7 Questions to Ask Before Investing in Philippine Stock Market

Many Filipinos were surprised and fascinated when a maid made a million through stock market even with just starting at small amount.

It takes discipline, proper guidance and knowledge to be successful in stock market that’s why in this post we’ll cover some basic questions about stock market.

What is it? Is it safe? How much do I need to start in stock market?

What is in stock market? How does it work?

This is where companies sell partial ownership of their business and investors buy this partial assets called shares.

In return, as their company grow your money will grow too.

Let’s take a look at Jollibee, their price per share last March 2013 is P115.

After 5 years, March 2018, their price went up to P298. If you bought at 115 and kept your investment, your money has been doubled already.

An investor could also sell his shares, you have positive earnings if you sell at 298. You can keep your investment long term, 10, 20 years or more or trade it (buy and sell).

Aside from selling, you can also earn through dividends. This is a way of some companies to share their earnings to investors at periodic payment.

As a buyer or an investor, you can proudly say that you are a part owner of that company.

How can you participate in stock market?

You cannot go directly to a company to buy stocks, you need to buy through a broker, and it could be an individual licensed broker or online broker.

Some of the most popular online brokers are COL Financial (used to be Citisec Online), BPI Securities and First Metro Securities.

A broker should be accredited by PSE – Philippine Stock Exchange. Here is the list of online brokers in the Philippines.

Is it safe as an investment?

Stock market is definitely not a scam, it is regulated by PSE the National Stock Exchange of the Philippines. PSE is licenced under the Securities and Exchange Commission (SEC).

Are earnings guaranteed?

In investment, the higher the risk, the higher the potential. Stock market is very volatile, it can go really high which gives you high earning but it can be really low which is an investment loss.

You really need to assess the companies you are investing in. There is no guarantee that’s why you need to arm yourself with knowledge to minimize the risk. It is important to know the basics of stock market.

Just a suggestion, you may invest in blue chips companies, again this is just a suggestion. It is still best to educate yourself and join in a community that could help you.

Choose wisely and safely. Remember, your money is at stake here.

What are blue chips companies?

They are listed in PSE Index that are well established, financially stable and with continuous growth over the past few years.

Normally their products or services are much known or address the needs like Meralco, they are the only huge electricity provider in the Philippines.

Some companies are SM, Ayala Corporation, PLDT, Globe, Jollibee Foods Corporation, and San Miguel Corporation.

Why should you invest in stock market?

Proven by data and history, it can give higher returns than saving your money in the bank.

Investing is different from saving, investing is putting your money with the goal of growing it.

Saving is keeping part of your income aiming to have something when you need it.

If you want higher returns, then you are fit to invest in stock market but remember as I mentioned earlier, it can give you positive or negative returns.

Is it too costly to invest in stock market?

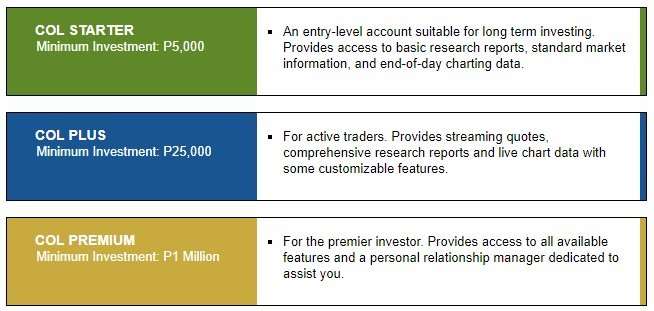

You can start your stock market journey with a minimum investment of P5, 000.

It is not hard, you can open an online account first in COL – you can also try other platforms like BPI Securities which do not require a minimum amout.

I recommend COL for newbies since it is easy to navigate and no issues so far, plus they give free seminar about stock market.

First step in investing in stock market.

If you are now decided to invest in stock market, there are certain requierements you need to submit to COL.

You may either go to their office personally or mail all your requirements, a sales officer from COL Financial will conduct a verification and schedule a call video conference call with you.

Again, you may start at P5,000 initial deposit which will be used for your investment. Check this link for the process and requirements for opening an account with COL Financial.

Financial Transactions Made Easy!

More on our Youtube Channel.

Subscribe Now!

Financial Transactions Made Easy!

More on our Youtube Channel.

Subscribe Now!