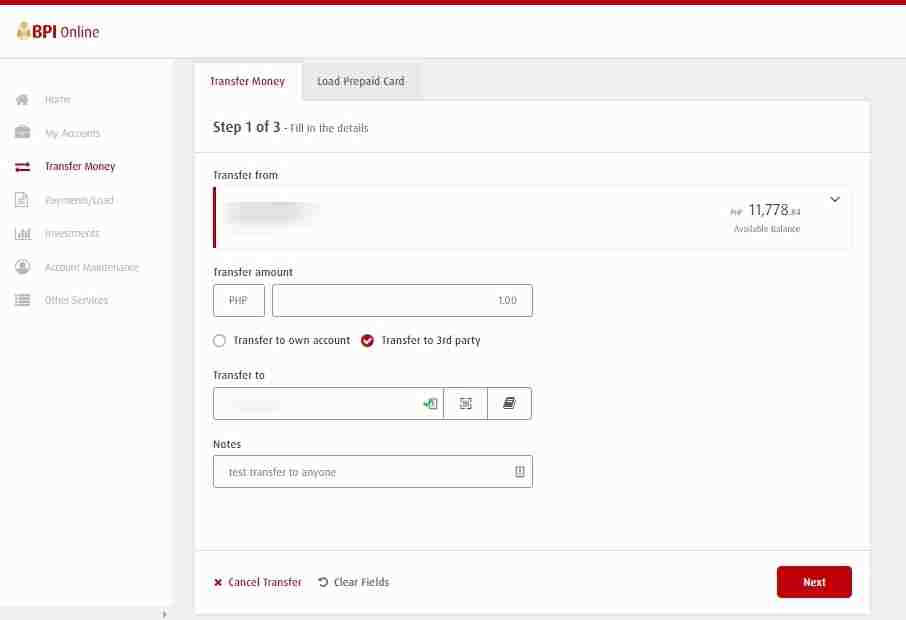

Step 3: Fill in the details needed, select Transfer to 3rd party and complete the form.

Similar to step 3 of the money transfer to own account section above, you will need to indicate which account has the funds that you will be transferring, the transfer amount and the type of transfer that you will be doing.

You will also have options to cancel the transfer or clear the input fields in the form by clicking on the corresponding button in the bottom part of the form.

This time around, we will be choosing the Transfer to 3rd party (also known as BPI Transfer to anyone) option.

Another set of form fields will show up after you click on the transfer to 3rd party radio button.

In the “Transfer to” field, specify the account number.

You have two ways to do this, you can either manually enter the account number or you can scan a QR code that is provided to you.

In this example, we will be manually entering the account number.

The second field is the Enter Notes section.

Place notes on your fund transfer so that you can easily track and identify the transfers that you will be making.

This can be helpful for those that do regular money transfers.

Step 4: Click on the next button to continue.

Once you fill up all the required fields in the form, the Next button will be clickable.

Click on it to continue.

There is a note that applicable service fees may be deducted for un-enrolled fund transfer. Take note of this.

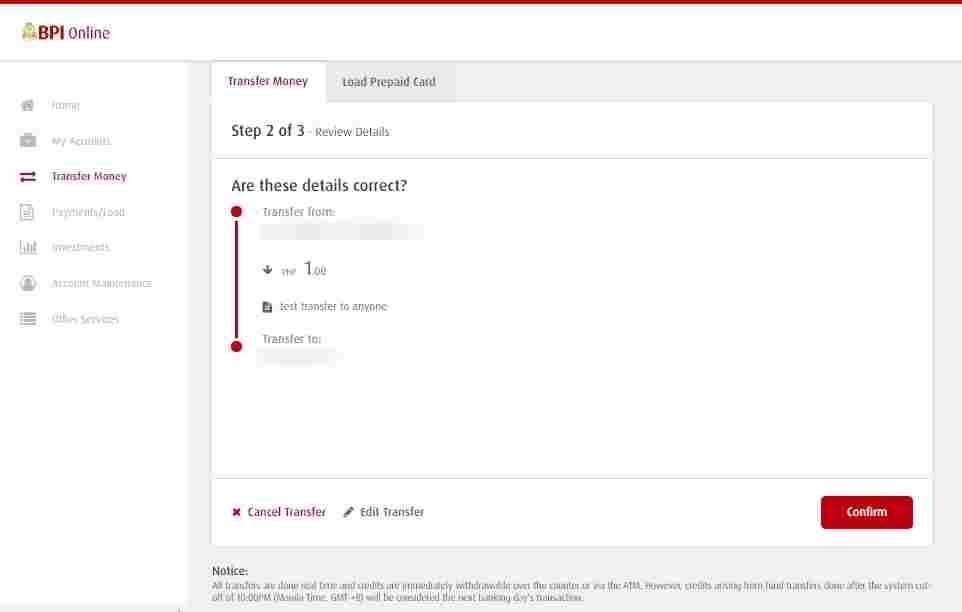

Step 5: Review the details and click on the Confirm button to continue.

Details of the pending transfer will be shown to you: transfer from account, amount to be transferred, your notes (if you added one) and the receiving account.

Review it and if all the details are correct, click on the confirm button.

On this step, you will have two buttons which are options to cancel the transfer transaction and a button to edit the transfer.

Take note that all transfers are done in real time.

The funds or credits transferred can immediately be withdrawn over the counter or via ATM.

Although, credits from fund transfers made after the system cut-off of 10:00 PM (GMT +8) will be considered part of the next banking day transaction.

This information is important especially if you want to know if you already reached your withdrawal amount limit for the day.

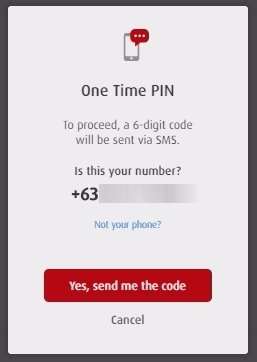

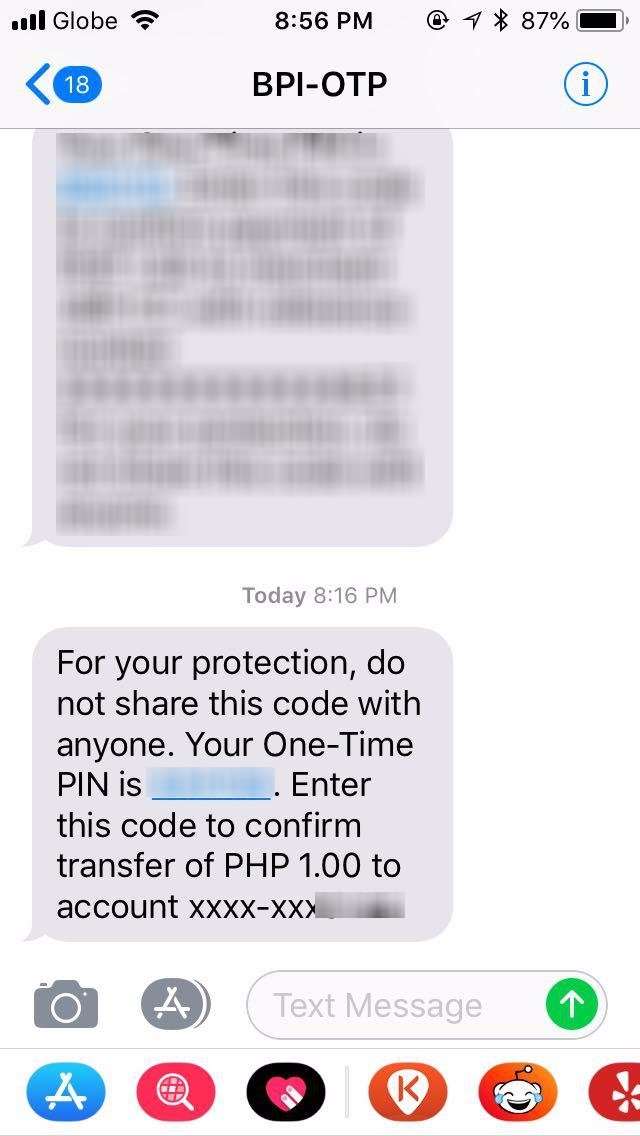

Step 6: You need a one time PIN to continue. Click on “Yes, send me the code” to proceed.

A pop-up will show up that informs you of a one-time PIN is needed to proceed.

Confirm if that is your correct phone number on the screen.

If not, just click the “Not your phone?” option.

If it is already showing your correct phone number, click on the “Yes, send me the code” button to continue.

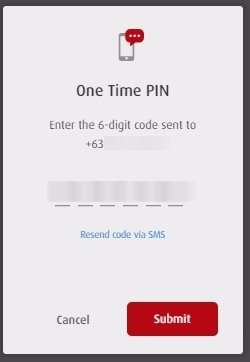

Step 7: Input the one time PIN that you received via SMS.

Place the one time PIN from the SMS that you received.

If you weren’t able to receive the SMS, you can request to have it resent by clicking on the “Resend code via SMS” link.

Hit on the submit button to continue once you have entered the correct code.

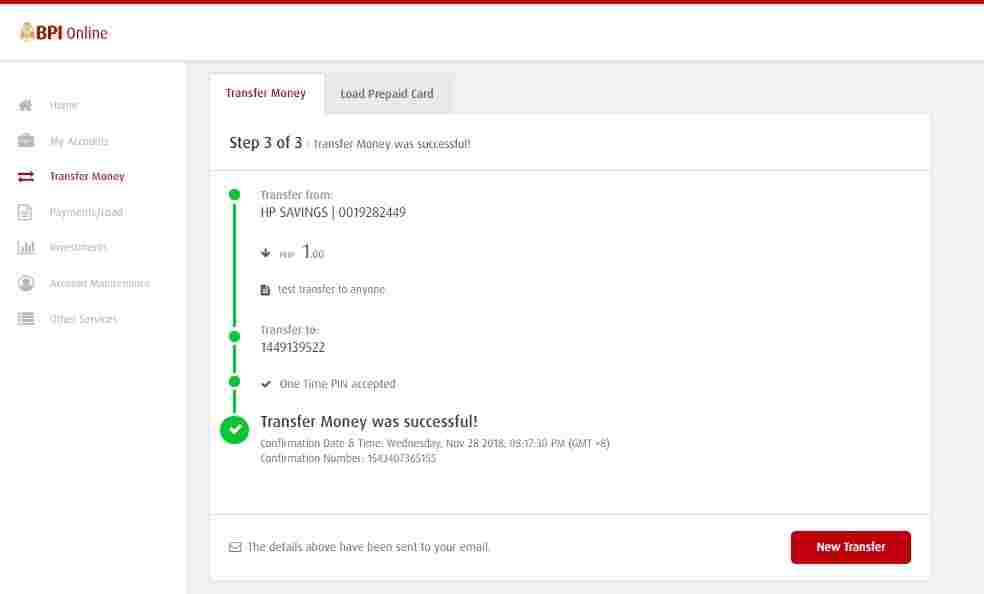

Step 8: Check if the Transfer was successful.

If the money transfer was successful, you will see the “Transfer Money was successful” confirmation note together with the confirmation date, time and number.

You will also see if the one time PIN was successfully accepted by the system.

Details of the money transfer will also be emailed to you.

BPI Online Merchant Payment

The new BPI Online also has the capability for you to pay bills to your chosen company / biller / merchant.

We tried paying several billers / merchants and so far our transactions were successful.

We detailed our merchant enrollment and payment transactions in separate step by step guides also found here in our Investlibrary blog.

Don’t worry we will also add those links here.

PLDT Online Payment using the New BPI Online

First on the list is our PLDT online payment.

You can find our step by step tutorial here (with YouTube video guide).

BPI Mobile App

What is the BPI Mobile App?

Aside from the website, BPI has a mobile app that can perform banking duties and transactions.

They also managed to upgrade their mobile app for a more intuitive and enhanced banking experience.

You can download the BPI mobile app here:

For Android users: Google Play Store

For iOS users: App Store

Financial Transactions Made Easy!

More on our Youtube Channel.

Subscribe Now!

I like the new bpi app. Except you can’t subscribe to your uitf or mutual fund thru it. Has to be done in the browser.